COVID Crisis: What Happens If Most People Don’t Get The Vaccine?

On the same day that COVID-19 cases in the U.S. topped 10 million and hit 50.5 million globally, the world got news that Pfizer and BioNTech had successfully completed Phase 3 trials of a COVID-19 vaccine on 43,000 people — and achieved an astounding 90 percent effectiveness rate.

It was a day that medical scientists and epidemiologists had been awaiting for eight long months, marking a significant scientific breakthrough for the virus that hobbled the world. And it was a stunning result.

Not only had these vaccine trials proven an effectiveness rate of 90 percent — nearly twice the 50 percent threshold the U.S. FDA had set for approval of a COVID vaccine — but it was at nearly the same level of effectiveness as vaccines for smallpox (95 percent) and measles (97 percent), and significantly more effective than vaccines for the flu (40 to 60 percent), shingles (51 percent) and pneumonia (60 to 70 percent).

On that day, Nov. 9, 2020, the stock market hit a high not seen since February, shortly before the world would feel the brunt of the global pandemic. Investors had more clarity, and hope, that consumers and businesses could soon be on a path to resume the physical activities that grounded important sectors of the U.S. and global economy for most of 2020.

That’s assuming most people got the vaccine. With a 90 percent effectiveness rate and no signs of serious side effects, who wouldn’t?

PYMNTS fielded a national consumer study of 2,806 U.S. consumers on Nov. 11 — three days after the Pfizer/BioNTech news was announced. We were curious to know whether consumers had heard the news of the vaccine, whether they thought it would be effective, and whether an imminent vaccine that could eliminate their risk of getting COVID had changed their views about reengaging in the physical world.

More than anything, though, this study sought to quantify how many U.S. consumers would get the vaccine based on what they knew at that time.

In this, PYMNTS’ 14th study of a national sample of now roughly 40,000 consumers since March on their sentiment about COVID and the digital behavioral shifts it has caused, we learned a lot.

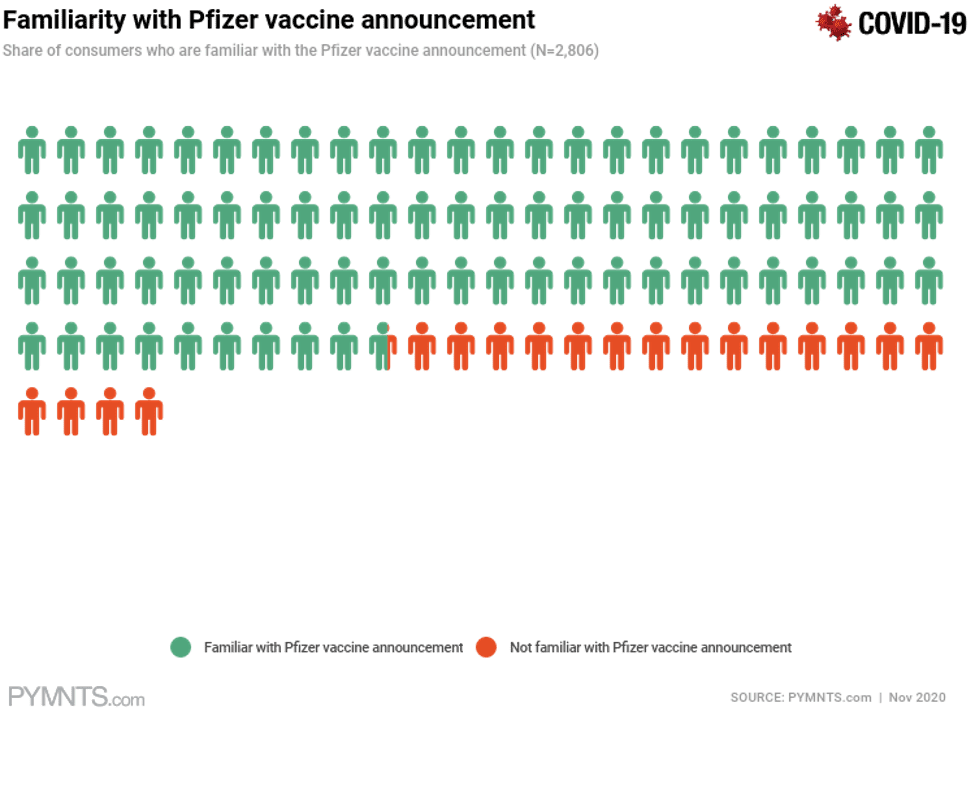

We found out that most consumers were well-informed about the vaccine news — more than eight in 10 (82 percent) said they were familiar with the Pfizer-BioNTech news. That’s remarkable, given that the news had just come out.

