Universities are still adjusting to the COVID-19 pandemic’s wide-ranging effects on educational systems across the United States. Remote learning has become a much larger part of student life since the health crisis began, and this is bringing up a host of challenges that colleges must quickly overcome.

One of the main hurdles each campus must confront is onboarding the thousands of new students who are beginning their college lives as a freshman, as this process must now be handle d virtually from beginning to end. Many universities are used to conducting at least some of their onboarding online. Still, many have long relied on in-person interactions to finalize details such as financial aid or verify students’ identities. Moving these procedures online thus represents a significant shift for these institutions — one that could be rife with pitfalls if they do not get it right. Failing to properly authenticate students could delay their enrollment and improper authentication during onboarding could also open up universities’ online portals to fraudsters.

d virtually from beginning to end. Many universities are used to conducting at least some of their onboarding online. Still, many have long relied on in-person interactions to finalize details such as financial aid or verify students’ identities. Moving these procedures online thus represents a significant shift for these institutions — one that could be rife with pitfalls if they do not get it right. Failing to properly authenticate students could delay their enrollment and improper authentication during onboarding could also open up universities’ online portals to fraudsters.

In the latest “Digital Consumer Onboarding Tracker®,” PYMNTS takes a closer look at how the pandemic has affected universities’ onboarding of and interactions with new students as well as how they can provide resources to these individuals once that process has been finalized.

Around the Digital Onboarding World

Georgetown University, for one, is augmenting its onboarding process via a mobile application that students are required to download onto their phones. It will leverage a third-party technology providers’ app to verify its students’ identities using two-factor authentication (2FA). Students who are logging onto the universities’ online resources portal will then be asked to authenticate themselves via the app once they have been onboarded. The tool works by identifying both the students’ passwords and smartphones onto which the apps have been downloaded to grant access.

Mobile i s also becoming a more popular channel for financial institutions (FIs) and merchants looking to onboard new customers as the health crisis keeps consumers from venturing into branches and shops. Both online and mobile account openings have increased recently, with one April study showing that mobile banking traffic rose by 85% during the month, for example. Another study found that community FIs have seen online account openings increase by 14.5% overall since the start of the pandemic. These digital shifts are likely to continue even after the pandemic ends, with only 40% of customers claiming they would return to physical bank branches when it does.

s also becoming a more popular channel for financial institutions (FIs) and merchants looking to onboard new customers as the health crisis keeps consumers from venturing into branches and shops. Both online and mobile account openings have increased recently, with one April study showing that mobile banking traffic rose by 85% during the month, for example. Another study found that community FIs have seen online account openings increase by 14.5% overall since the start of the pandemic. These digital shifts are likely to continue even after the pandemic ends, with only 40% of customers claiming they would return to physical bank branches when it does.

Biometric tools are also witnessing a spike in interest for digital onboarding usage. Curve, a mobile FinTech based in the United Kingdom, announced that it would be tapping a third-party provider’s biometric technologies to upgrade its onboarding process. New users will now be asked to take selfies before uploading them to the Curve platform alongside pictures of their driver’s license, passport or other official ID documents. The FinTech will then use its partner’s biometric capabilities to compare the two images and verify potential customers’ identities.

For more on these and other stories, visit the Tracker’s News & Trends.

WVU On How the Pandemic Has Pushed Universities to Adopt Digital Onboarding

U.S. universities have opened their doors on a new fall semester, setting up digital classes and resources for new and returning students alike. Many of these institutions needed to make swift adjustments to their onboarding processes as they face the health and safety risks posed by the COVID-19 pandemic, however. Schools are used to using digital technologies to support some onboarding aspects, but they now must consider how to virtually conduct almost all of the process. That means that schools must find ways to process students’ financial aid, housing, meal plans and numerous smaller details online without any strain, Corey Farris, dean of students for West Virginia University (WVU), explained in a recent PYMNTS interview.

To learn more about how WVU is expanding its use of online tools for new student onboarding, visit the Tracker’s Feature Story.

Deep Dive: How the Pandemic Pushed  New Student Onboarding Online

New Student Onboarding Online

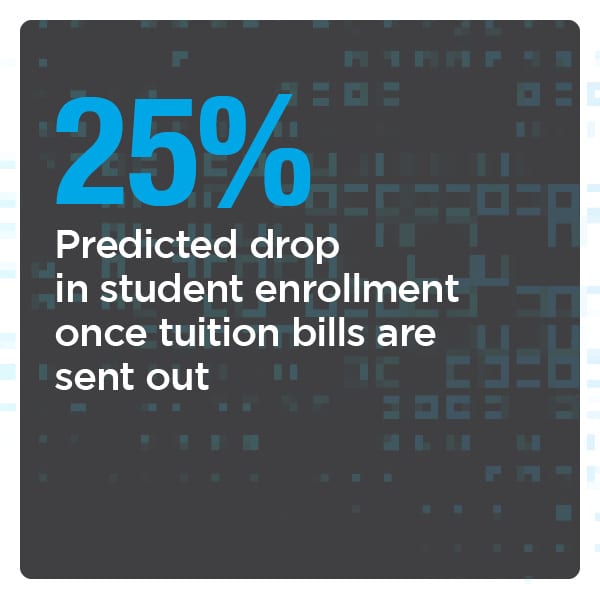

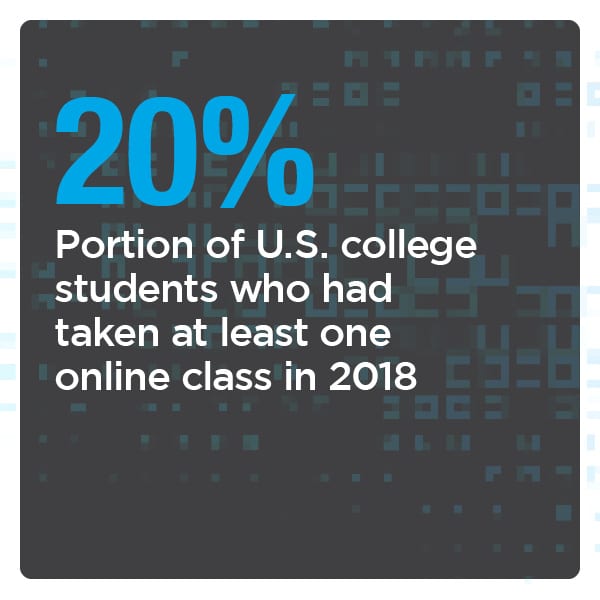

The pandemic is leading to rapid shifts in how students are learning and interacting with their teachers and classmates. One 2018 study found that just 20% of college undergraduates took even a single online class that year, for example, a far cry from the current university atmosphere in which digital classes have become the new normal. Universities now need to find ways to manage large numbers of students online as well as to finalize the onboarding of new students using primarily digital tools. This requires them to coordinate everything from financial aid to housing online rather than in-person, all while making sure new students’ identities have been properly verified.

To learn more about how the ongoing pandemic is pressing universities to move more of their student onboarding activities online, visit the Tracker’s Deep Dive.

About the Tracker

The “Digital Consumer Onboarding Tracker®,” a partnership with Melissa, examines the latest know your customer (KYC), digital onboarding and online verification news and trends. The Tracker also examines the role alternative data sources and related technologies such as advanced analytical tools can play in this space as onboarding needs grow more sophisticated.