Inflation’s Resurgence Threatens ‘Nonessential’ Spending at Grocers, Retailers

Inflation has notched a milestone this summer, reaching its highest level for the year.

And the pressure to put food on the table and pay for rent and clothing bumps up against paying for gas.

The latest Consumer Price Index from the U.S. Bureau of Labor Statistics detailed that prices rose 0.6% in August, as measured month over month, and reflect an acceleration of inflation, where the rate was roughly 0.1% earlier in the year. It’s the fastest pace seen since June of last year. The annualized pace was 3.7%, 0.1% higher than consensus expectations.

The specter of another interest rate hike from the Federal Reserve seems back on the table. But in parsing the data, the puts and takes show the challenges that consumers are already facing day to day. Gasoline prices jumped 10.6% month on month, the index showed, after being volatile through the past several months, and as inflation in this category was 0.2% in July.

The index showed that eating food at home (groceries) was 0.2% more expensive in August and has risen 3% in the last year. The costs of going out to eat were 0.3% higher month over month, up 6.5% in the past year.

Food has become one of the more expensive categories, as measured in terms of annualized inflation rates, up 4.3%, outpacing the overall inflation rate.

Apparel costs were up 0.2% in August and had been flat in the prior month. Shelter was running ahead of that general trend, too, up 7.3% in the last year.

Several Moving Parts

The resurgence of inflation may prove more manageable if gas prices recede a bit, which would happen if the weather cooperates, so to speak, the hurricane season does not disrupt the energy landscape, and/or if oil production cuts do not continue.

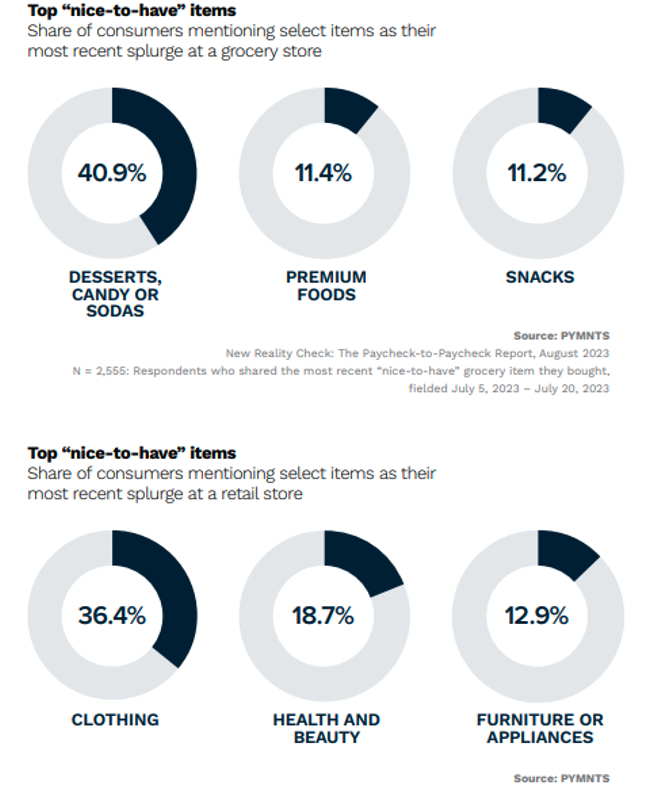

But PYMNTS data hints at some of the areas of spending that might see the most turbulence. Nearly two-thirds of U.S. consumers live paycheck to paycheck, as estimated as recently as July.

For more than 20% of those consumers, nonessential spending is one reason for their financial lifestyle, with 10% saying it is their top reason for living paycheck to paycheck. Two-thirds of overall consumers still include discretionary items in their baskets and budgets.

Thirty-six percent of Generation Z consumers said they have been spending indulgently for at least three product or service categories. But that generation will tackle the resumption of student loan payments and a hit to discretionary income.