Digital Banks Lack ‘Home Field’ Advantage Needed to Overcome Consumer Security Concerns

Consumers have become increasingly reliant on digital banking channels since 2020, forcing financial institutions (FIs) to prioritize secure and convenient digital customer experiences. At the same time, even as consumers move to digital banking channels, criminals are responding with increased incidences of digital fraud and security breaches. Identity fraud rose 79% in 2021, while unprecedented levels of data breaches led to the exposure of personally identifiable information (PII) for approximately 300 million victims.

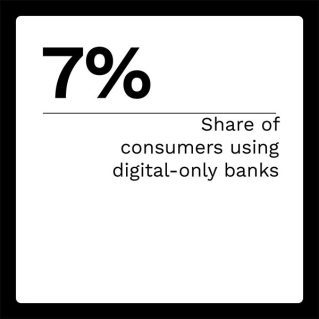

With a nearly boundless field of potential competitors in the digital space and just 7% of surveyed consumers using digital-only FIs, those institutions will need to overcome data security concerns to ensure a place in this crowded marketplace. Technology solutions such as artificial intelligence (AI) and machine learning (ML) algorithms can help create low-friction yet secure user experiences, thus building trust with consumers and ensuring they are not discouraged by poor customer experiences.

The latest edition of the “Digital-First Banking Tracker®” explores the latest trends shaping digital security risk and the need for low-friction solutions that still build consumer trust.

Around the Digital-First Banking Space

As consumers have become aware of the need for unique and complex passwords for each login, the popularity of alternative authentication methods for financial services has increased. Sixty-one percent of surveyed consumers recently said they would be happy to do away with passwords entirely and use other methods to authenticate their financial service accounts. In addition, 45% said they are comfortable with the level of security provided by nonpassword authentication methods.

One-third of surveyed consumers say they have had negative banking experiences bad enough to make them view a visit to the dentist more favorably than visiting their FIs. Some of the frustrating areas of banking for consumers include poor customer support and unpleasant digital experiences. A lack of support for preferred communication channels is also a significant deterrent to customers.

For more on these and other stories, visit the Tracker’s News and Trends section.

BM Technologies on Managing Digital Security and the Customer Experience

In a financial services space forever changed by the emergence of digital-only and digital-first providers, criminals are taking their own digitally prioritized approaches to fraud and financial crimes. Digital-only providers have a frontline position in this fight and the advantage of a digitally focused mindset.

In this month’s Feature Story, Jamie Donahue, chief technology officer at BM Technologies, discusses how his company creates customer-focused data security solutions with the help of partners and an open approach to collaboration.

Why Data Security Is Key to Consumer Trust in Digital-Only Banking

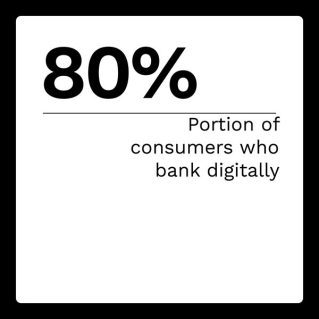

Forty-one percent of consumers say mobile apps are their primary banking method, compared to 26% who use computers for most of their banking and 11% who primarily use bank branches. In all, 80% of consumers say they do at least some of their banking digitally. Regardless of this growing interest in digital banking solutions, just 7% of those surveyed said they use a digital-only bank. Most prefer to do their digital banking with institutions that still have a physical presence.

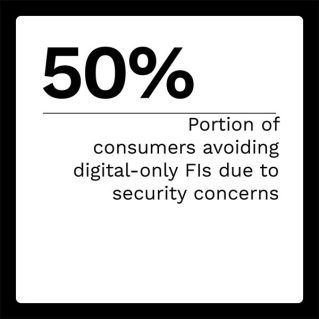

Consumers offered a number of reasons for this preference, but the largest share, 47%, said they avoid digital-only banks because they are concerned about digital data security. In fact, 83% of consumers cited that even a single security-enhancing feature inspired increased trust. The greatest distrust of digital-only banking is among baby boomers and seniors, while 42% of bridge millennials and 41% of millennials still express strong interest in having a digital-only primary bank account.

To learn more about data security and consumer trust in digital-only banking, read the Tracker’s PYMNTS Intelligence.

About the Tracker

The “Digital-First Banking Tracker®,” a PYMNTS collaboration with NCR, is your go-to monthly resource for updates on trends and changes in digital-first banking.