Strike CEO: El Salvador’s Bitcoin Experiment Isn’t Over

In an interview this week, bitcoin payments firm Strike’s CEO said that El Salvador’s bitcoin-as-legal-tender experiment hasn’t hurt his company in any way, noting that its only involvement with the project was him giving President Nayib Bukele advice.

He also said that he thought it had been a success, in a CoinDesk interview on Thursday (Sept. 29), asking if the Central American nation should copy what the tumbling British pound is doing.

Comparing the government’s year-old experiment with bitcoin joining the dollar legal tender to a homework assignment, Strike’s Jack Mallers asked when it was due, suggesting that legal bitcoin’s anniversary on Sept. 7 is not the end of the experiment.

“You’re talking about a country that’s historically been crushed by inflation, crushed by banks such as the Federal Reserve,” he added.

That said, the results have been dismal so far, given the amount that the government has spent trying to convince people to use it — an estimated $375 million, excluding paper losses on its bitcoin holdings — with so little success that anecdotally, most merchants in San Salvador’s central business district have stopped accepting it, despite being legally required to do so.

Read more: One Year in, Bitcoin Currency Experiment Has Bombed

There are remittances, which should be the sweet spot for sending funds home to El Salvador, as the country’s Chivo digital makes them free and in real time. Despite that, just 2% of remittances are sent through Chivo, and not all of that is bitcoin, as it can be used to send dollars as well.

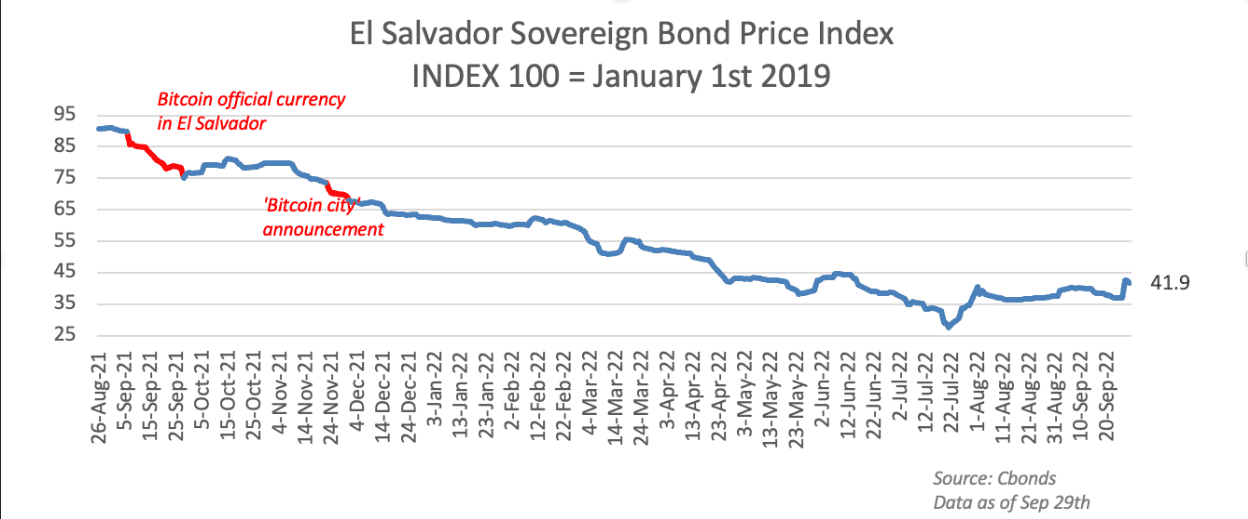

Beyond that, the broader financial damage includes alienating the International Monetary Fund (IMF), which has refused to go ahead with a loan that will help it avoid a default at the beginning of 2023, and its sovereign bonds have collapsed to the point where their current value of about 40 cents on the dollar is up almost 50% since July — but down from $0.85 last September.

Bitcoin payments have mostly taken hold in countries where the local currency is suffering severe or hyperinflation — Argentina’s, which is 80%, for example, is having that effect — but first of all, El Salvador’s inflation rate is under 8%, and second, it doesn’t have a national currency to hyperinflate. The only other legal tender is the dollar.

Still, when delivering a speech to the UN General Assembly last week, Bukele began with, “I bring you greetings from the land of surf, volcanoes, coffee, peace, Bitcoin, and freedom,” He then spent a fair bit of the speech to freedom, complaining about rich and powerful countries bullying smaller neighbors — with a couple of swipes that were likely euphemisms for the International Monetary Fund.

“Freedom is something we still fight for in our country because while we are free and sovereign and independent on paper, we will not be until the powerful understand that we want to be their friends,” he said, according to Criptonoticias. “That our doors are open to build the best relationships … The essential requirement is that the powerful respect our freedom.”

See also: Bringing Bitcoin Firmly into Payments, Strike Partners with NCR, Shopify, Blackhawk