Main Street Small Businesses May See Margin Relief as Producer Prices Fall

The latest readings on inflation, released Wednesday (June 14), signal some margin relief for Main Street small businesses.

And, by extension, consumers may see some benefit — if, of course, those small and medium-sized businesses (SMBs) pause a trend of boosting prices in a bid to offset rising input costs.

As reported by the U.S. Bureau of Labor Statistics, the Producer Price Index (PPI) declined by 0.3% in May, as measured month over month. The Index measures wholesale prices — in other words, some of the input costs that are tied to the day-to-day cost for merchants and other businesses to keep the lights on, the doors open, the shelves stocked. Generally speaking, when wholesale prices rise, it’s a signal that we’ll see a higher Consumer Price Index (CPI) down the line. As measured from a year ago, the 1.1% increase in the PPI last month from May of 2022 is the most muted year on year gain since December of 2020.

The Bureau estimated that 60% of the decline seen in the latest reading stemmed from a 13.8% drop in gasoline prices. The BLS added that the index for unprocessed goods for “intermediate demand” — comprising some of items (metals, foodstuffs and other tangible items) that are in turn used to make consumer-facing goods — was down 4.8%. The services index was up slightly month on month by about 0.2%.

A Pause in Interest Rates’ Upward March?

The data this morning may be grist for the proverbial mill for the Fed to pause its long-standing campaign of boosting interest rates to counter stubborn inflation. If that does happen, then the “breathing room” for Main Street SMBs may be more keenly felt.

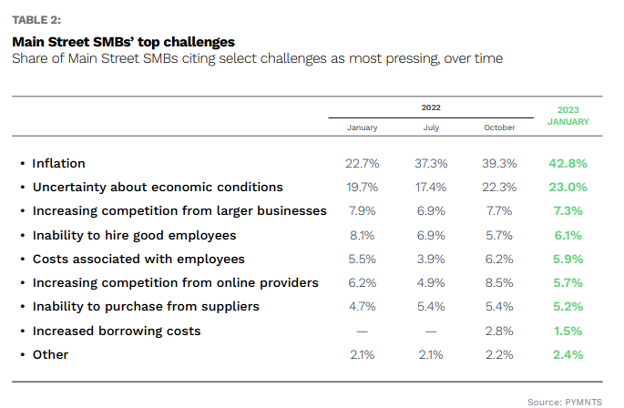

It’s worth noting that PYMNTS’ own research has, through the past several months, detailed the ongoing battle with inflation. In the April study on the outlook and challenges faced by these smaller firms — the backbone of the U.S. economy — 43% of Main Street SMBs said that inflation remained the biggest challenge they faced coming into 2023.

The chart at right shows that inflation has been an increasingly pressing concern for these companies over time. Inflation, of course, eats into margins and cash coffers, and we found that that a minority of firms, at 26%, had cash cushions that would tide them over for more than 60 days.