Cryptocurrency and blockchain technologies are proving increasingly useful for cross-border businesses. Cryptocurrencies facilitate easy and cost-effective international payments, and blockchain-based smart contracts foster trust with partners in faraway locations.

Cryptocurrency and blockchain technologies are proving increasingly useful for cross-border businesses. Cryptocurrencies facilitate easy and cost-effective international payments, and blockchain-based smart contracts foster trust with partners in faraway locations.  Despite these benefits, few financial institutions (FIs) provide cryptocurrency access or blockchain products to their business clients, according to new PYMNTS research. Just one in 10 currently offers cryptocurrency products, even though 64% acknowledge that these products are important to their customers.

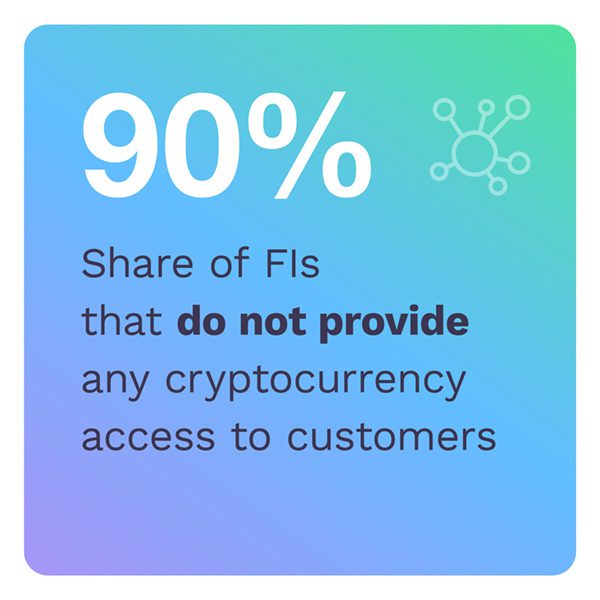

Despite these benefits, few financial institutions (FIs) provide cryptocurrency access or blockchain products to their business clients, according to new PYMNTS research. Just one in 10 currently offers cryptocurrency products, even though 64% acknowledge that these products are important to their customers.

These are just a few of the takeaways revealed in Cryptocurrency, Blockchain And Cross-Border Payments: How Multinationals Leverage New Technology To Optimize Business Payments, a PYMNTS and Circle collaboration. The Playbook is based on a survey of executives at 250 cross-border businesses with at least $10 million in annual revenue and 250 FIs, comprising banks (60%) and FinTech firms, to compare what multinational businesses want with what FIs offer and how this is evolving.

Key findings from PYMNTS’ research include:

Key findings from PYMNTS’ research include:

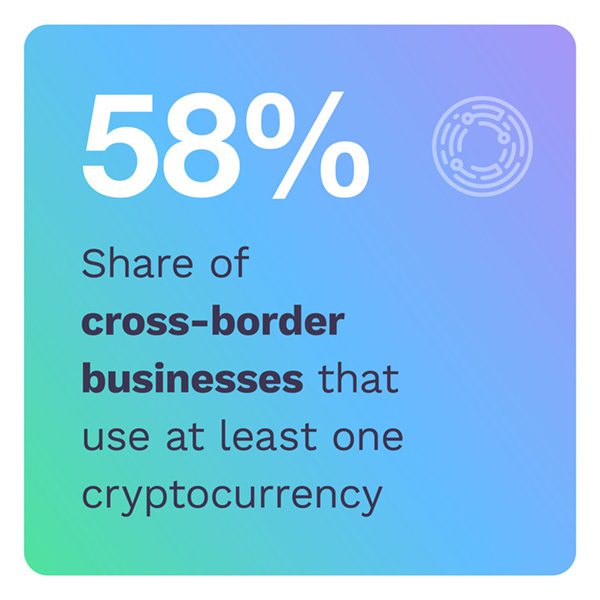

- Fifty-eight percent of multinational firms use at least one form of cryptocurrency, and most firms use blockchain technology. Bitcoin is the most widely used cryptocurrency, cited by 31% of firms, followed by stablecoins at 29% and Ethereum at 24%. Fifty-six percent of multinational firms, meanwhile, use at least one blockchain network. Thirty-seven percent use public networks, while 15% use public and private networks.

- Just one in 10 FIs offer business-to-business (B2B) customers the chance to use cryptocurrency. This underscores why businesses that have adopted cryptocurrencies often face hurdles when attempting to use them for payments without robust cross-border payments solutions in place. Of the 10% of FIs that give customers access to cryptocurrency, 6% offer bitcoin, while Bitcoin cash, Ethereum and stablecoins are offered by 4% each.

- FIs seem to be at a loss when prioritizing their strategies for cryptocurrency and blockchain innovations, with slightly more than one-quarter of them pointing to any specific driving factor as being important.

Twenty-six percent of FIs say that the relative strength — or lack thereof — of their digital infrastructures factors significantly into their strategies, while 24% say attracting and retaining customers and 23% point to the potential for better data security as critical factors.

Twenty-six percent of FIs say that the relative strength — or lack thereof — of their digital infrastructures factors significantly into their strategies, while 24% say attracting and retaining customers and 23% point to the potential for better data security as critical factors.

These findings merely scratch the surface of what we uncovered in Cryptocurrency, Blockchain And Cross-Border Payments: How Multinationals Leverage New Technology To Optimize Business Payments. To learn more about how cross-border businesses use blockchain and cryptocurrency and what FIs can do to better keep up with their needs, download the report.

See More In: B2B, B2B Payments, Blockchain, business payments, circle, cross-border payments, Cryptocurrency, Cryptocurrency Blockchain And Cross-Border Payments Report, Featured News, News, PYMNTS Study

Cryptocurrency and blockchain technologies are proving increasingly useful for cross-border businesses. Cryptocurrencies facilitate easy and cost-effective international payments, and blockchain-based smart contracts foster trust with partners in faraway locations.

Cryptocurrency and blockchain technologies are proving increasingly useful for cross-border businesses. Cryptocurrencies facilitate easy and cost-effective international payments, and blockchain-based smart contracts foster trust with partners in faraway locations.  Despite these benefits, few financial institutions (FIs) provide cryptocurrency access or blockchain products to their business clients, according to new PYMNTS research. Just one in 10 currently offers cryptocurrency products, even though 64% acknowledge that these products are important to their customers.

Despite these benefits, few financial institutions (FIs) provide cryptocurrency access or blockchain products to their business clients, according to new PYMNTS research. Just one in 10 currently offers cryptocurrency products, even though 64% acknowledge that these products are important to their customers.