New Data: SMBs Shift COVID Cash Flow Challenges To Their Workforce

The coronavirus pandemic is advancing, wreaking havoc on U.S. citizens and the economy.

The coronavirus pandemic is advancing, wreaking havoc on U.S. citizens and the economy.

Consumers are staying at home more, buying less and saving what they can, while retailers and their vendors are enacting their own measures to slow the spread of contagion. The resulting drop in revenues has put many small- to medium-sized businesses (SMBs) in an impossible conundrum.

According to PYMNTS research, the average SMB owner believes it will take 178 days for their local economies to recover from the pandemic’s economic slump. The trouble is that they only have access to enough cash to last them an average of 20 days — and many have even less.

According to PYMNTS research, the average SMB owner believes it will take 178 days for their local economies to recover from the pandemic’s economic slump. The trouble is that they only have access to enough cash to last them an average of 20 days — and many have even less.

How are the businesses of Main Street U.S.A. working to keep their doors open, even as their economic forecast grows ever-more dire?

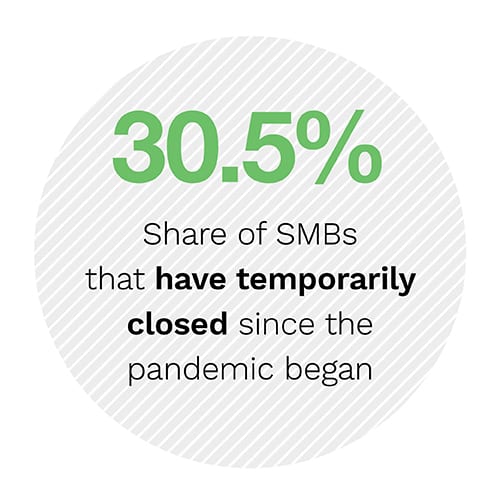

For the Main Street On Lockdown: How SMBs Are Coping With The Economic Fallout Of COVID-19 edition, PYMNTS asked 200 SMB owners how the COVID-19 pandemic is impacting their businesses and the measures they are taking to help mitigate the damage it is causing. We also spoke to SMB owners to learn more about the large-scale impact the pandemic is having on the small players that help form the foundation of countless local economies  throughout the nation.

throughout the nation.

Our research shows that one of the most common avenues SMB owners say they can use to access the cash they need to survive the pandemic is by dipping into their own savings and investment portfolios. Indeed, it is often the only resource they have. Among the SMB owners we surveyed, 49.1 percent say they would be able to use their personal credit cards to help fund their businesses during the pandemic, while 25.5 percent say they would be able to liquidate some of their personal investments. We also see 12.7 percent reporting they would be able to take out a mortgage on their house to generate the funds they need in order to survive the pandemic.

It is easy to see why SMB owners are feeling the pressure to take immediate, drastic measures to save their  businesses. Our survey finds that 27.9 percent of SMBs have asked employees to work fewer hours, and 22.6 percent have laid off at least some employees to help reduce operational costs. Many others have appealed for financial assistance from the government (25.3 percent) or from their banks (18.9 percent).

businesses. Our survey finds that 27.9 percent of SMBs have asked employees to work fewer hours, and 22.6 percent have laid off at least some employees to help reduce operational costs. Many others have appealed for financial assistance from the government (25.3 percent) or from their banks (18.9 percent).

Yet, if the pandemic is expected to last nine times as long as their cash reserves, even all of this and more may not be enough.

To learn more about how SMB owners are working to help keep their businesses afloat in the face of the economic slowdown, download the brief.