We also learned that of those consumers familiar with news of the vaccine, just as many say they definitely won’t or likely won’t get the vaccine (38.4 percent) as those who say they definitely or very likely will (37.9 percent). The remainder were somewhat likely.

We also learned that of those consumers familiar with news of the vaccine, just as many say they definitely won’t or likely won’t get the vaccine (38.4 percent) as those who say they definitely or very likely will (37.9 percent). The remainder were somewhat likely.

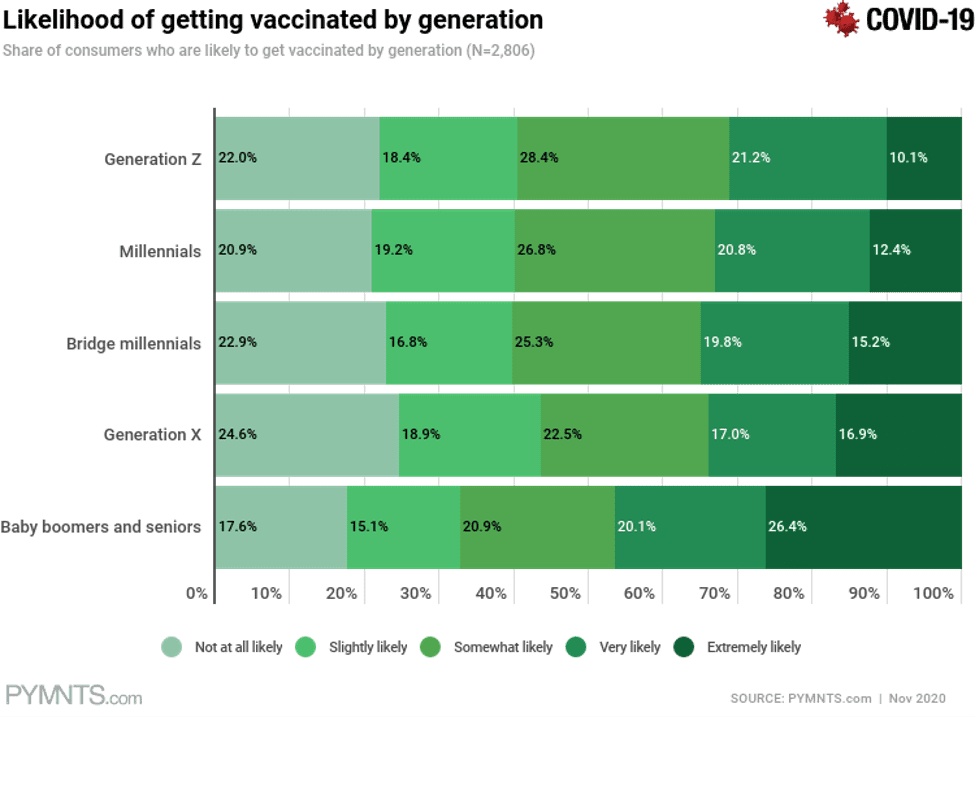

Across generations, PYMNTS’ research found that 40 percent each of Gen Zs, millennials and bridge millennials (respondents born between 1979 and 1988) say that they either won’t or likely won’t get the vaccine, 25 percent more than those who say they very likely or likely will.

All of this despite the fact that nearly two times as many consumers say they believe that the Pfizer-BioNTech vaccine will be successful (33 percent) as those who believe it will not (18 percent).

All of this despite the fact that nearly two times as many consumers say they believe that the Pfizer-BioNTech vaccine will be successful (33 percent) as those who believe it will not (18 percent).

And despite the fact that the most frequently mentioned thing consumers say they need to be comfortable reengaging in the physical world is a vaccine.

Thirty-four (34) percent of consumers in the November 2020 PYMNTS study report feeling this way, three times more than those who cite having a therapeutic available as the most important factor, 2.4 times more than those who say that seeing COVID cases drop is most important. This finding has remained consistently at this same level since March.

