Co-Branded Credit Card Holders Seek Perks From Retailers

Among consumers turning to co-branded credit cards to maximize their rewards, the lion’s share want these perks from their favorite retailers, PYMNTS Intelligence research shows.

By the Numbers

The recent report “The Role of Strategic Partnerships in Consumer Credit Cards,” a PYMNTS Intelligence and Elan collaboration, draws on responses from thousands of consumers to explore how consumers view and use co-branded credit and store cards.

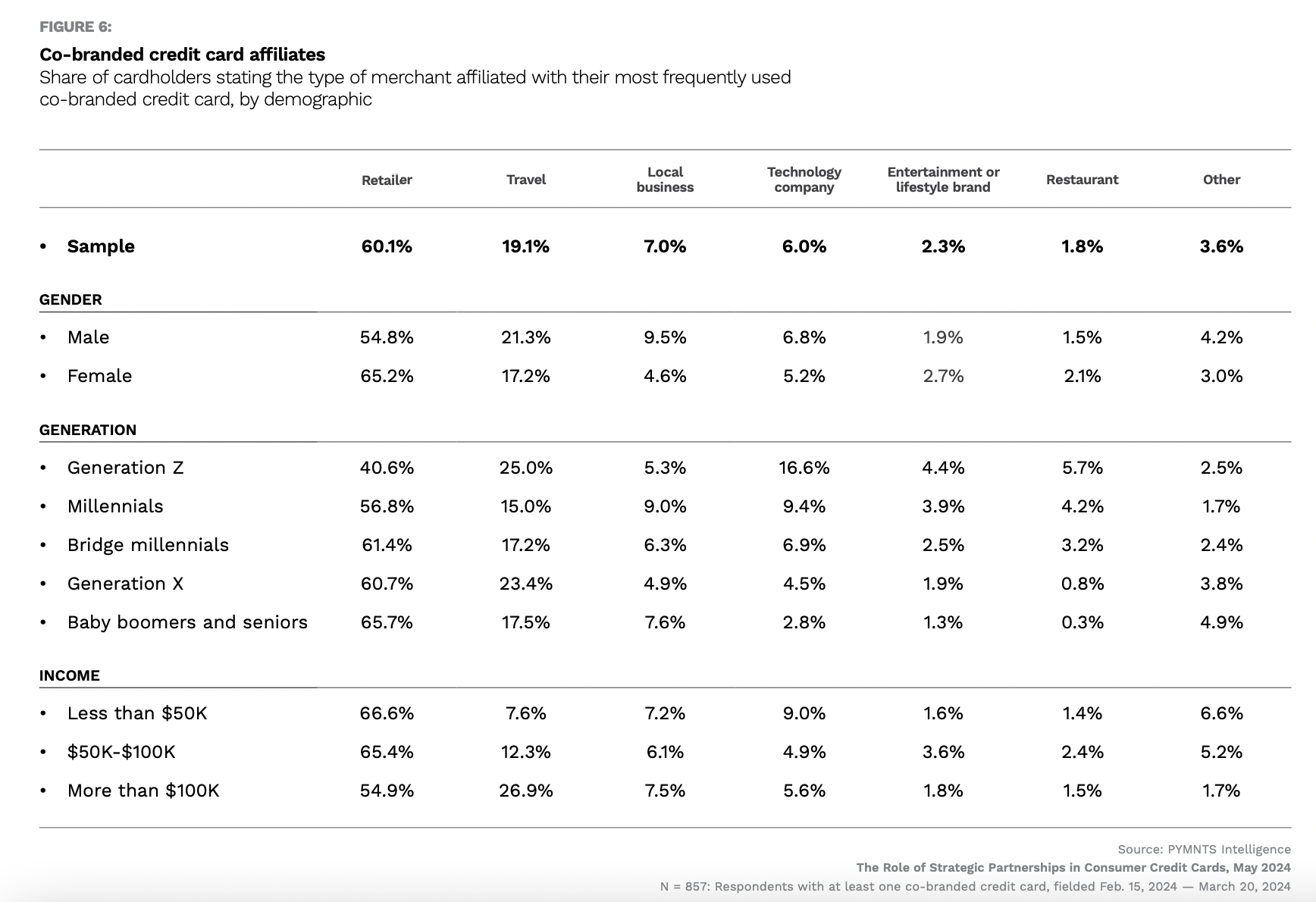

The study finds that more than 60% of consumers who hold at least one co-branded credit card say that their most frequently used co-branded credit card is affiliated with a retailer — a far greater share than said the same of any other kind of brand.

“Retailer-affiliated co-branded cards hold the widest appeal among consumers, likely because cardholders find it easy to use rewards and other benefits at major national retailers,” the study states.

The Data in Context

Co-branded cards unlock new marketing opportunities for retailers.

“To add relevance, we used AI on our site to position the right products in the right moments — think serving up promotions to RedCard holders so they get the best deal plus extra 5% off by using their card or helping a guest find the perfect gift for their teenager,” Cara Sylvester, Target’s executive vice president, chief marketing and digital officer, told analysts on the company’s latest earnings call. “This integrated campaign, tapped into our powerful ecosystem of digital, social, marketing, and merchandising, absolutely resonated with shoppers.”

In the fall, apparel seller J.Crew launched a multi-year credit card program with Synchrony and Mastercard.

“As consumers seek more curated financial services and products, it’s important that we continue to provide choices and benefits that match their lifestyles,” Chiro Aikat, Mastercard’s executive vice president for U.S. market development, said in a statement at the time. “We’re bringing safe and seamless offerings to J.Crew shoppers that add value and enhance loyalty for their favorite brands.”