Most Borrowers Drawn to Speed and Convenience of Instant Disbursements

Disbursements are a critical part of consumers’ financial lives, encompassing various payments such as earnings, income, tax refunds, insurance claims and loan disbursements. While these disbursements are predominantly received through non-instant methods, there is a growing interest among consumers in instant payouts.

A recent report by PYMNTS Intelligence, “Measuring Consumer Satisfaction With Instant Payouts,” sheds light on this trend and highlights the importance of instant disbursements, including for consumers looking to borrow money.

The study, produced in collaboration with Ingo Money, draws on insights from a survey of over 3,900 consumers across the United States to examine consumers’ growing interest in instant disbursements, even as some issuers are lagging in offering instant options.

According to the study’s findings, consumers received an average of $34,000 in disbursements in the last year. Income and earnings disbursements represented the largest share at 25.1%, followed by government disbursements at 22.4%. However, only 36% of these disbursements were received via instant payment rails, indicating room for growth in the adoption of instant payouts.

The report reveals that consumers expressed higher satisfaction when receiving disbursements via instant payment methods. On average, 78% of consumers reported being very or extremely satisfied with instant payouts, compared to 70% for non-instant methods. Satisfaction was highest for government disbursements at 89%, indicating the potential for issuers to improve customer satisfaction by offering instant options.

It’s no surprise then that consumers are increasingly interested in instant disbursements, per the report. In fact, when given the choice, 72% of consumers prefer to receive their disbursements instantly. This preference is particularly strong among those receiving payments for freelance, contract or consulting projects, with 81% choosing instant options. Additionally, 62% of consumers who did not have the option of instant payouts expressed a desire for this method if given the chance.

Generational differences also play a role in the adoption of instant payments. Generation Z consumers are leading the way, with nearly 40% of them receiving disbursements via instant methods. This generation’s familiarity with digital payments and their financial needs may contribute to their preference for instant disbursements. In contrast, only 32% of Generation X consumers opted for instant payouts, indicating a potential opportunity for issuers to engage this demographic.

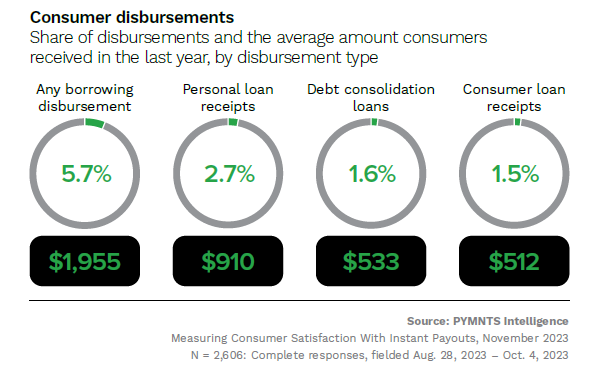

Examining the data further shows that interest in instant disbursements extends to consumers looking to borrow money. In fact, despite borrowing disbursements representing the smallest category of disbursements, consumers still showed interest in receiving their loan funds instantly.

Among those receiving borrowing disbursements, 76% reported being very or extremely satisfied with instant payment methods, compared to 68% for non-instant methods. This suggests that borrowers value the speed and convenience of instant disbursements, particularly when facing financial crunches.

In conclusion, the report highlights the growing interest in instant disbursements among consumers, including those looking to borrow money. Consumers prefer instant payouts due to their speed, guarantee of good funds and convenience. Against this backdrop, issuers have an opportunity to meet this demand by offering instant payment options, thereby improving customer satisfaction and engagement with consumers.