Tech-Enabled Business Solutions Drive Fiverr’s 12% Revenue Growth in Q3

Despite the ongoing crisis in its home turf, Israeli freelance marketplace Fiverr reported strong third-quarter performance Thursday (Nov. 9), with company executives highlighting the stabilization of cohorts in the core marketplace, increased spend per buyer, and “healthy” growth in value-added services as key factors.

“These results underscore the power of our business model and the progress we are making to solidify our position as the global leader of freelancing marketplaces,” Micha Kaufman, the founder and CEO of Fiverr, told investors on an earnings call.

The online marketplace saw Q3 revenue increase 12.1% year over year (YoY) to reach $92.5 million, with spend per buyer improving to $271, up 4% YoY.

One of the key developments this quarter was the introduction of Fiverr Neo, a personalized recruiting expert that leverages the latest technology and algorithms to help customers “more accurately scope their projects and get matched with freelance talent, just like a human recruiter, only with more data and more brain power,” Kaufman explained.

Over 100,000 users have tried the Fiverr Neo since rollout, he added, benefitting from more accurate matches which in turn has led to higher engagement and satisfaction levels.

Fiverr is also targeting higher-end customers with its Fiverr Business Solutions like Fiverr Enterprise, which allows clients to manage ongoing engagements with freelance talent and provides tools for continuous task and project management.

The company has also seen significant traction for its Fiverr Pro offering, particularly the newly introduced Project Partner service, which provides separate project planning and management services to serve a broad range of businesses.

Gig Work Helps Tackle Inflation

Inflation pressures and the heightened cost of living has prompted consumers, especially those living paycheck to paycheck, to explore additional means of supplementing their regular income, such as engaging in informal tasks or gig work.

According to insights detailed in the August “Consumer Inflation Sentiment Report” by PYMNTS Intelligence, 40% of employed consumers said their current salary falls short of their expectations, with nearly half of those earning less than $50,000 annually sharing with viewpoint.

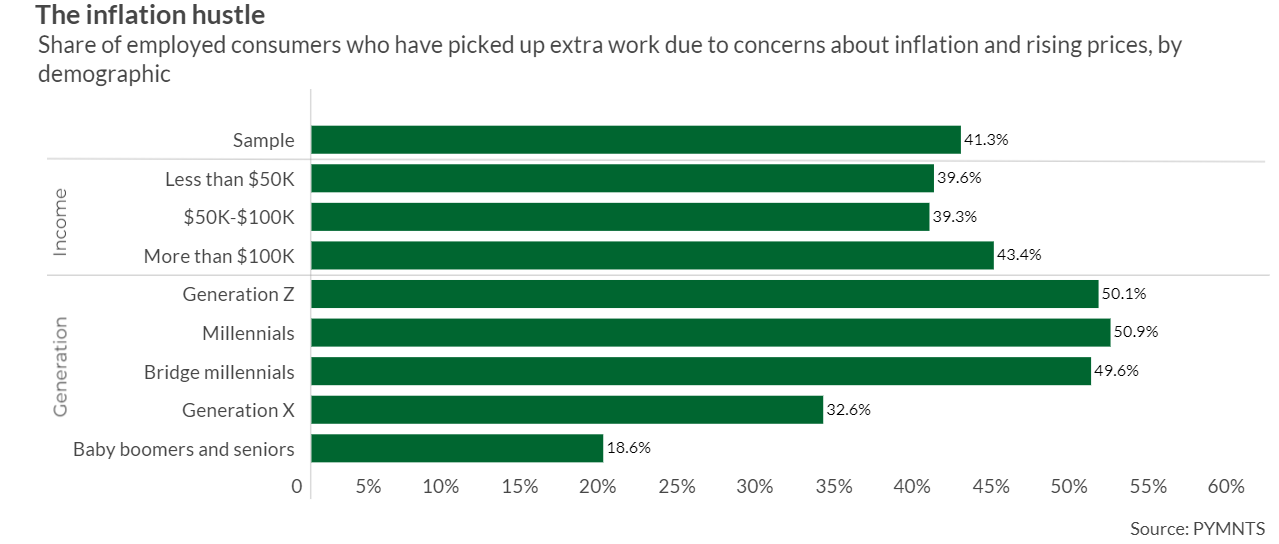

To make ends meet, 41% of employed consumers have taken on additional work, with Generation Z and millennials leading the way. Even individuals with incomes of more than $100,000 per year are not exempt from these concerns about inflation and rising prices, forcing them to pursue extra employment opportunities.

However, although many consumers take on side jobs to help pay the bills, separate research from PYMNTS Intelligence shows that there are non-financial reasons as to why consumers pursue side jobs. As noted in The Supplemental Income Edition report, 60% of individuals who don’t live paycheck to paycheck have a side job hustle because marketplaces and platforms make it fun and easy.

Specifically, 70% of this group got a side job because the extra income was easy to earn, while nearly 60% did so because they found the work enjoyable. Consumers not living paycheck to paycheck also expressed similar sentiments about earning money through informal tasks or selling handmade or used items, at 77% and 61%, respectively.