As major rideshare companies compete for even greater shares of the market, they’re placing a heavy focus on fine-tuning onboarding processes. Making it easy for both drivers and riders to join the app is key to quickly expanding user bases, but this speed cannot be achieved at the expense of rigorous driver identity verification and background checks.

The March “Digital Consumer Onboarding Tracker” explores how rideshare companies, online gig marketplaces and other platforms are working to provide even faster and more secure digital onboarding experiences.

Around the Digital Onboarding World

Any online marketplace needs to provide secure onboarding to keep all users safe from fraud. Yet, should the platform slip up, the damage can be very different, depending on who the marketplace is connecting.

Failure to catch fraud early on can derail a project, but the stakes are higher if fraud goes uncaught between would-be home renters and hosts. After all, no one wants to show up at an apartment they think they rented, only to find it was a fake listing, leaving them stranded in a strange city without anywhere to spend the night. Likewise, no homeowner wants to open their doors to bad actors.

With this kind of risk at play, apartment rental platforms are upping their efforts to verify the hosts and guests that they connect. That includes 2nd Address, an online home rental marketplace, which recently adopted a selfie-based verification solution for its users.

Argentina-based Wilobank is also turning to selfies for authentication. The challenger bank now provides smartphone-based know your customer (KYC) and onboarding processes. Customers upload ID documents and create video selfies to confirm their identities, thereby thwarting fraudsters.

However, even while some players advance selfie-based authentication solutions, password use also lingers. That’s a problem because, while passwords aren’t inherently insecure, using them properly is a friction-filled experience for customers, explained Stephen Maloney, executive vice president of business development and strategy for Acuant, in a recent interview. Change, though, is in sight.

Increasingly, companies are adopting more innovative authentication measures, and are tailoring their security approaches to the context of the situation. That includes companies tapping mobile geo-tracking as an additional authentication measure when offering mobile services, or being willing to introduce higher friction authentication for more security-critical operations like bank transfers, while keeping actions like paying for a rideshare more streamlined.

Find the rest of the latest headlines in the Tracker.

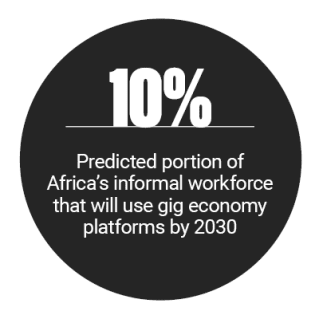

Deep Dive: Gig Economy Onboarding and the Push for Faster Payments

Digital marketplaces are also taking fresh approaches to their onboarding security procedures as they seek to woo employers and gig workers alike. These marketplaces must provide robust identity confirmation and authentication, while still enabling freelancers to quickly get set up to start earning funds.

This month’s Deep Dive explores how digital marketplaces are working to provide better payment experiences and more streamlined identity verification procedures.

How Freelancer.com Securely Onboards Global Users

Global freelancing marketplaces face the challenge of providing employers with a wide array of skilled freelancers they can trust to get the job done, and providing workers with confidence that they will be paid. However, smoothly and securely connecting employers with freelancers requires powerful onboarding tools that can entail leveraging a mix of advanced technology and live human support, said Freelancer.com CEO Matt Barrie.

In this month’s feature story, Barrie spoke about using machine learning, local ID knowledge, live video calls and more to help protect the marketplace’s 32 million users.

About the Tracker

The “Digital Consumer Onboarding Tracker,” powered by Acuant, examines the latest KYC, digital onboarding and online verification news and trends. The Tracker also gauges the roles that technologies, such as biometrics and blockchain, play as identity verification procedures continue to change and expand around the world.