Gen X Shoppers Cut Back on Groceries the Most Amid Inflation

As consumers rethink their spending on groceries amid inflation, PYMNTS Intelligence research reveals, Gen X shoppers are quicker to make changes to everything from what products they buy to where they are buying them.

By the Numbers

The 2023 PYMNTS Intelligence study “Consumer Inflation Sentiment Report: Consumers Cut Back by Trading Down” drew from a survey of more than 2,000 U.S. consumers about their experiences and perceptions to better understand how inflation and increased prices of consumer goods are affecting their shopping habits and relationships with retailers.

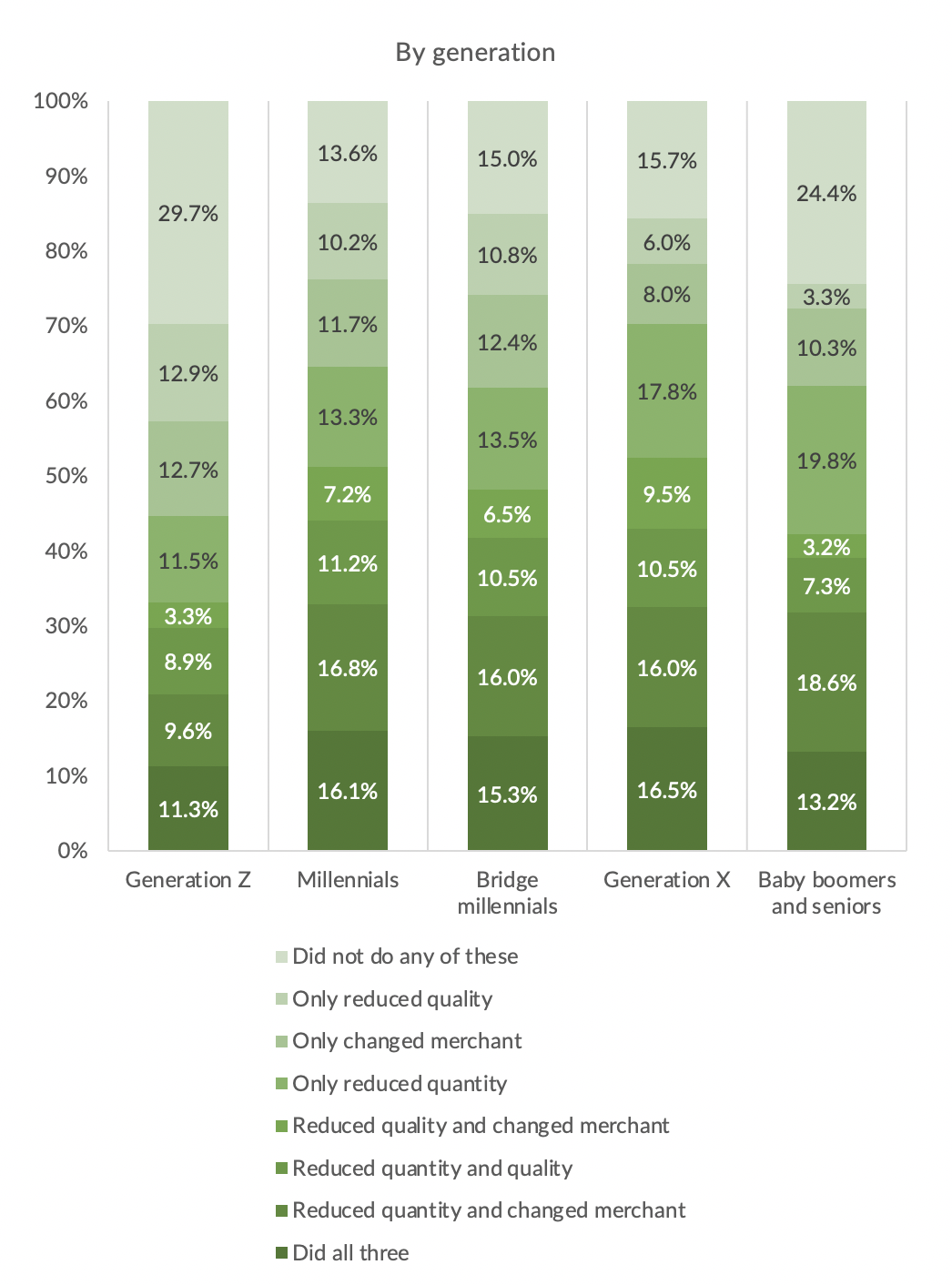

The study found that, while millennials were the most likely to have made at least one change to their grocery shopping behavior in the face of rising prices: to reduce the quality of products they had purchased, to make fewer nonessential purchases or to buy from less expensive merchants. Yet it is Gen Xers who emerged as most likely to have made all three such changes.

The Data in Context

Having experienced more economic cycles, including the 2008 financial crisis, Gen Xers might be more cautious and proactive in managing their finances during periods of economic uncertainty than their younger counterparts. This could lead them to adopt a combination of strategies to mitigate the impact of inflation.

Retailers are adapting to consumers’ demand for grocery savings. Target, for its part, plans to lower prices on roughly 5,000 “frequently shopped items,” including milk, meat, bread, produce, peanut butter, coffee, diapers, paper towels and pet food, according to a Monday (May 20) press release.

Walmart, too, is touting lower prices, as the retail giant’s CEO Doug McMillon told analysts Thursday (May 16) on a call accompanying the release of the company’s better-than-expected first quarter earnings.

He credited consumers’ demand for affordability for the company’s sales increases, especially in food. Plus, in April, Walmart launched bettergoods, a “chef-inspired” food line that the company said is its largest private-brand food rollout in 20 years, with the retailer focusing on low-priced products.