Streamlined digital account opening is a must-have for all financial institutions (FIs). A critical step in that process is the login experience, for which customers increasingly require speed and security. The need for a seamless experience is crucial, as incorrect password attempts cause consumers to abandon their login sessions or even switch providers completely.

Poor password hygiene and password manager misuse are among the many reasons identity theft is on the rise. Security and user experience, however, are most important in establishing digital trust among FIs. Consumers also want consistent experiences across platforms, and they want to know how their transactions are secured. Knowledge, choice and flexibility can add to an ideal customer experience and help FIs acquire and retain more clients.

The “Digital Identity Tracker®” explores how FIs that adopt advanced ID verification can fight fraud and give customers the convenient, seamless experiences they seek.

Around the Digital Identity Space

Data breaches are rising, and fraud is particularly costly for FinTechs, costing 2% of their annual revenue. Advanced ID verification has proven to be a popular and effective tool to fend off bad actors, as most consumers who use technologies such as voice recognition, keyboard logging or liveness detection come back to use them again.

Data breaches are rising, and fraud is particularly costly for FinTechs, costing 2% of their annual revenue. Advanced ID verification has proven to be a popular and effective tool to fend off bad actors, as most consumers who use technologies such as voice recognition, keyboard logging or liveness detection come back to use them again.

Advanced ID technology is coming to airport check-in counters and boarding gates in the form of biometrics. With new standards on digital identification, the International Air Transport Association is aiming to streamline and improve the One ID initiative. With more global passengers willing to share immigration information to accelerate processing, navigating air travel will become easier and more secure for passengers and airlines.

For more on these and other stories, visit the Tracker’s News and Trends section.

An Inside Look at Authentication Done Right

FinTech Spark Wallet was losing too much money to fraud, especially bots, and needed a solution. The company began implementing third-party solutions, which helped the company measure identity reputation while watching the bots get turned away. Now Spark Wallet is bot-free and able to reinvest in customers.

Martin Spusta, Spark Wallet’s CEO, provides the Insider POV on digital authentication done right.

Interest in Advanced Digital ID Growing to Address Convenience, Safety Concerns

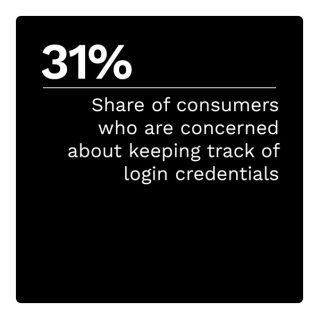

Consumers are not interested in waiting to access an account. They want friction-free, streamlined experiences at the login stage, and as advanced digital ID tools gain wider adoption, consumers are becoming more comfortable with them. Login credentials can be problematic for consumers for several reasons. Companies that reduce identity friction can avoid losing customers who would switch brands because of a poor login experience. Also, brands must reach customers on their preferred channels with the authentication methods they seek. Biometrics can help address the biggest challenge of digital ID, which is adding layers of security without adding friction.

To learn more about how advanced digital ID verification is growing, read the Tracker’s PYMNTS Intelligence.

About the Tracker

The “Digital Identity Tracker®,” a collaboration with Prove, examines the growth of advanced digital ID verification as a vital tool for companies to deliver the convenient and secure experiences consumers have come to expect.