Deep Dive: The Growing Demand for Instant Payment Options Across the Economy

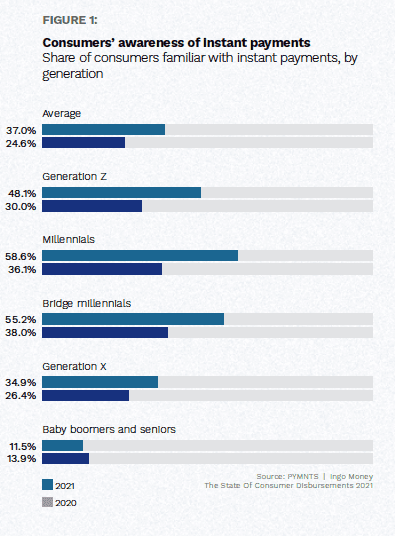

Instant disbursements were on the rise in 2021, with nearly three times as many consumers receiving an instant disbursement last year compared to 2020, while 17% of consumers received at least one instant disbursement. Instant disbursements could overtake Automated Clearing House (ACH) payments as the most popular disbursement method in the United States this year, in fact, as 37% of consumers were familiar with instant payments in 2021 compared to nearly 25% in 2020, according to PYMNTS research.

Demand is rising as individuals become aware of instant disbursements’ benefits — but not just for consumers. From small businesses conducting business-to-business (B2B) transactions to payroll departments issuing paychecks, many sectors perceive a growing need for payment options that make disbursements faster, safer and easier. Even insurance organizations are exploring options as varied as Zelle, PayPal, Venmo and push-to-card methods to pay out claims, cut down on costs and ensure policyholders receive money in a timely manner.

This month’s Deep Dive examines how the evolving perception of digital disbursements is reshaping demand for how transactions are conducted, as well as the challenges businesses face in offering disbursement choice.

The Need for Faster Payment Options in the B2B Marketplace

The pandemic hit the 31.7 million small businesses that make up 99.9% of all U.S. enterprises  hard, and slow payments have not helped. Among small business owners, 59% have experienced late payments from larger, corporate, public sector and nonprofit clients, and 25% have received payments 20 to 30 days late. Forty-seven percent of owners have seen increased problems related to late payments from large firms throughout the pandemic, and 78% of small businesses experienced declining revenues in 2020 and 46% had to reduce their workforces.

hard, and slow payments have not helped. Among small business owners, 59% have experienced late payments from larger, corporate, public sector and nonprofit clients, and 25% have received payments 20 to 30 days late. Forty-seven percent of owners have seen increased problems related to late payments from large firms throughout the pandemic, and 78% of small businesses experienced declining revenues in 2020 and 46% had to reduce their workforces.

Not all of those cash flow problems were directly related to the pandemic, however, with 44% of small businesses saying that late payments from other entities negatively affected their businesses. The effect has trickled down to employees, with 40% of small businesses either delaying hiring or considering doing so due to late payments, while 39% delayed inventory purchases and 36% cut employee hours for the same reason. Conversely, 64% of small businesses said that faster payments would enable them to invest in their businesses, and 58% said they would be able to pay back loans or pay down lines of credit more quickly.

When it comes to employee payments, workers aged 18 to 44 do not just want their paychecks fast; they want them immediately, with 83% saying they should have access to their earned wages at the end of each workday or shift rather than waiting for payday. Going beyond end-of-shift disbursements, 80% of employees would prefer to see funds automatically streamed to their bank accounts as they earn them. On-demand pay could improve loyalty for 78%, and 79% said they would feel more valued as an employee if they were paid that way. In terms of competition for talent, 81% would be more likely to choose an employer based on the availability of on-demand pay provided at no cost to the employee. Companies have been making strides toward payroll modernization, and 61% of payroll systems were cloud-based in 2021.

The interest in instant pay is not limited to traditional employees either, and gig workers — often driven by a lack of savings and need for on-hand funds — also want to get paid faster, with 45% saying they would like to be paid daily or on-demand. Another 45% of gig workers would like to be paid at least weekly. This growing demand has been accompanied by innovations in how workers are paid, from the use of Visa Direct and Mastercard Send by payroll departments to the increased number of vendors offering earned wage access, which allows workers to access wages they have earned but not yet received.

Taking The Load off of Human Resources

Digital solutions offer workers the opportunity to be more effective and efficient in many different processes, and digital disbursements are no exception. In addition to efficiencies that can be realized through modernizing payroll practices, businesses can also benefit from digital disbursements in regard to off-cycle payments, such as reimbursing travel or home office expenses to employees, as well as when handling payments to gig workers and vendors that fall outside of normal payroll operations. A process that involves issuing thousands of paper checks may be made more manageable through digital disbursements, allowing for reduced oversight and work hours.

Faster, modernized payment practices can free up HR and finance teams to focus on other priorities while also helping to ensure employees and customers are satisfied. HR departments can spend more time focused on initiatives to engage and support employees, finance professionals can spend their time identifying potential ways to improve their companies’ finances rather than disbursing payments, and payees at all levels can receive money in a manner that best suits them and without delays or having to take up additional employee time.