The Number Of Disbursements Is Increasing, The Number Sent Instantly Barely Breaks 10 Percent

Disbursements have become part of consumers’ lives like never before in the United States. Millions of consumers and small businesses have received government stimulus and small business assistance payments in response to the economic downturn caused by the coronavirus pandemic, while others are getting paid for freelance or contract work to help make ends meet. These payments join an already long list that includes insurance payouts, stock dividends and product refunds.

Disbursements have become part of consumers’ lives like never before in the United States. Millions of consumers and small businesses have received government stimulus and small business assistance payments in response to the economic downturn caused by the coronavirus pandemic, while others are getting paid for freelance or contract work to help make ends meet. These payments join an already long list that includes insurance payouts, stock dividends and product refunds.

More than two-thirds of U.S. consumers have received at least one disbursement in the last 12 months — a more than 7 percent increase from 2019, according to PYMNTS’ latest research. The share that has received more than one disbursement has grown even more sharply, to more than 52.2 percent.

More than two-thirds of U.S. consumers have received at least one disbursement in the last 12 months — a more than 7 percent increase from 2019, according to PYMNTS’ latest research. The share that has received more than one disbursement has grown even more sharply, to more than 52.2 percent.

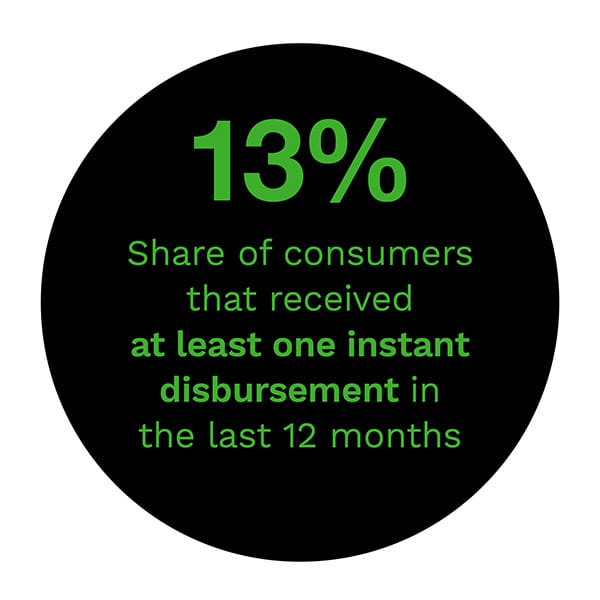

Yet, the way consumers receive disbursements stands in stark contrast to how many of them make payments today, with one-touch simplicity of peer-to-peer (P2P) apps like Venmo and digital wallets like Apple Pay. Only 13 percent of consumers currently receive disbursements through instant payments to digital wallets or debit, credit or prepaid cards. The share is even lower among small businesses with fewer than three employees: Just 8 percent of these microbusinesses say they can access instant disbursements.

Two methods of disbursement remain far more prevalent: direct deposit, which may require considerable time to set up, and checks, which can be even more onerous and time consuming. Such complications are often the last thing consumers and small businesses need, especially in the current economic environment.

PYMNTS’ latest research report, Disbursements Satisfaction 2020: Monetizing Payout Choice, a collaboration with Ingo Money, extensively examines these trends. The report is based on surveys of more than 5,000 U.S. consumers and 500 microbusinesses that receive disbursements, as well as 600 companies of all sizes that pay disbursements across the country.

PYMNTS’ latest research report, Disbursements Satisfaction 2020: Monetizing Payout Choice, a collaboration with Ingo Money, extensively examines these trends. The report is based on surveys of more than 5,000 U.S. consumers and 500 microbusinesses that receive disbursements, as well as 600 companies of all sizes that pay disbursements across the country.

The study focuses specifically on digital solutions that have emerged in recent years allowing consumers to access funds within 30 minutes of disbursement, and sometimes within seconds. Funds can be transferred directly into any type of account, including bank, prepaid and digital wallet accounts. Our research shows that using such solutions could make or break business relationships between companies and their customers and partners.

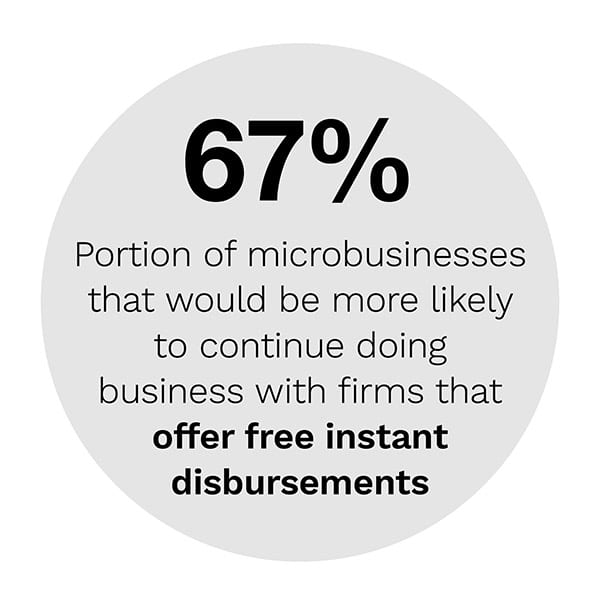

Two-thirds of microbusinesses and 61 percent of consumers that receive disbursements would be more likely to continue doing business with firms that offer instant payment options without fees. Without this option, the share likely to continue business relationships drops to 30 percent. Moreover, many companies have a blind spot regarding how highly their customers and partners value instant payments, believing that 67 percent would continue working with them even if they did not offer instant payments.

It is not enough for companies to say they offer fast digital disbursement options, though. They have to do more to make sure their customers and partners know the options are available and easy to use. Our research reveals a perception gap between payers and payees when it comes to payment choice. Nearly 80 percent of companies say they offer payout choice including instant options — 30 percent more than the share of consumers and microbusinesses that say these options are available to them.

It is not enough for companies to say they offer fast digital disbursement options, though. They have to do more to make sure their customers and partners know the options are available and easy to use. Our research reveals a perception gap between payers and payees when it comes to payment choice. Nearly 80 percent of companies say they offer payout choice including instant options — 30 percent more than the share of consumers and microbusinesses that say these options are available to them.

These findings merely scratch the surface of our findings. To learn more about the state of disbursements, download the report.

About The Report

Disbursements Satisfaction 2020: Monetizing Payout Choice provides a multidimensional look at the potential and demand for instant digital disbursement solutions.