Remitly: FinTechs and Banks Team to Serve the Underbanked

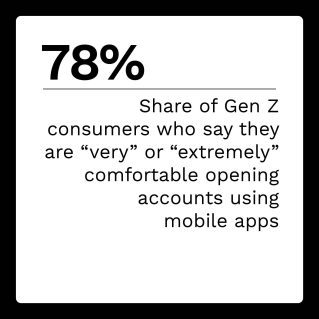

As life begins to settle back into some semblance of normalcy, more than a few digital conveniences that consumers took advantage of throughout the pandemic have found a permanent place in their daily lives. Among these are mobile apps, online banking services and other digital platforms consumers have come to rely on. The technologies behind banking-as-a-service (BaaS) enable seamless, connected banking experiences for consumers through sleek, professional platforms that can help financial institutions (FIs) and other organizations entering the banking sphere to enhance their data, personalize their customer experiences and know what the customers will need before they do.

In this edition of the Digital First Banking Tracker®, PYMNTS examines the state of BaaS and its future. It also explains how new players can enter the field and offer new conveniences to help both consumers and FIs alike.

Around the Banking-as-a-Service Space

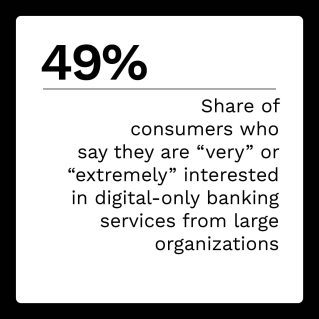

Maintaining the status quo is no longer enough for traditional banks if they hope to remain competitive. Banks are integrating the same artificial intelligence and data-based tools as neobanks and FinTechs to keep pace. A sudden explosion in the number of FinTechs and growth within the neobanking sector has caused higher consumer expectations for rewarding and engaging banking experiences. Seventy-five percent of survey respondents said that offering low-cost, fast and easy-to-use products that are readily available is what attracted them to these traditional bank competitors. Unrewarding relationships with traditional banks may drive customer enthusiasm for FinTechs. Forty-nine percent of respondents said their relationship with their current bank was not rewarding, and 48% said they did not feel an emotional connection to their bank.

With banking and technology melding more than ever, the need for increased regulatory compliance spending is expanding rapidly. The benefits of artificial intelligence (AI) and other technologies that allow for personalization or prediction are invaluable, but their implementation requires that all regulations are adhered to, which can be complicated by the fact that many of the technology providers behind new money management tools may have no prior experience in banking. Spending on regulatory technologies has increased, with research predicting that it will go from $68 billion in 2022 to more than $204 billion by 2026. The same study found that 26% of banking-related digital onboarding processes will have adopted AI programs by 2026, a rate which currently sits at 8%.

For more on these and other stories, visit the Tracker’s News & Trends.

Remitly on Building Alignment With Partners and Trust With Underbanked Populations

The challenge of moving to a new country as an immigrant is never easy, and unfortunately, gaining access to banking services is among the more difficult transitions for new residents of the United States. Dan Webber, general manager of Remitly, seeks to ensure this oft-underserved segment of the population has access to transparent and convenient international remittances while also partnering with the best possible organizations to ensure transparency, privacy and compliance both in the United States and abroad. Making sure these customers are connected is never easy, but meeting this goal is absolutely vital for this organization.

To read more, visit the Feature Story.

How Open Banking Developments Are Shaping the Future of BaaS

The technologies behind BaaS are incredibly valuable, as they facilitate smooth, seamless experiences and pave the way for new players to enter the market. Key to this movement has been open banking technologies, which have grown in popularity worldwide in the past few years as white-label financial services and BaaS technologies have established themselves. However, the field is still fairly open and the prospective benefits are clear: Direct banks that invest in open banking platforms will now be rewarded with new revenue streams and partnerships with the most capable FinTechs.

About the Tracker

The Digital-First Banking Tracker®, done in collaboration with NCR, examines how the permanent shift to digital is changing the way consumers bank — and making banking-as-a-service and related technologies more available than ever before.