Securing The Bank’s Digital Front Door

Financial institutions (FIs) are familiar with the challenges of pairing customer satisfaction with security, a balancing act that becomes crucial when onboarding customers.

Financial institutions (FIs) are familiar with the challenges of pairing customer satisfaction with security, a balancing act that becomes crucial when onboarding customers.

Maintaining digital onboarding experiences that allow customers to access their accounts with ease is essential for competing banks, but to do so, customers’ identities must be verified as quickly as possible.  That means banks need access to as much data as reasonably possible so they can confirm customers are legitimate. Having access to more data, however, means that banks can authenticate customers by requesting one or two pieces of information, rather than providing identity documents or visiting branches to complete the onboarding experience, easing frictions in this process.

That means banks need access to as much data as reasonably possible so they can confirm customers are legitimate. Having access to more data, however, means that banks can authenticate customers by requesting one or two pieces of information, rather than providing identity documents or visiting branches to complete the onboarding experience, easing frictions in this process.

In the latest “Digital Consumer Onboarding Tracker®,” PYMNTS examines how banks are responding to online onboarding challenges as well as the importance of relevant data in creating a seamless experience. The Tracker also analyzes the impact of the coronavirus and how banks may be experimenting with more online tools and technologies for onboarding and customer service in its aftermath.

Around the Digital Onboarding World

The Royal Bank of Canada (RBC) is one FI that is trying out biometric tools as a way to speed authentication during its onboarding process. The FI implemented biometric authentication into its mobile onboarding process just weeks before COVID-19 led to global stay-at-home orders. The introduction of these tools means that customers do not have to submit physical documents or further authenticate themselves in physical branches. RBC also announced it is allowing customers to scan their passports using their cameras for identification, something that could also come in handy as quarantine continues.

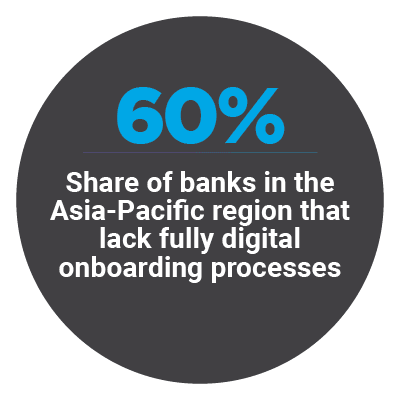

COVID-19 has shuttered many bank branches worldwide, something that may contribute to the spread of digital onboarding tools in markets where FIs still heavily rely on in-person authentication checks. Sixty percent of banks in the Asia-Pacific region do not yet have digital onboarding tools implemented onto their platforms, according to one recent study, for example, while some European banks still rely on “liveness” checks that require banks to check consumers’ identities in person.  The impact of the pandemic could give these FIs a push toward making digital onboarding tools more widely available, as consumers may not wish to go back to onboarding in physical branches.

The impact of the pandemic could give these FIs a push toward making digital onboarding tools more widely available, as consumers may not wish to go back to onboarding in physical branches.

Many FIs identified speedier onboarding as a key area of focus before the virus’s outbreak. One recent survey of North American FIs saw 80% of banks stating that improving their customer experience through onboarding would be their top priority for 2020. They are looking to reduce the number of manual processes they use as part of this experience, turning instead to automated technologies that can help to process identification factors and customer data much faster. Ninety percent of the 100 FIs surveyed are looking to use automation in some form, according to the study.

For more on these and other stories, visit the Tracker’s News And Trends.

How Digital-First Quontic Bank Is Innovating Onboarding For Digital Customers

Creating their new bank accounts is the very first experience consumers have with their FIs — one that sets the tone for the rest of the customer relationship. The expectation for seamless onboarding for every experience has only grown among consumers as digital commerce becomes the norm, where accessing one’s retail account takes only a moment. Banks need to provide the same sort of instant experience — but with triple the security — and to do that, they need access to as much information as possible at the start to ensure they have a full and transparent view of their customers. Fast identity verification relies on transparent, up-to-date data, explained Patrick Sells, chief innovation officer for New York-based digital-first FI Quontic Bank.

To learn more about how Quontic Bank is driving its onboarding experience forward for its online customers, visit the Tracker’s Feature Story.

To learn more about how Quontic Bank is driving its onboarding experience forward for its online customers, visit the Tracker’s Feature Story.

Deep Dive: FIs and the Outdated Data Problem

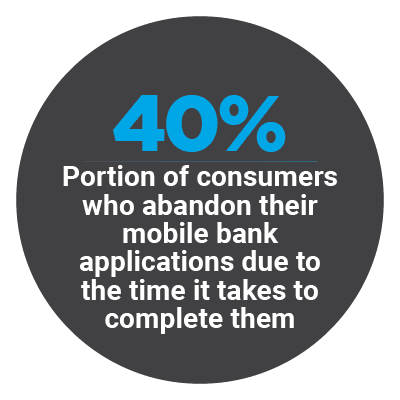

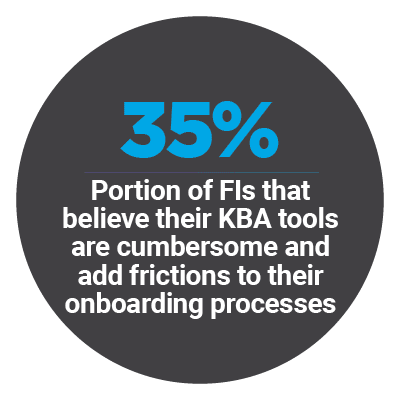

Crafting seamless onboarding is critical for banks, but there are pitfalls: FIs with longer authentication processes or reliance on outdated data can frustrate consumers, leading to them to abandon their accounts for competitors. Banks that use an outdated data cache to check customer identities during this process can also be less able to pick up on new account fraud or identity theft, since they have views of their customers that are incomplete. Making sure that the information that is grafted into the onboarding experience is accurate and current is becoming much more essential to digital onboarding now that fraudsters are growing more sophisticated and customers more impatient.

To learn more about the problems outdated data can cause FIs during the onboarding process, visit the Tracker’s Deep Dive.

About the Tracker

The “Digital Consumer Onboarding Tracker®,” a partnership with Melissa, examines the latest KYC, digital onboarding and online verification news and trends. The Tracker also examines the role alternative data sources and related technologies, such as advanced analytical tools, can play in this space as onboarding needs grow more sophisticated.