To be fair, PYMNTS queried people quite literally within a few days of the announcement. The news was still very fresh, and questions still remained — even though the medical community has publicly lauded the Pfizer-BioNTech news as a critical step toward taming the global pandemic in the U.S. and around the world.

So, we’ll see whether over time, with more information and with COVID cases now spiraling out of control in most parts of the country, more people will be persuaded to get the vaccine.

Hopefully, many more.

Doctors and epidemiologists say that herd immunity is present when 70 percent of a population has immunity to a disease. To achieve that level with COVID-19, a vaccine with a 90 percent effective rate would require that 80 percent of the population in the U.S. gets vaccinated — roughly 264 million people.

With a two-dose vaccine, which is the Pfizer-BioNTech protocol, 264 million people must get vaccinated twice, 21 days apart. That presents a logistical challenge that experts have acknowledged, but insist is doable and manageable.

Turns out that could be the easy part. If 38.4 percent of the population won’t get the vaccine, barely half of the 80 percent goal will be met.

The Digital Shifters Keep Shifting — and Want to Get Vaccinated

The PYMNTS study also tested the impact of the vaccine news — and interest in getting the vaccine — on consumers’ shopping and eating preferences.

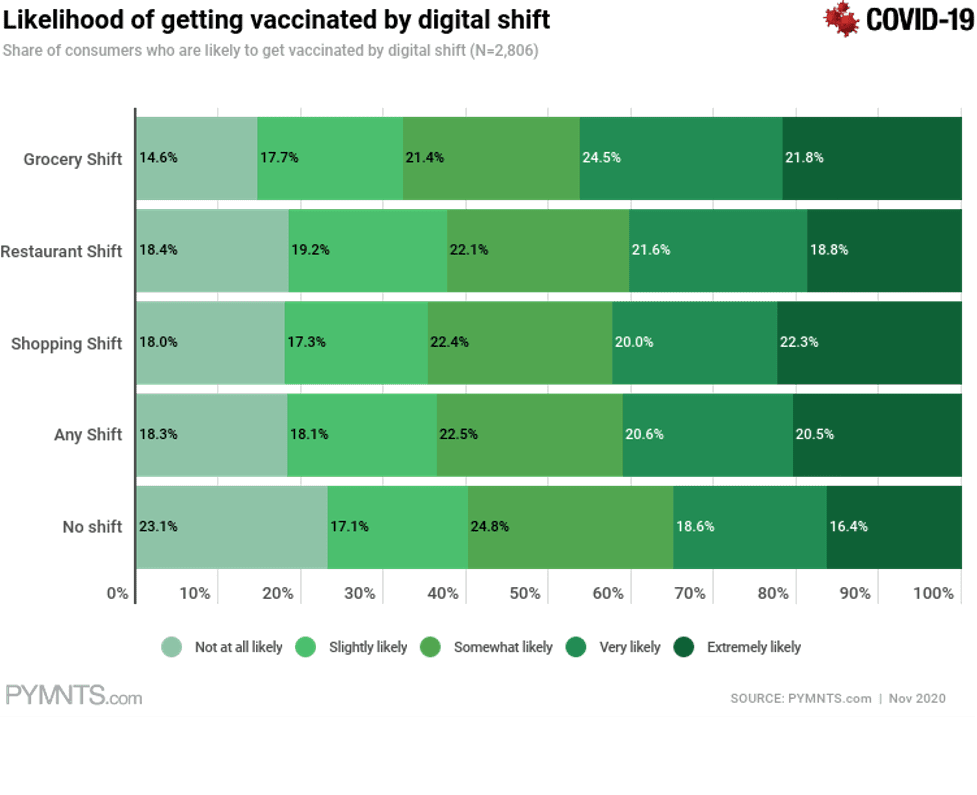

Interest in getting the vaccine is the greatest among those who have largely shifted to digital for shopping for retail products (42.3 percent), buying food at the grocery store (46.2 percent) and ordering food for delivery or takeout at restaurants (40.4 percent).

Nearly two-thirds (64 percent) of consumers who have shifted digital in one or more of those activities say they are somewhat, very or extremely likely to get a vaccine. Consumers who have shifted to digital over the last eight months have done so over fears of going into stores to shop at all, or out of a wish to minimize their encounters at the physical store when they do shop there.

Nearly two-thirds (64 percent) of consumers who have shifted digital in one or more of those activities say they are somewhat, very or extremely likely to get a vaccine. Consumers who have shifted to digital over the last eight months have done so over fears of going into stores to shop at all, or out of a wish to minimize their encounters at the physical store when they do shop there.

