Innovating the ATM Beyond Cash

The COVID-19 pandemic is accelerating the pace of digital innovation across the financial sector, and credit unions (CUs) are no exception.

CU branches across the United States have temporarily closed to help slow the spread of contagion, forcing CUs to find new ways to engage with their members via connected technologies, from mobile devices to laptops and especially ATMs. The ATM has emerged as one of CUs’ most important tools in this member engagement effort, in fact, with many investing in digitally-enabled ATM kiosks that provide members with on-demand videoconference consultations and a full range of digital banking services.

In the May “Credit Union Tracker®,” PYMNTS explores the latest developments from across the CU ecosystem, including an influx in Paycheck Protection Program (PPP) loan applications, an overview of the latest ATM technologies, and a look at Redwood Credit Union’s holistic approach to digital innovation.

In the May “Credit Union Tracker®,” PYMNTS explores the latest developments from across the CU ecosystem, including an influx in Paycheck Protection Program (PPP) loan applications, an overview of the latest ATM technologies, and a look at Redwood Credit Union’s holistic approach to digital innovation.

Developments From Around the CU Ecosystem

Many CUs are still struggling to overcome logistical difficulties that have risen amid the pandemic. Reduced staff, delayed directives from the Small Business Administration (SBA) and a wave of new regulatory requirements have left many ill-equipped to handle the high loan application volumes they are receiving, meaning their members wind up waiting longer than they should to receive the funding they need to stay financially sound.

CUs are also faced with the challenge of how to adjust their operations to match new legal regulatory  requirements, such as those stipulated in the CARES Act, and the Credit Union National Association (CUNA) hopes to help. CUNA is launching a new web-based compliance platform to help CUs mitigate the challenges of meeting these new regulatory criteria, which it hopes will help CUs more quickly and easily meet their members’ evolving financial needs.

requirements, such as those stipulated in the CARES Act, and the Credit Union National Association (CUNA) hopes to help. CUNA is launching a new web-based compliance platform to help CUs mitigate the challenges of meeting these new regulatory criteria, which it hopes will help CUs more quickly and easily meet their members’ evolving financial needs.

Meanwhile, CUs such as Pioneer Federal Credit Union are working to ensure their members retain access to banking services at their brick-and-mortar branches, even in the face of social distancing guidelines. Not only is Pioneer Federal encouraging members to use videoconferences to communicate with its tellers in the hopes of limiting in-person contact and the transmission of the COVID-19 virus, but the CU is also reporting increased usage of its mobile banking application.

For more on these and other CU news items, download this month’s Tracker.

How Balancing Members’ Needs Improves End-to-End ATM Experiences

How Balancing Members’ Needs Improves End-to-End ATM Experiences

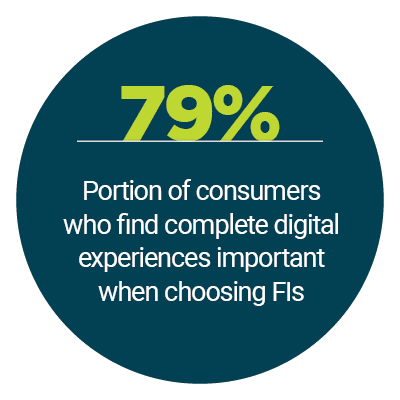

Many CUs are investing heavily in new digital technologies to help serve their members during the COVID-19 pandemic, but not all innovations are successful. The drive to digitize has led some CUs to invest in technologies that their members will not use or that do not meet their members’ expectations.

For this month’s Feature Story, PYMNTS spoke with Redwood Credit Union Chief Administrative Officer Tony Hildesheim about why CUs should focus on understanding what members expect from their digital banking experiences before investing in the development of new technologies.

Deep Dive: Offering an End-to-End Customer Experience Through ATMs

CUs are upgrading their ATMs to provide a full range of banking services, from account transfers to loan applications and beyond, in the hopes that having more versatile ATMs will be able to meet their members’ needs while their physical branches remain closed.

This month’s Deep Dive examines how CUs are using videoconferencing capabilities on interactive teller machines (ITMs) to maintain their branch operations during the pandemic, and how biometric technology is helping them provide faster, more secure and touchless ATM services.

About the Tracker

The “Credit Union Tracker®,” done in collaboration with PSCU, is the go-to monthly resource for updates on trends and changes in the credit union industry.