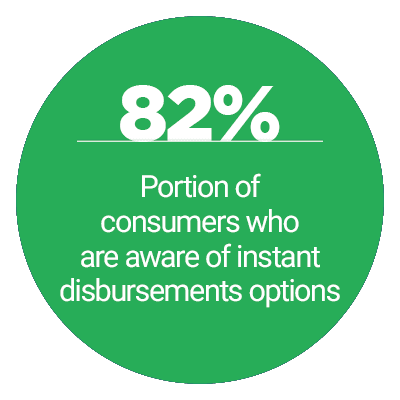

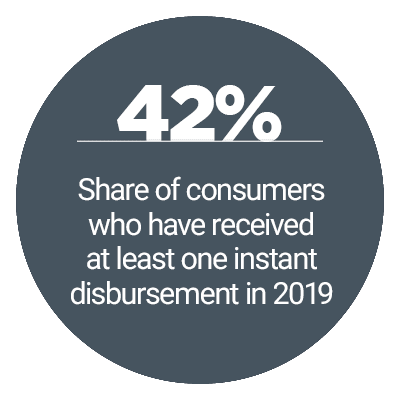

Both consumers and businesses appear to have a much higher preference for digital disbursement tools, however. Fifty-one percent of consumers surveyed in the PYMNTS Disbursement Satisfaction Report would like to receive disbursements through instant payments, and yet, not all of these customers received such payments in 2019.

The December Disbursements Tracker examines the current state of disbursements and instant, online payments, which are becoming more common in many industries. The Tracker also examines the challenges of ousting checks in those industries that are still  relying on them for the majority of their disbursements.

relying on them for the majority of their disbursements.

Around The Disbursements World

Uber is among the private companies hoping that faster disbursements will foster greater employee loyalty. The company has developed Uber Money, a real-time disbursements service for its drivers, which will deposit their funds immediately after individual rides are finished. The feature is aimed at supporting gig workers who typically live paycheck-to-paycheck, and thus need faster access to their wages.

Ube r is far from the only company looking to support gig workers with these types of payments. JPMorgan Chase has created a mobile wallet to aid with sharing economy disbursements, a feature that can be used by partner services such as Airbnb, Lyft or Uber. The bank will offer partner companies and their employees additional perks for using these services, such as discounts for home rentals as well as quick access to their wages.

r is far from the only company looking to support gig workers with these types of payments. JPMorgan Chase has created a mobile wallet to aid with sharing economy disbursements, a feature that can be used by partner services such as Airbnb, Lyft or Uber. The bank will offer partner companies and their employees additional perks for using these services, such as discounts for home rentals as well as quick access to their wages.

Advertisement: Scroll to Continue

Disbursements are expanding in several other markets outside of the U.S. and the gig economy as well, including China. Tencent, the parent firm of payments and messaging application WeChat, has created a mobile payment solution that may be accessed from the WeChat messaging app. Money can be sent using the new offering to any user of the WeChat platform, regardless of if the two parties have been previously connected. The feature can be used for both individual peer-to-peer (P2P) payments as well as transactions between consumers and businesses on the WeChat platform.

To learn more about this and other news items in the space, visit the Tracker’s News & Trends section.

Law Firms And The Digital Disbursement Challenge

There are still some areas where digital transactions are not the norm, no matter how much consumers would prefer it. Legal firms have still resisted online methods to send out claims and other disbursements, keeping many payments in the realm of checks even as consumer frustrations continue to mount. These firms may simply not realize that checks are so highly grafted into their disbursements experience, says Joshua Browder, founder and CEO of legal app, DoNotPay. Alternatively, many of these firms may still be wary of digital payments and their overall security, despite the frailty of checks. To learn more about legal disbursement challenges and innovations, visit the Tracker’s Feature Story.

There are still some areas where digital transactions are not the norm, no matter how much consumers would prefer it. Legal firms have still resisted online methods to send out claims and other disbursements, keeping many payments in the realm of checks even as consumer frustrations continue to mount. These firms may simply not realize that checks are so highly grafted into their disbursements experience, says Joshua Browder, founder and CEO of legal app, DoNotPay. Alternatively, many of these firms may still be wary of digital payments and their overall security, despite the frailty of checks. To learn more about legal disbursement challenges and innovations, visit the Tracker’s Feature Story.

Digital Disbursement Growth Is Slow Going For The Legal Space

Digital disbursements may be growing, but legal firms still have their qualms about them. Part of the reason that these online methods remain less popular for legal payments than other types of disbursement is simply because legal payments are more complex. Consumers who are not well versed in legal jargon may thus find themselves waiting months for checks, which can severely limit their financial freedom. To learn more about the challenges digital disbursements are facing within the legal world, visit the Tracker’s Deep Dive.

About the Tracker

The PYMNTS Disbursements Tracker™, powered by Ingo Money, is the go-to monthly resource for staying up to date on the trends and changes in the digital disbursements space.