The Chart That Sparked A Debate On Global Poverty

A well-made chart can be good for a lot of things, like breaking down a complex problem into an accessible visual, illustrating a point or making a presentation more interesting. Last week, charts broke into a new niche: sparking Twitter wars between economists and social theorists about whether or not the world is objectively becoming a better place to live.

Or, perhaps to put it a bit more succinctly, if the world is becoming less poor over time.

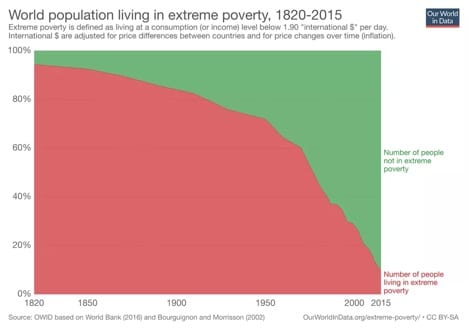

The chart in question, shown below, was produced by Our World in Data, a Gates Foundation-funded nonprofit website led by Max Roser. The economist notes it is not “his” chart, as it is very similar to the charts more famously associated with Georgetown Professor Martin Ravallion’s book, “The Economics of Poverty.”

The chart is meant to illustrate the extreme global poverty rate, measured as the share of humanity living on $1.90 a day or less – and how that poverty has dropped like a rock by 94.4 percent over the last 200 or so years, between 1820 and 2015.

The chart alone did raise much ire – but when Bill Gates tweeted it as part of an infographic depicting progress (the chart also showed gains in global education, healthcare, life expectancy and democracy during the same time period), an argument broke out.

Anthropologist Jason Hickel noted in an article for The Guardian – titled “Bill Gates says poverty is decreasing. He couldn’t be more wrong” – that $1.90 a day is too low of a bar to set for global poverty, and that a measure of $7.40 per day is more reasonable. But Hickel noted that the current rate of progress is too slow, and that $7.40-per-day poverty is not on track to be eliminated in our lifetimes. He also argued that data from pre-1981, which is when the World Bank began formally collecting data on world poverty, is essentially useless.

Defenders of the chart, notably Harvard Professor Steven Pinker, argued that even at the higher poverty line named, poverty has still been decreasing at a marked rate, particularly over the last 20 years – and that saying progress is not as fast as it could be is not the same thing as saying progress does not exist.

And, of course, there was a fair amount of name-calling, with Hickel accusing Pinker and Gates of being “neo-liberals” more concerned with preserving “the current world order” than lifting people out of poverty. Meanwhile, Pinker called Hickel a “Marxist” who is embarrassed that data demonstrating progress on poverty comes from “markets and globalization rather than an overthrow of capitalism and global redistribution.”

Nothing like civilized academic conversation.

Still, with all the tweets and think pieces flying back and forth, it did seem curious that while global income levels came up a lot, very little was said about improvements in access to funds and the advance of digital money – and the retreat of the total dominance of cash in some markets was nearly absent from the conversation.

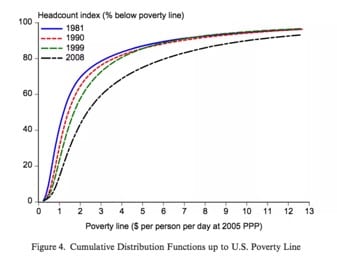

The omission is odd, particularly in light of this chart from a 2013 paper by Martin Ravallion and Shaohua Chen, the lead development statistician at the World Bank, which appeared during the various Twitter debates that emerged on the subject.

The chart is a little difficult to read. The x-axis offers different hypothetical poverty thresholds between $0 and $13. Then the y-axis tells what percentage of humanity lived below that poverty line in a given year, with the various colored lines representing the years. Among the more interesting takeaways is that for every amount used as a poverty line on the chart, global poverty was lower in 2008 than it was in 1981. That isn’t true for the years between 1981 and 1990 or 1990 and 1999, when the proportion of people living on less than $5 fell – but above that mark, there was barely any change (and between 1990 and 1999 there was, in fact, positive growth).

Much of what changed in that 10-year gap, and beyond it as the mobile and digital age really began picking up speed in the post-smartphone world of 2008, was that questions about income in developing countries expanded from being strictly measured in terms of absolute numbers and increasingly in terms of access to and usability of funds.

In 2004, Alibaba launched Alipay; today, Alipay has around a billion global users. A decade ago, China was a nearly entirely cash-dominated society; as of early 2019, cash isn’t quite obsolete in China, but it’s gotten remarkably close in an incredibly short amount of time. M-Pesa first launched in in 2007 in Kenya as a service that made it easy to move digitized funds with mobile phones. As of 2019, the service has 25 million global customers, with nearly 14 million outside of Kenya – and its platform has grown to include lending and savings programs, and even global money transfer services, care of a new partnership with Western Union.

Moreover, these new channels for moving funds have created new channels for accessing them –for example, microlending platforms, which experts agree have been critical in changing how families in developing countries can manage their funds.

“Incomes are seldom steady and predictable; needs vary as well: Families need to pay for schools, medicines and food during slow periods … evidence that microfinance loans are used to fund non-business needs (even for education or health) is sometimes used to criticize microfinance, but that misses the point … poor families, like richer families, need broad financial tools. In fact, the poor may need them more urgently,” researchers Daryl Collins, Jonathan Morduch, Stuart Rutherford and Orlanda Ruthven noted in their study, Portfolios of the Poor.

Moreover, economists Emily Breza and Cynthia Kinnan also found in a study that microfinance almost immediately affects consumer mobility. Those who have taken microloans are better able to travel further from their hometowns or villages, more likely to solicit further education and better able to command higher wages in the market.

“Microlending moves hand-in-hand with the digitization of funds in the developing world,” the study said. “Simply giving consumers a method to hold and control their funds – without having to physically carry cash with all the attendant risks – has been a terribly important advance.”

Remember all those other improving metrics around education, vaccination and healthcare? The ability to move, control and borrow money all have big effects on those numbers – and the standard of living beyond what absolute income counts can show.

So, problem solved, poverty eliminated, financial inclusion solved for?

Hardly.

But if the debate is around whether things are getting better, it seems easily resolved. Yes, by many counts and by many metrics, even the staunchest critics of a rosy report on poverty eradication will admit that progress has been made.

The more interesting discussion, going forward, might be about access to money as opposed to only about absolute figures. The biggest budge in recent memory seems to have come in around the time funds started going digital – which means it seems worth exploring, at least, whether the timeline can be sped up more with bigger and better digital advances.