As Real Incomes Fall, Student Loans and Everyday Spend Pressure Paycheck-to-Paycheck Economy

Real incomes are falling, and for the paycheck-to-paycheck economy, the struggle to meet monthly obligations will continue to be a challenge at best — and at worst, an impossibility.

The U.S. Census Bureau announced this week that real median household income fell by 2.3% from $76,330 in 2021 to $74,580 in 2022.

“Income estimates are expressed in real or 2022 dollars to reflect changes in the cost of living,” the Bureau announced. “Between 2021 and 2022, inflation rose 7.8%; this is the largest annual increase in the cost-of-living adjustment since 1981.”

Real income, generally defined, is a measure of purchasing power. When it declines, we get less for our dollar, and as expenses rise the declines can be enough to push at least some individuals into a more financially precarious position.

More Expenses on the Horizon

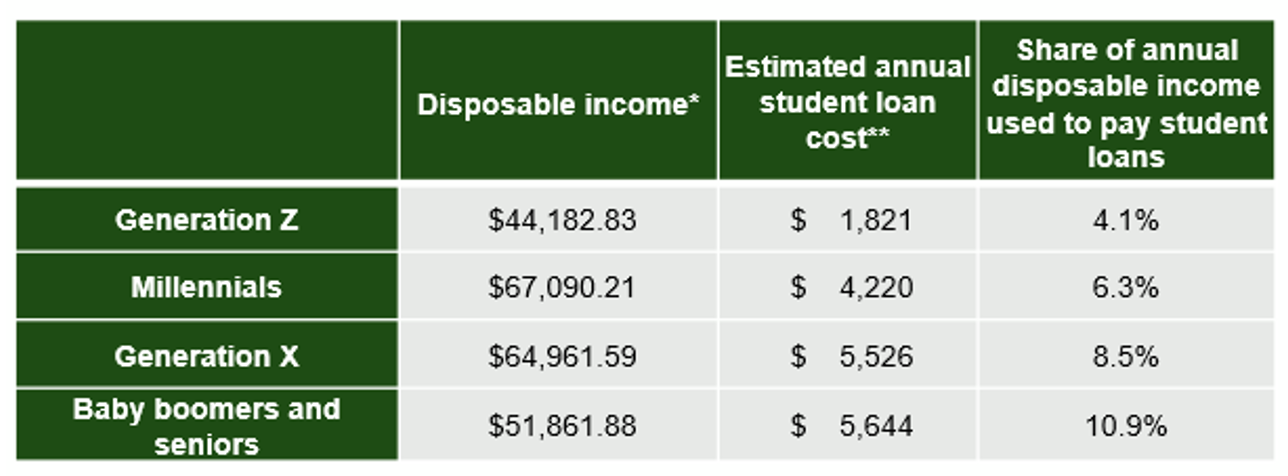

That’s especially true with the fact that more expenses are coming online, so to speak — chiefly in the form of student loans. If, as the data show, monthly purchasing power declines by about $150 per individual, the addition of hundreds of dollars more in monthly expenses has an outsized impact on consumers — across all demographics. The accompanying chart shows the impact by generation, and the average monthly expense shakes out to $360. If real income declines by $150 and the resumption of student loans added $360 in (nominal) expenses, well, the squeeze is on.

In the “New Reality Check – The Paycheck-to-Paycheck Report: The Nonessential Spend Deep Dive Edition” report, PYMNTS Intelligence, in collaboration with LendingClub, found that 61% of the population lives paycheck to paycheck. And as many as 10% of all paycheck-to-paycheck consumers, representing 16 million individuals in the United States, consider nonessential spending the primary reason they live paycheck to paycheck, and have challenges in making sure that their dollars stretch to cover the monthly bills. With a bit more granularity: 6.2% of the U.S. adult population can be classified as “discretional” paycheck-to-paycheck consumers, while 13% live paycheck to paycheck partly due to nonessential spending.

The impact of these pressures — the student loans and the movement toward buying what one might not necessarily need — are perhaps most readily apparent for younger consumers, and in particular, Generation Z. The data from the Paycheck-to-Paycheck report finds that the more than a third of consumers from this cohort state that their spending has been “indulgent” for at least three product or service categories.

We note that the 2022 data presented by the Census Bureau feels long ago and far away, as we’re touching down near the end of the third quarter of 2023.

The latest Consumer Price Index from the U.S. Bureau of Labor Statistics detailed that prices rose 0.6% in August, as measured month over month, which is the fastest pace seen in a bit more than year — and the annualized pace was 3.7%. At the same time, separate data from the BLS indicates that real average earnings in the July to August period declined by 0.5%.