Lower Wages and Lack of Savings Drive Gen Z’s Increasing Reliance on Instant Payouts

Disbursements, which include various types of payments such as earnings, tax refunds, insurance claim payments, and loan disbursements, play a crucial role in consumers’ financial lives. In the United States alone, 62% of consumers received such payments in the last 12 months, with an average disbursement amount of $34,000 per consumer.

While non-instant methods are still prevalent, the data indicates a growing preference for these disbursements via instant payments. In fact, when given the choice, 72% of consumers prefer instant payouts, and 62% would have opted for instant options if available. Consumers are even willing to pay a fee to receive disbursements through instant rails, particularly those involved in freelance, contract or consulting projects.

These are some of the findings detailed in “Measuring Consumer Satisfaction With Instant Payouts,” a PYMNTS Intelligence and Ingo Money collaboration. The report draws on insights from a survey of over 3,900 consumers across the United States to examine consumers’ growing interest in instant disbursements, even as some issuers are lagging in offering instant options.

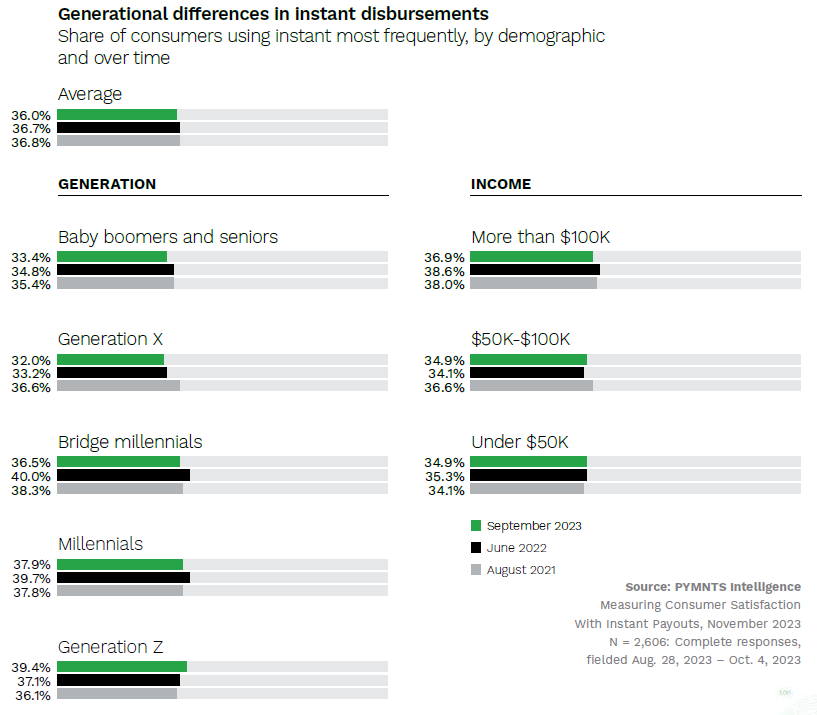

Another key finding captured in the study: the generational disparities in instant payment usage. Generation Z, known for digital savviness, is at the forefront of adopting instant payments, with 39% of this age group receiving disbursements through instant methods this year, marking an increase from 36% in 2021. In contrast, only 32% of Generation X consumers received instant payments this year, a decline from 37% in 2021.

Gen Z’s increasing reliance on instant payouts can be attributed to the lower wages and a lack of savings commonly associated with this generation, “resulting in a greater need for quick access to good funds.”

Looking closely at specific individual categories, it’s evident that individuals earning income from freelance, contract or consulting work strongly favor instant transactions, with 81% preferring them. Among these independent professionals, there’s a clear readiness to pay fees for the convenience of instant payment methods, surpassing other groups in their eagerness for this choice.

The report further suggests that issuers have an opportunity to engage their customers by offering instant payouts. Consumers highly value the speed and reliability of instant payments, and they are more likely to maintain a client relationship with an issuer if offered free instant payments.

The significant and increasing demand for instant payments is likely to continue growing, with Generation Z leading the way in adopting this payment method. And as technology evolves and digital payments become more widespread, it is likely that instant payments will become even more prevalent moving forward. Issuers have an opportunity to attract and retain customers by offering free instant payouts, catering to the growing preference for this convenient and efficient payment option.