This shift has prompted colleges and universities to invest significantly in automation and advanced mobile systems, not just to upgrade security measures but also to accommodate students’ preference for smartphones as their primary payment method.

This evolution reflects a necessary adjustment from traditional university models towards digital solutions that align with students’ evolving behaviors and preferences.

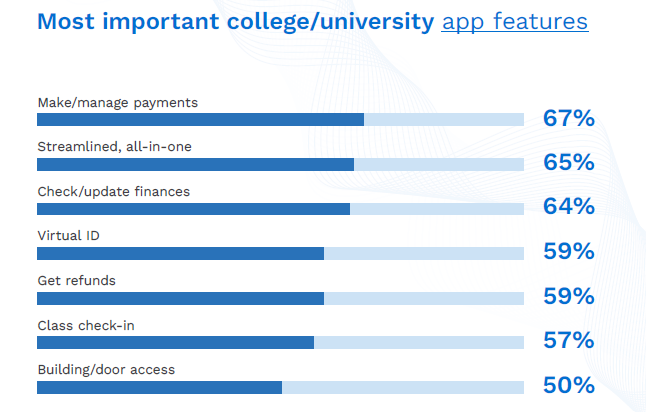

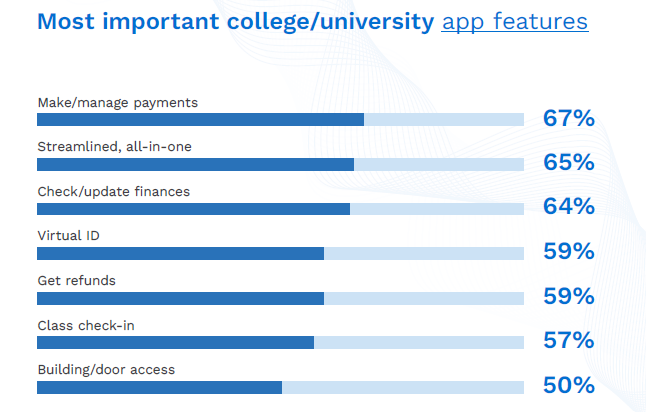

As detailed in the “The Automated Campus: Enabling the Future of Higher Education,” a collaboration between PYMNTS Intelligence and American Express, the most essential features and functions students value in their college app are payment management; a streamlined, all-in-one app; checking and updating finances; and using the app as a virtual ID card.

Additionally, more than half of the students surveyed also cited the importance of features like receiving refunds, class check-ins, and access to buildings or doors, underscoring the growing significance of mobile automation in creating a secure and convenient campus experience.

Virtual student IDs, in particular, are gaining popularity, granting students access to buildings and enabling payments for meals, parking, books, supplies and laundry, effectively eliminating the need for cash or credit cards.

Advertisement: Scroll to Continue

As further evidence of the growing trend, Drake University in Iowa is set to introduce a virtual student ID program this spring, becoming the first college or university in the state to offer mobile credentials to students, The Times-Delphic, the institution’s student newspaper, reported last month.

The virtual IDs will be compatible with a wide range of Apple iPhone and watch models, along with several Android phone and watch models. Using the school’s Transact eAccounts app, students can add their mobile credentials to a single phone and smartwatch, giving them access to a multitude of campus amenities, spanning doors, printers, dining areas, and even popular spots like Starbucks, the report noted.

“Our students live in an era and a date and time where having information on your phone, having your Apple Pay or credit cards or even plane tickets on your phone is just normal.” Director of Public Safety Scott Law said of the campus-wide program launch. “We realize this is the way of the future, this is where people are going.”

ITS Project Manager Jeff Regan added: “From a functionality perspective, printing physical cards and supporting card printing software and machines is an art that is going away. As we see a higher adoption rate for mobile IDs across campus […] we expect to see an ease and improvement from a user experience perspective […].”

Drake University is not the first U.S. educational institution to implement virtual IDs. Since 2018, Apple Wallet has facilitated contactless student IDs in several universities nationwide including Northern Arizona University, University of Maine and New Mexico State University.

Notably, the University of Alabama, an early participant in the program, exclusively issued mobile student IDs to eligible device users in the fall of 2021, with Android phone owners able to access the digital cards through Google Pay, The Verge reported at the time.

This widespread adoption of automation, virtual student IDs and advanced mobile systems goes to show that the concept of the connected campus is no longer a distant vision but a reality being embraced by colleges and universities across the United States.

And with the higher-education software market projected to hit $169.7 billion by 2030, per PYMNTS Intelligence, campuses are poised to evolve into more interconnected and efficient hubs, optimizing operations, resource utilization and significantly enriching the educational experience for today’s students.