Despite Slight Easing in April, High Consumer Prices Keep 2022 Outlook on Pins and Needles

Those looking for a ray of economic sunshine amid inflationary clouds might not find it in April’s Consumer Price Index (CPI), which is lower than March but still historically high.

Takeaways from the new numbers can be seen as both pessimistic and optimistic, as a moderate easing in April still finds inflation casting a shadow of uncertainty on the recovery.

Finding the CPI up 0.3% in April on a seasonally adjusted basis compared to a 1.2% increase in March, the U.S. Bureau of Labor Statistics (BLS) said that over the last 12 months, the index increased 8.3% before seasonal adjustment, painting a mixed picture of economic health.

That mixed bag of news may well put a dent in post-pandemic spending activity, which data from PYMNTS’ report, “Digital Economy Payments April 2022 U.S. Edition: How Consumers Pay in the Digital World,” showed some signs of buoyancy in the previous month.

For now, though, many are focused on staggering increases in energy and housing — and the price increase of food that’s hitting Americans in the figurative “breadbasket.”

BLS said the food index rose 0.9% in April, marking the 17th consecutive monthly increase for comestibles. The “at home” food CPI — groceries — increased 1% in April, improving on a 1.5% March rise.

Still, food prices remain high and may stay that way this year.

“Five of the six major grocery store food group indexes increased over the month,” BLS said.

See also: Inflation Moderates for First Time in 8 Months

Shopping Less, Spending More

PYMNTS’ monthly tracking of consumer spending last month found a bit of buoyancy as pandemic restrictions like mask mandates were lifted, travel restrictions eased, and people began interacting more with the world outside of dwellings where they’ve been holed up since 2020.

PYMNTS’ “Digital Economy Payments April 2022 U.S. Edition” found consumers shopping less but spending more as prices remained at or near 40-year highs. It’s based on surveys from over 3,000 U.S. consumers from a census-balanced sample.

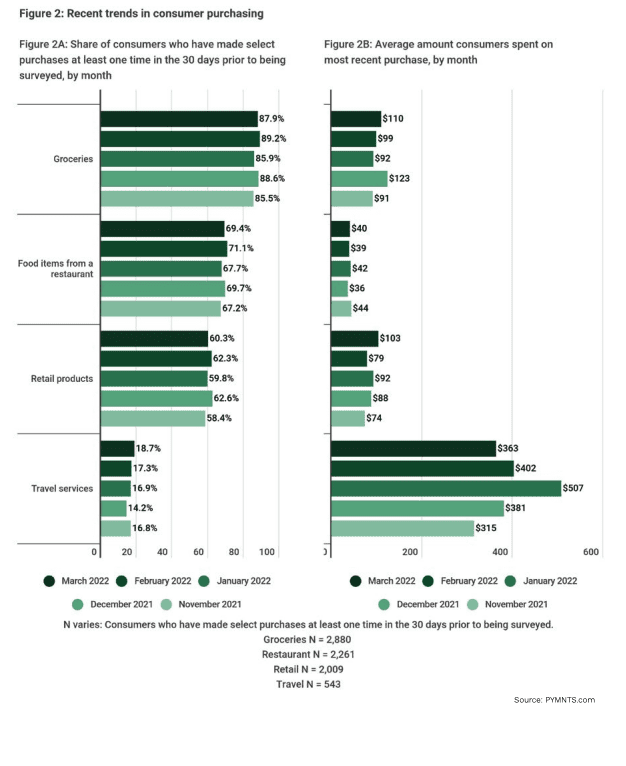

“Inflation may have influenced the rise in expenditures,” the report stated. “The share of consumers who stated that they shopped for groceries decreased from 89% in February to 88% in March and retail shopping decreased from 62% to 60%, yet the average spend increased in March for each.”

In two telltale categories, PYMNTS research found grocery spend rose $11 to $110, and retail spend rose $24 to $103. Restaurants showed some weakness but not to the extent of groceries or retail goods, as average spend slightly increased $1 to $40.

Travel Prices Lift Off

Travel Prices Lift Off

Travel purchases are one area of the economy where prices are flying. Travel’s resilience in the face of skyrocketing prices — airfares are up nearly 19%, according to the latest BLS data — is reflected in PYMNTS spending data as well.

As “Digital Economy Payments April 2022 U.S. Edition” stated, “Travel made a notable comeback: 19% of consumers purchased travel services in March — an all-time high for the series. Consumers’ average travel spend was $363, a lower figure than in previous months.”

It’s an indicator of just how pent-up travel demand truly is.

On news that airfares spiked, The Wall Street Journal (WSJ) reported that it “marked the fastest one-month increase since at least 1963 and exceeded economist expectations. High demand for travel after pandemic-related disruptions, coupled with soaring oil prices, has led to a squeeze on consumers.”

Get the report: How Consumers Pay in the Digital World