Why Millennial SMB Owners Need Faster Tax Disbursements

The joys of tax season: complex paperwork, long wait times and check disbursements.

Many United States consumers are still reliant on paper checks when it comes to receiving their tax refunds, which represents the largest sum of money many of them will receive at one point during the fiscal year. Checks are still a persistent part of the tax experience within the country, but tax firms and other supportive businesses have slowly, persistently, begun implementing digital disbursement tools to make payments easier. Innovation may not be progressing at the rate consumers may like, however.

Many United States consumers are still reliant on paper checks when it comes to receiving their tax refunds, which represents the largest sum of money many of them will receive at one point during the fiscal year. Checks are still a persistent part of the tax experience within the country, but tax firms and other supportive businesses have slowly, persistently, begun implementing digital disbursement tools to make payments easier. Innovation may not be progressing at the rate consumers may like, however.

In the latest Disbursements Tracker®, PYMNTS analyzes the latest developments in the tax disbursements space, and how faster payments may be used to eliminate some of the traditional frustrations experienced by taxpayers and business owners.

Around the Disbursements World

Most U.S. taxpayers still have to wait weeks to receive their refund checks through the mail before they can finally put them to use. The average wait time to receive these checks is 21 days, according to the Internal Revenue Service (IRS). Refunds can also be slowed down if there is incomplete or missing information in individual tax returns, further complicating an already complex process. Most consumers can see their refund amounts within 24 hours of filing their taxes, which makes this wait time even more harrowing for those who may depend on that money to pay bills.

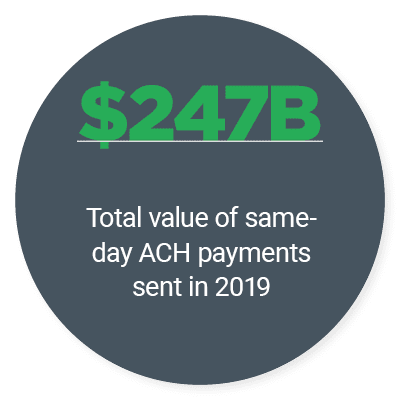

Checks are unlikely to disappear completely from  the U.S. tax disbursement process within the next couple of years, however. Many U.S. state governments have implemented ACH or other digital payment methods to ensure disbursements can be made at speed, but are not getting rid of checks completely as an option for underbanked or unbanked residents who may not have the ability to accept digital payments.

the U.S. tax disbursement process within the next couple of years, however. Many U.S. state governments have implemented ACH or other digital payment methods to ensure disbursements can be made at speed, but are not getting rid of checks completely as an option for underbanked or unbanked residents who may not have the ability to accept digital payments.

The U.S. is far from the only place where taxes are receiving an upgrade. Singapore is also making moves to create a more innovative tax experience for its citizens. The city-state’s regulators are looking to remove checks from their tax processes, with its government having partnered with its native banks to enable more digital payment processes. Regulators and banks will work together to enable digital wages and other financial features for Singaporean residents, eliminating the need for checks come tax time.

To learn more about this and other developments in the space, visit the Tracker’s News And Trends section.

Innovating Tax Disbursements for the Next Generation of Businesses

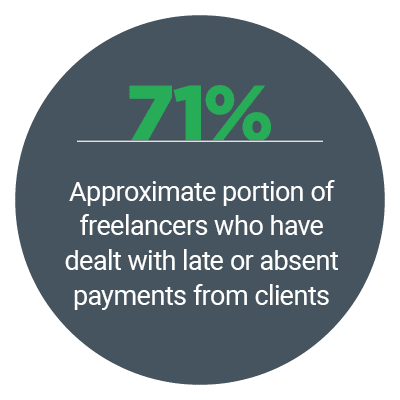

More millennials are beginning to operate independent or small- to medium-sized businesses (SMBs), where knowledge of one’s cash flow and outstanding finances is critically important to success. Lagging tax disbursements can thus be a cause of financial strain to these younger business owners, who may have less personal experience with checks than older generations. Digital disbursements and personalized tax services can help to ease these frustrations, said Waseem Daher, founder and CEO of corporate tax and bookkeeping firm Pilot. To learn more about how disbursements can be upgraded for millennial-run SMBs, visit the Tracker’s Feature Story.

Lagging Tax Disbursements Cause Financial Strain

Only 24 percent of U.S. consumers currently receive their tax refunds through digital means, leaving the rest counting down the days until physical checks are delivered in the mail. This delay between filing and receiving funds can have significant impacts on taxpayers’ financial health, as they may be depending on their refunds to pay bills or make other important payments. Faster disbursements would enable them to receive this money more quickly so that it can be put to use, allowing consumers to make larger-scale financial purchases as well as to pay off existing debt or other bills. To learn more about how faster disbursements can provide real benefits for consumers, visit the Tracker’s Deep Dive.

Only 24 percent of U.S. consumers currently receive their tax refunds through digital means, leaving the rest counting down the days until physical checks are delivered in the mail. This delay between filing and receiving funds can have significant impacts on taxpayers’ financial health, as they may be depending on their refunds to pay bills or make other important payments. Faster disbursements would enable them to receive this money more quickly so that it can be put to use, allowing consumers to make larger-scale financial purchases as well as to pay off existing debt or other bills. To learn more about how faster disbursements can provide real benefits for consumers, visit the Tracker’s Deep Dive.

About the Tracker

The PYMNTS Disbursements Tracker®, powered by Ingo Money, is the go-to monthly resource for staying up to date on the trends and changes in the digital disbursements space.