The Instant Payments Divide: How Lenders Can Use Disbursements To Create Lasting Trust

The lending industry was hit hard during the pandemic’s early months, with many banks and traditional lenders rapidly adjusting their standards and rates to accommodate businesses’ and consumers’ shifting needs. Demand among businesses — especially smaller firms — skyrocketed as they attempted to blunt revenue challenges and keep their operations above water, but these companies faced numerous hiccups when securing financing.

The crisis has also increased consumers’ demand for loans in several categories. Housing loan applications in the European Union recovered in Q3 after a significant dip earlier in the year, for example, with banks seeing such applications rise 31 percent. This means financial institutions (FIs) have had to tread carefully to vet potential recipients, assess the risks they present and disburse loans with the necessary speed. The ongoing global health crisis has also affected recipients’ expectations regarding how they will receive such funds, especially as businesses and consumers look to swiftly reach their own financial goals.

Lending overall may be inching back to its pre-pandemic levels in several areas, but the global health crisis could have profound effects on the industry’s future as customers adjust their views on the process. The following Deep Dive examines the pandemic’s effects on the lending industry as a whole and focuses on consumers’ and businesses’ disbursement expectations. It also analyzes how these shifts could create more opportunities for nontraditional lenders, especially those that have embraced digital or instant payment methods.

The Disbursements Expectation Catch

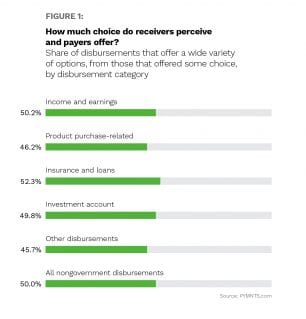

Banks and lenders wishing to gain consumers’ trust in the current market must familiarize themselves with what these consumers want and expect from the process, particularly when it comes to disbursements. There appear to be some notable perception gaps in terms of what consumers would like from disbursements and what they think their lenders can provide.

Consumers are becoming more familiar with digital technologies and are expecting swifter disbursement methods in other areas of their lives, such as for P2P or retail-related payments. This increased familiarity with digital payments is still somewhat offset by recipients’ perceptions of whether lenders can fulfill these expectations, however. Fifty-eight percent of consumers in a recent PYMNTS survey reported receiving nongovernment disbursements – such as loans, insurance payments or rebates – through non-instant payment methods, but this did not necessarily reflect payors’ capacities to make instant payments. Payors surveyed stated that they made only 45 percent of all their disbursements via non-instant payment methods, in fact.

This puts lenders in a sort of innovation quandary when it comes to keeping their customers satisfied. The share of customers who want or expect swift payments everywhere is growing, prompting banks and lenders to

adopt digital disbursement tools. A sizable portion of consumers seems to be unaware of these developments, however, which stunts adoption and creates more frustration for customers and lenders alike. The latter must therefore showcase digital disbursement options in ways that pique consumers’ interest and earn their trust. Adopting emerging instant payment tools that provide speed beyond simple digital methods, such as ACH disbursements, could attract customers who are frustrated with what they perceive to be the lending status quo.

Instant Payments and the Millennial Push

Implementing instant disbursements can offer numerous benefits for lenders, as familiarity with instant payment methods for loan disbursements is surprisingly low among consumers who are interested in using faster payment methods to send and collect funds in other use cases.

Nearly half of all consumers are at least somewhat familiar with instant disbursement methods, according to one PYMNTS report, revealing that these options could become increasingly appealing.

Incorporating instant payment methods could also boost lenders’ appeal among younger consumers, who are much more likely to be familiar with such disbursements. A recent PYMNTS study found that 16 percent of millennials have received at least one disbursement via instant payment methods within the past year, for example.

Younger consumers like millennials and Generation Z members are also more likely than others to expect disbursement flexibility, including the option to receive loans and other funds via instant payments, according to another PYMNTS study. Sixty-two percent of millennials said they could choose a payment method when interacting with lenders or insurers, for example, whereas 31 percent of baby boomers said the same.

Providing support for instant digital disbursement methods could ensure lenders’ continued success in a rapidly changing industry, but their approaches must resonate with consumers.

Lenders failing to pitch or offer these disbursement options in engaging ways could lose consumers’ interest or even increase their frustrations surrounding lending processes.