Millennials With Student Loans to Lose 6.5% of Spending Power as Repayments Resume

Federal student loan payments are resuming after a three-year moratorium, putting a dent in millennial and Generation Z consumers’ disposable income.

And major retailers are poised to see their top lines pinched as a result.

Disposable Income Takes a Hit

PYMNTS’ data revealed that no matter the cohort, student loan repayments — for both federal and private student loans — will take a chunk out of disposable income. Government data shows that 45.9 million individuals in the U.S., 17.6% of the total population, have student loans, equating to $1.7 trillion in debt.

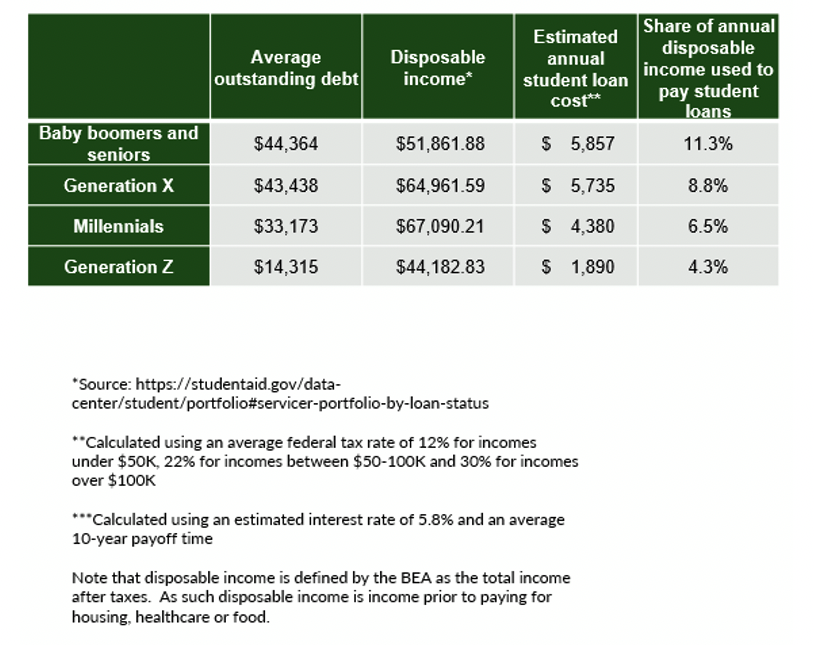

Drill down a bit, and we can see the real impact of paying for education, broken down by generation, annual cost, and the share of disposable income that would have to be slated purely for loan payments. Baby Boomers and seniors are carrying the most debt, with an average of $44,000 per borrower, and where more than 11% of their disposable income goes to satisfy that obligation. Millennials and Generation X have more disposable income, and so the debt obligations run to a range of 6.5% to 8.8% of disposable income.

The government data defines disposable income as gross income less taxes; it does not take into account the real and ongoing expenses of paying for shelter, food and healthcare. These are among the most non-negotiable spending categories.

The government data defines disposable income as gross income less taxes; it does not take into account the real and ongoing expenses of paying for shelter, food and healthcare. These are among the most non-negotiable spending categories.

PYMNTS data shows that the cost of those essentials as a share of disposable income comes to 22.4%.

So, the reality is that paying for daily life andadding in student loan repayments will claim roughly 30% or more of consumers’ disposable income starting in September, right into the fourth quarter that marks the all-important holiday shopping season. That means there’s less money to go around and less money to spend in stores or online.

Wall Street is taking notice. As Yahoo Finance reported, shares in Target got a downgrade from J.P. Morgan, from an overweight rating to a neutral rating.

“Target over-indexes to the millennial customer and, should student loan payments come back on, the company is more exposed than others in our coverage,” the story stated.

Separately, subscription renewals for Amazon and Walmart are seeing some pressure among millennial and Gen Z demographics. For example, the data shows that about 76% of millennials had Amazon subscriptions in place as of last month, down from 78% in April; 65% of the Gen Z cohort held those subscriptions in May, down from 75% in April.

Card spending may take a hit too. Younger generations have been more likely in recent months to shift more spending to their credit cards, with 43% of millennials and Generation Z consumers and doing so. American Express noted in its first-quarter earnings results that millennials now account for roughly 30% of spending volumes on the company’s cards.

With several percentage points “less” of disposable income in hand, the negative ripple effects will likely reverberate across the commerce ecosystem.