These are the same consumers who are highly motivated to get the vaccine in order to reengage in many of the physical world activities that have been unavailable to them since March — those for which digital-only or digital-first is an inadequate substitute. More on that a bit later.

But even with a vaccine, these digital shifters also say they are most likely to stick with most or all of their newly acquired digital-first habits.

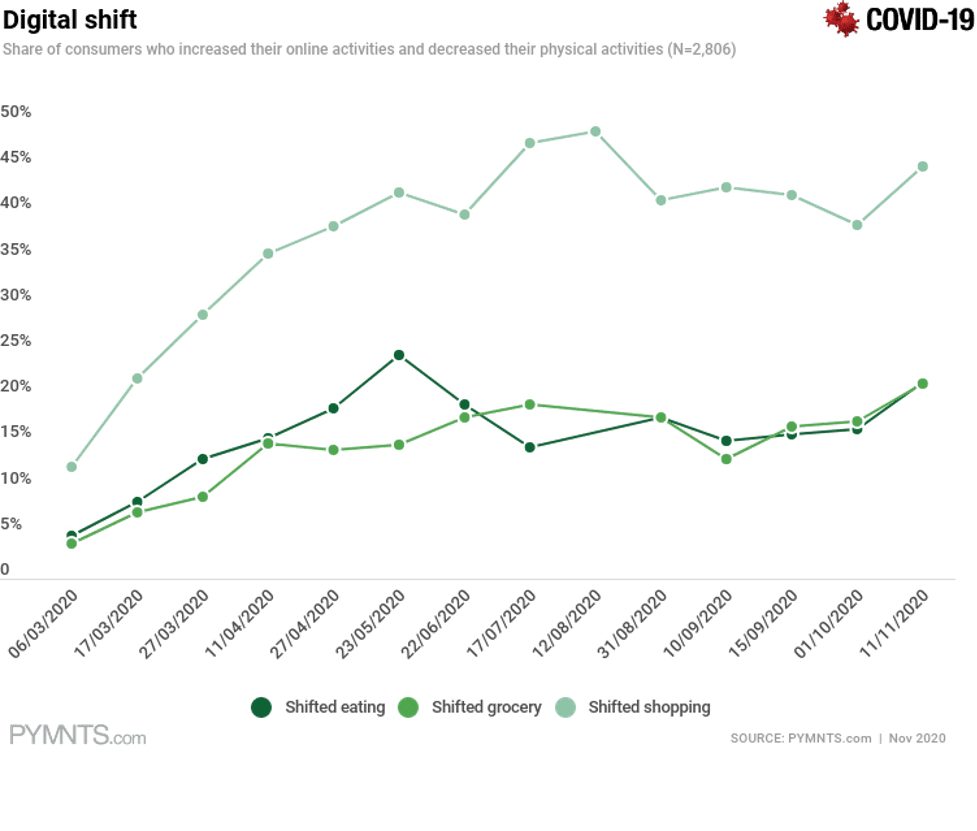

After eight-plus months of adapting their shopping behaviors to a more digital-first channel, we find that 47 percent of consumers have shifted their retail shopping habits to digital, and so have 21 percent of consumers shopping for groceries and 21 percent of consumers who eat at restaurants. The magnitude of these shifts can’t be underestimated: Five times as many consumers have adopted digital-first habits at restaurants, four times as many have adopted digital-first habits when shopping for retail products and nearly six times as many consumers have shifted to digital when shopping for groceries since March.

Driven now by convenience and by their satisfaction with those experiences, roughly 80 percent of those consumers say they’ll stick with those shifts when shopping for groceries, buying retail products and eating at restaurants even after getting the vaccine.

And they will shop in a different way.

These findings offer more proof that when these consumers re-engage in the physical world, how and where they shop and eat, and what they buy across the physical and digital channels, will be different — and will be shaped by the digital-first habits they’ve been honing since March.

On the flip side, interest in the vaccine is the lowest among those who have not shifted any of their shopping or eating habits to the digital world; many are lower-income individuals who continue to shop and eat exclusively in brick-and-mortar establishments, in some cases perhaps because they lack the technology or are unable to pay delivery surcharges. Only a quarter of the 53 percent of those consumers say they are extremely or very likely to get a vaccine when one is made available.

