New Study: Crypto Emerging as a Favored Form for Cross-Border Remittances

PYMNTS research finds that nearly 60% of consumers making cross-border remittances in the past year increased such payments under the pandemic, and, with U.S. consumers sending some $76 billion annually in remittances to people in other countries, the potential to reduce the cost of these payments while increasing their speed is too tempting to ignore.

With more people now looking to blockchain and cryptocurrencies to dramatically improve the cost and speed of cross-border payments, PYMNTS researchers surveyed nearly 2,100 consumers on the subject and found significant interest in adopting crypto remittances.

For example, The Digital Currency Shift: The Cross-Border Remittances Report, done in collaboration with Stellar Development Foundation and PYMNTS, found that 70% of consumers pay a fee to send money overseas, “with 41 percent paying a percentage fee averaging 6.2 percent, and 28 percent paying a fixed fee that averages $14.80. In aggregate, the cost to U.S. consumers is $3.5 billion. While 30 percent of respondents stated that they do not pay a fee, they may be paying exchange rate costs.”

Those embracing cryptocurrencies for remittances are reporting a different experience.

Per the study findings, “23 percent of respondents — representing 8 million adults — who made online payments to friends or family in other countries used at least one kind of cryptocurrency. In fact, 13 percent of consumers surveyed say cryptocurrencies were their most used payment method for online cross-border remittances.”

Read: The Digital Currency Shift: The Cross-Border Remittances Report

Crypto Holders Like It for Remittances

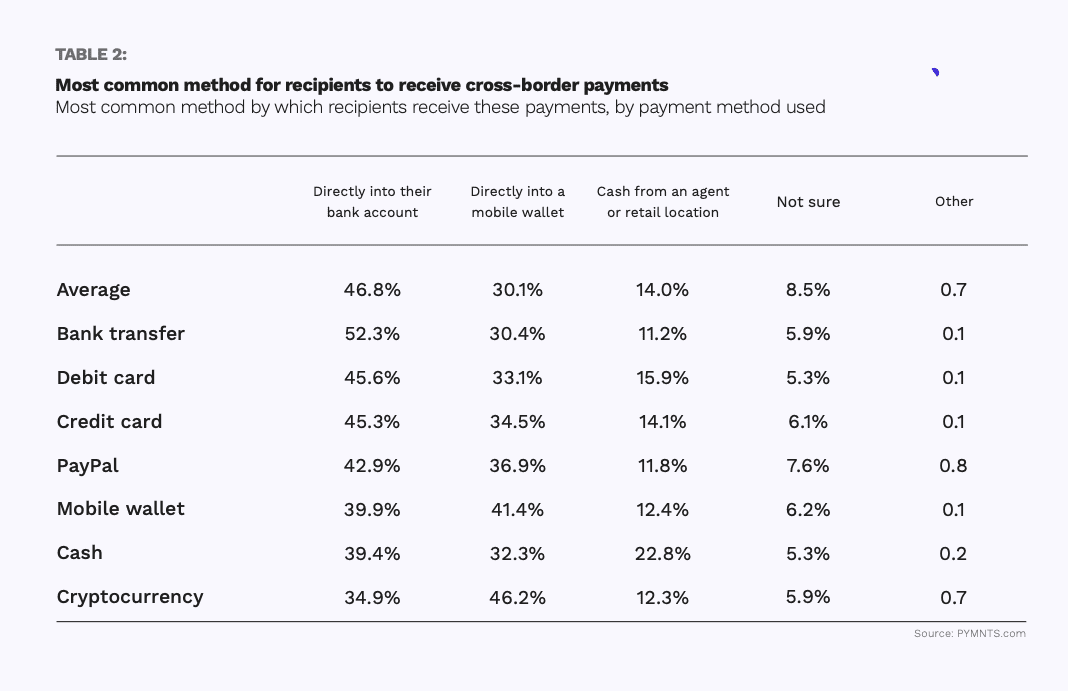

While PayPal, credit cards and bank transfers are used most often for sending remittances, cryptocurrency usage is increasing due to its unique attributes for cross-border uses.

