Deep Dive: How The Pandemic Is Accelerating Instant Payments’ Necessity In The Growing Gig Economy

More consumers have been turning to gig platforms both as a source of new income and to order restaurant meals, groceries or other goods for greater convenience since the start of the pandemic. The value of these platforms has, in turn, continued to expand over the past year, with the gig economy growing 33 percent in 2020 to hit a value of $1.6 trillion, according to one recent study. Younger consumers in the millennial and Generation Z age ranges were particularly drawn to freelancing during this period as well, and another report found that at least half of Gen Z workers did some freelance work in the past year. Thirty-six percent of that generation’s freelancers did so for the first time since the start of the pandemic, for that matter.

The growth of the gig economy brings with it a slew of new challenges for its workers and platforms, however. Opportunities dipped during the year as the number of candidates seeking gig work swelled while the global economy contracted due to pandemic-driven hardships. Gig economy participants are also falling under regulatory scrutiny as the legal definition of what constitutes a freelancer remains in flux, especially in the U.K. and the U.S. This impacts the financial or health benefits that freelancers can access, including government-funded programs such as unemployment or the U.S. Paycheck Protection Program, for example.

Many freelancers are seeking ways to access funds for completed jobs more swiftly as well, increasing the demand for digital — and preferably instant — disbursement methods. Barriers to instant payment ubiquity remain in this market, however, as outdated infrastructure and the continued reliance on paper-based processes stall disbursement speed on the platforms hiring freelancers. Addressing these problems is therefore crucial to the gig economy’s continued growth. The following Deep Dive examines how the gig economy has expanded in recent years — especially in 2020 — and how this expansion is changing freelancers’ payment expectations for good. It also analyzes why instant payments are playing a more critical role in this space.

The Pandemic’s Effect On The Gig Economy

Fulfilling freelancers’ payment needs at speed is crucial as more individuals turn to ad hoc work full-time and the pandemic continues to narrow the number of available job opportunities. Research indicates that 23 percent of American gig workers are full-time freelancers and that 49 percent work part-time, while 63 percent of ad hoc workers in a global study reported freelancing as their primary income. Gig work is becoming more attractive to a wider swath of consumers as they work remotely around the world, but the pandemic has also highlighted some of freelancing’s drawbacks. The ongoing global health crisis has cinched gig workers’ margins, with one report finding U.K. freelancers’ income on average decreased by 25 percent from April to June 2020. The amount of time ad hoc workers spent working also declined, with the study indicating a 66 percent increase in the time self-employed U.K. workers spent not working or between projects.

This puts a tight financial squeeze on freelancers competing for opportunities, but these workers are also increasingly struggling to receive their earnings from projects they have completed. Late or delayed payments are a familiar problem for ad hoc workers: 2019 data shows U.K. freelancers in creative industries lost approximately £5,400 (roughly $7,500) on average annually due to late payments, for example. Late payments have only risen in frequency over the course of the pandemic, with both younger and less experienced ad hoc workers especially affected. One recent study showed that 57 percent of U.K. freelancers 16 to 34 years old and 53 percent of those with only one to three years of freelancing experience have observed a jump in late payments during this time. These workers are more likely to have less savings to draw upon than older or more experienced freelancers, exacerbating the impact on their finances.

The late payments problem is prompting greater scrutiny of instant payment solutions among companies looking to compete for freelancers by sending their payments with speed and ease. Freelancers’ increased interest in instant payments could also significantly impact the gig economy’s future.

The Instant Payments Push

Less available work, a more saturated playing field and the frictions of late payments are all contributing to workers seeking out payment methods that can allow them quicker access to incoming funds. Seventy percent of gig workers in one recent study noted they would be more loyal to companies that offered them same-day pay, suggesting that this feature is becoming a higher priority for workers applying for projects.

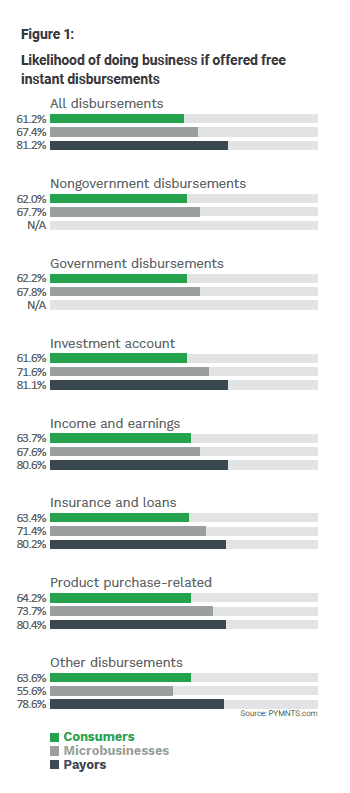

This growing demand for faster pay is also reflected in the wider working world. Recent PYMNTS data showed that nearly 64 percent of U.S. consumers overall indicated they would be more likely to work for companies that offered them free instant payment support for their income and earnings, for example. That same study found that 26 percent of consumers would be willing to pay a fee to access their income and earnings via instant payment solutions.

This study demonstrates how instant payments are becoming essential not only to workers in the gig economy but also to workers in general. Determining how to meet this growing expectation for swift and seamless disbursements is therefore the next great challenge for companies and their banking partners. Firms must be prepared to innovate their payment processes and offerings quickly to keep pace.