Of course, that means the people who are most engaged in the physical world and are coming in contact with each other are the least likely to get vaccinated — and are the ones who are at the highest risk of dying because of other health issues.

The Vaccine’s Physical-World Boost

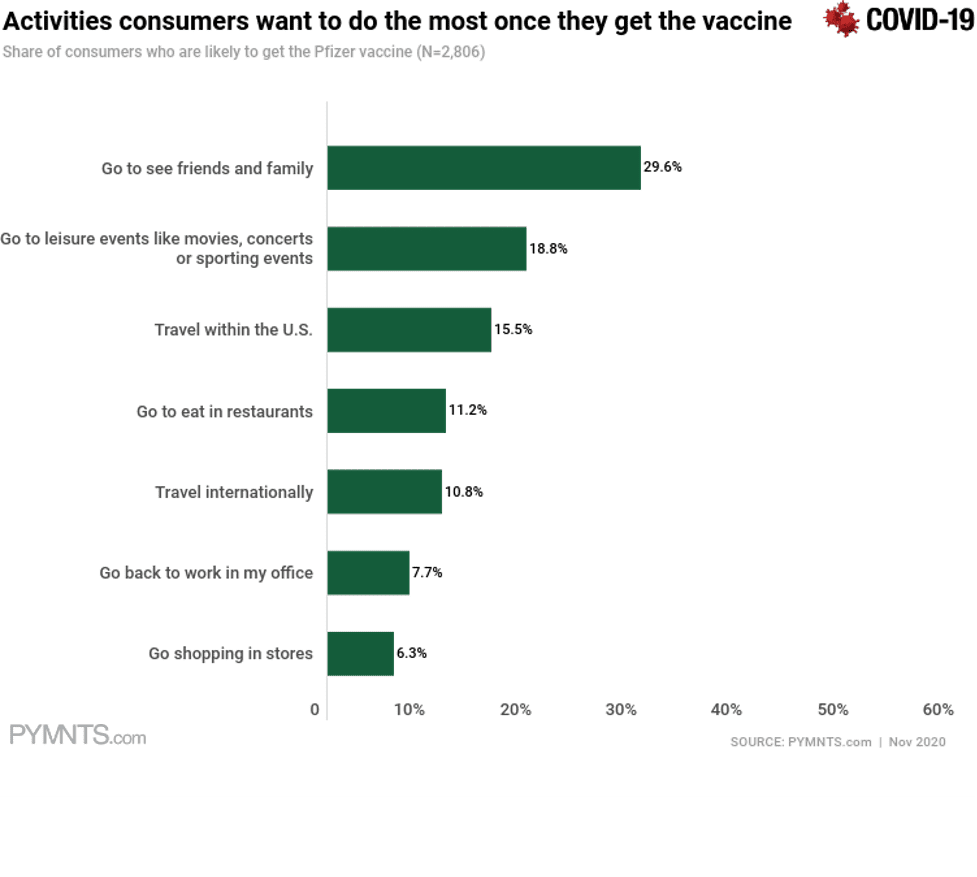

Once a vaccine is available and consumers are vaccinated, there is a long list of physical-world activities they say they are eager to resume. This list reflects the activities for which digital or digital-first has been more of a have-to stop-gap than a want-to experience — and where there’s more pent-up demand among consumers to do the things that have been largely off-limits over the last eight months. These are the activities that involve social and/or physical interaction with large groups of people.

Consumers with an interest in getting a vaccine say that the activity they most want to do is see family and friends — free of masks and without social distancing requirements. Going to weddings, birthday parties, graduations and family reunions — and having family and friends over for the holidays — are all of the experiences that have been postponed or eliminated due to COVID risks. And, not surprisingly, those are the things that consumers say they miss the most.

Consumers with an interest in getting a vaccine say that the activity they most want to do is see family and friends — free of masks and without social distancing requirements. Going to weddings, birthday parties, graduations and family reunions — and having family and friends over for the holidays — are all of the experiences that have been postponed or eliminated due to COVID risks. And, not surprisingly, those are the things that consumers say they miss the most.

Right behind that is engaging in leisure activities — going to the movies and live events like sporting events and concerts. Interestingly, on Friday (Nov. 13), Ticketmaster announced that it would require proof of vaccination to enter an event venue, a position it later backtracked, leaving the door open by saying that organizers might insist upon vaccinations.