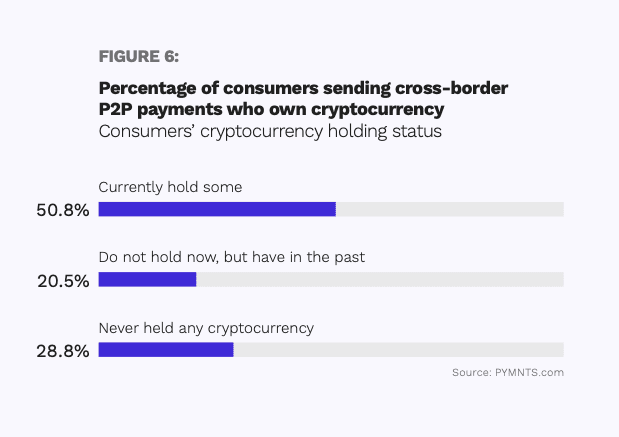

Owning cryptocurrency increases the likelihood of using it for cross-border payments, as one would expect, and the growing population of crypto holders are driving the trend.

According to the study, “Fifty-one percent of consumers making cross-border P2P payments currently hold cryptocurrency, compared with approximately 12 percent of the general U.S. population. Nearly half of these consumers have purchased cryptocurrency for transactions of any kind. This is unsurprising, as consumers with a need to send funds quickly will likely favor options that allow them to transfer money instantly and fund their payments in a variety of ways convenient to them.”

See more: The Digital Currency Shift: The Cross-Border Remittances Report

Trust and Choice Influencing Cross-Border Crypto Use

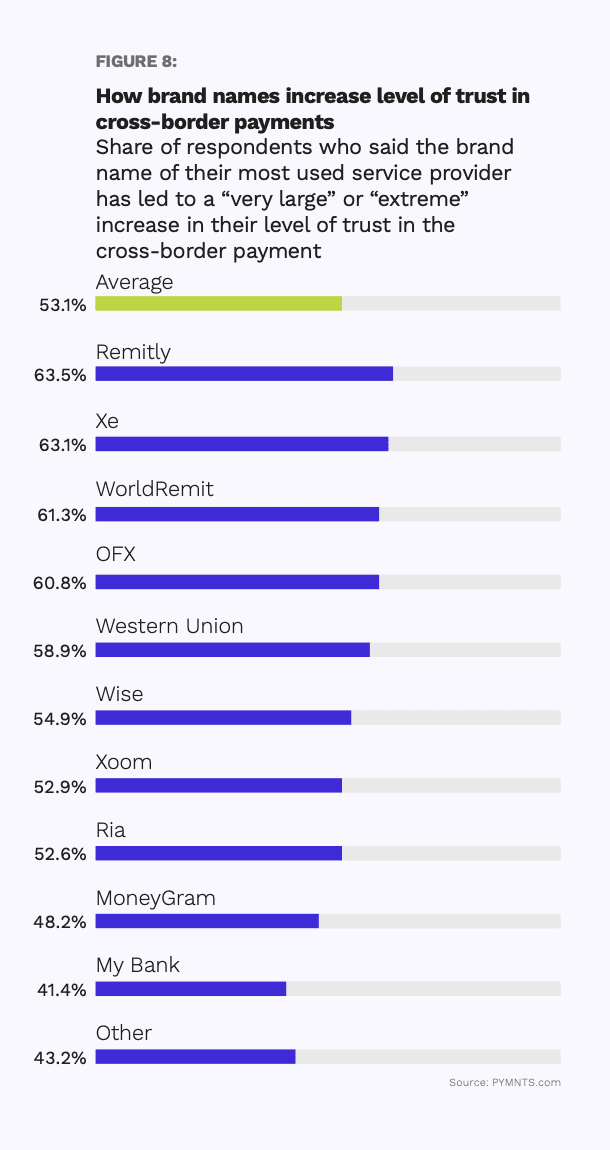

Trust underpins the entire financial system, and cryptocurrency is no different. Trust is the deciding factor in how consumers send peer-to-peer (P2P) funds.

As the study states, “Among consumers who make remittance payments using cryptocurrency, trust in the brand name of their PSP matters. Nearly two-thirds of cryptocurrency holders see a significant increase in their level of trust in their cross-border payments because of the remittance service’s brand name, compared with 52 percent among non-users of cryptocurrency.”

However, up to 24% of consumers said they would be “choose a specific provider if receiving payments in cryptocurrency were available, and 22 percent would if making payments in cryptocurrency were available. These percentages go up to 45 percent (receiving payments in cryptocurrency) and 50 percent (making payments in cryptocurrency) among those who already make cryptocurrency cross-border P2P payments.”

See: The Digital Currency Shift: The Cross-Border Remittances Report