Hey, if seeing one’s family isn’t enough of a motivator to get vaccinated, maybe going to see Justin Bieber in concert in June could be enough of a motivator. Whatever works.

Third on the list is satisfying their wanderlust to travel again, both inside and outside the U.S. This is the first time since March that PYMNTS surveys have seen an uptick in consumers’ interest in hopping on a plane to travel internationally, particularly among affluent consumers.

Slightly more important than jetting off to faraway places is eating inside a restaurant, an activity that 87.4 percent of consumers say they’ve done less of since March. Eleven (11) percent of consumers say that is the most important thing on their list.

Also interesting when looking at this list are the activities for which consumers largely feel that digital substitutes are suitable, and for which physical-world options may not be as important in 2021 and beyond even after a vaccine.

Only 14.8 percent and 17.8 percent of consumers say they will do more shopping in physical retail or grocery stores, respectively.

Only 6.4 percent of consumers who decreased their physical business conference attendance say they’ll attend business conferences as they once did even after getting a vaccine. Working from home — and anywhere in the country — is something that more than twice as many affluent consumers who have gone to the office less since March say they want to do, but only 8 percent of middle-income and 11 percent of upper-income consumers express an interest in doing even after they are vaccinated.

Consumers have perfected their use of digital channels, using them to create schedules and routines that now comprise how they do business. Using offices, going to events and returning to stores are activities that people will still do — but differently, selectively and only when digital channels can’t deliver the outcomes they seek.

Will a Vaccine Save 2021?

The excitement over the availability of a vaccine has prompted many questions about when it will be available to most of the population. Dr. Anthony Fauci told Jake Tapper on Meet The Press yesterday (Nov. 15) that the U.S. could start to see general availability in the early part of 2021, and that “some return to normalcy” could be likely in the late spring and summer of 2021.

Josh Sharfstein, vice dean for public health and community engagement at the Johns Hopkins Bloomberg School of Public Health, offered a more pragmatic view last week, when he said the vaccine won’t likely be available to the general population until the spring, and perhaps even the early fall. High-risk populations (the elderly, people with preconditions and healthcare practitioners) will have earlier access to the vaccine, some even as soon as December of 2020.

If that’s the case, it’s likely that 2021 will be a year of transition, where the population remains masked and socially distant as people get vaccinated — and hopefully, enough of them do so to achieve the level of herd immunity required to make COVID a part of our past and not a persistent part of our present.

It seems as though the U.S. consumer shares that view. Respondents in the November PYMNTS research study said it will take until January of 2022 before they feel as comfortable engaging in the physical world as they did in January of 2020. That’s up from September of 2021 just a month ago.

Consumers may know something the experts don’t know: that a vaccine available in April 2021 may not be a panacea.

Less than half of the adult population — 45.6 percent, to be precise — got the flu vaccine in 2019. And only 37.9 percent of the people PYMNTS surveyed were definitely or very likely to get the COVID-19 vaccine. Those who get the vaccine will benefit, but unless that rate goes up a lot, we’ll be a long way from achieving herd immunity.

That could mean a tougher slog through 2021 than some experts are predicting.

And for businesses, it may mean, for better or worse, doubling down on digital-first for at least another year.

For policymakers, the stakes may never be higher. Giving people information about the vaccine, its importance and the risks (which appear to be quite low, based on what we know right now) is critical to persuading at least those in the “somewhat likely” camp that a vaccine is in their best interests.

For payments and tech innovators, the opportunity may never be greater.

If there’s one thing these players know how to do, it’s motivating people to take action and to use digital platforms and methods to distribute those incentives. Imagine if instead of getting a “flu fighter” Band-Aid at the pharmacy when getting the vaccine, that person got an eGift card that is spendable at the pharmacy. Or a credit to their digital wallet. Or something.

With a model that projects a death count could reach 500,000 in the U.S. by the end of February, it seems like a very small price to pay to solve humankind’s massively deadly and economically costly problem.

Read More On Karen Webster:

- Who Is the Paycheck-to-Paycheck Consumer in America?

- CFPB, Crypto and Consumer Confidence: Inside DC’s Unpredictable Regulatory Storm

- Higher Prices and Fewer Choices: What American Consumers and Small Businesses Think About Tariffs

- Five Years Post-COVID, We’re Really Not Shopping (or Doing Much Else) Like It’s 2019