Sezzle Takes Aim at BNPL Fraud With AI, Machine Learning

In a world where consumers expect everything on demand, the popularity of buy now, pay later (BNPL) has surged for its instant spending power. In fact, BNPL is expected to account for 4.5% of all eCommerce payments in the United States by 2024. Fraudsters naturally gravitate toward markets that show notable growth patterns, however, and as more consumers implement BNPL solutions into their buying habits, security risks become more apparent.

BNPL’s newfound popularity makes it crucial for IT teams to prioritize fraud prevention procedures and consider investing in advanced security tools. This rings true especially for merchants who enable BNPL options at checkout, as 65% of digital shoppers said they would end their relationships with retailers after only one instance of data theft or payment fraud.

In this month’s “Digital Fraud Tracker,” PYMNTS examines how BNPL providers and the merchants they enable can incorporate artificial intelligence (AI), machine learning (ML) and other advanced technologies to mitigate fraud attacks and data breaches, creating a more secure shopping experience for their customers.

Around the Digital Fraud Space

The U.S. BNPL market is experiencing remarkable growth, with an estimated 45.1 million users expected in 2021. As BNPL solutions take off, however, fraudsters are paying more attention to the space. BNPL fraud occurs when bad actors use stolen information to create fake accounts or through account takeovers (ATOs). The lax verification and checkout processes of many BNPL platforms make such attacks easy for fraudsters. To combat sophisticated fraudsters, merchants and BNPL providers should incorporate cybersecurity tools that leverage advanced technology, such as AI and ML.

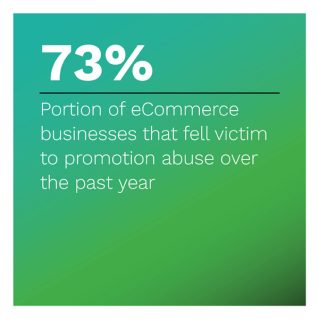

Fraud is not just a problem in the BNPL space — it’s a concern for all digital channels. In a survey of 2,000 U.S. small businesses, 56% of participants were not worried about security breaches in the next year. This attitude does not match the current state of online fraud, especially following the rapid uptick in cybercrimes during the pandemic. Small- to medium-sized businesses (SMBs) need to rethink their approach to data security and fraud prevention, as 28% of all data breaches in 2020 involved small  businesses. Implementing anti-fraud solutions is the best way to prevent financial and reputational damage associated with a breach or cyberattack.

businesses. Implementing anti-fraud solutions is the best way to prevent financial and reputational damage associated with a breach or cyberattack.

Aside from fraud attacks, ransomware and remote work are top-of-mind for cybersecurity experts. Digital delinquency hit an all-time high as employees ditched their offices for a comfortable seat in cyberspace, and ransomware attacks skyrocketed. The cloud’s advanced data processing technology allows organizations to dissect fraud patterns quicker and more efficiently, stopping fraud in its tracks before it has the chance to pose a larger threat.

As such, a growing number of IT teams are choosing to migrate to the cloud, and 50% intend to make that move this year. Contrarily, just 8% of IT teams plan to move their data from the cloud to on-premises solutions.

For more on these and other stories, visit the Tracker’s News and Trends.

Sezzle on Why AI, ML Tools Are Essential for Mitigating BNPL Fraud

BNPL usage is on the rise among consumers as they recognize the many benefits of an alternative installment payment plan. Offering BNPL options at checkout may also lead to increased sales and greater customer satisfaction for merchants. Charlie Youakim, co-founder and CEO of BNPL provider Sezzle, explained that fraud will always be a problem for online payment systems, and BNPL providers need to remain diligent with their fraud prevention practices. To learn more about how BNPL providers are harnessing the powers of AI and ML technology to combat the rise in fraud, visit the Tracker’s Feature Story.

Deep Dive: How Stronger Identity Verification Tools Can Prevent BNPL Fraud

BNPL solutions have taken off in recent years, especially as consumers become more w illing to try out alternative payment solutions. Now, one-quarter of U.S. merchants accept BNPL payments, and nearly 50% expect to enable them soon. The simple application process and potential revenue growth draw consumers and merchants alike to BNPL’s installment payment plans, but BNPL’s quick and easy operational model has also caught the attention of fraudsters.

illing to try out alternative payment solutions. Now, one-quarter of U.S. merchants accept BNPL payments, and nearly 50% expect to enable them soon. The simple application process and potential revenue growth draw consumers and merchants alike to BNPL’s installment payment plans, but BNPL’s quick and easy operational model has also caught the attention of fraudsters.

As a result, BNPL providers are turning to advanced fraud prevention tools, such as AI and ML, to better identify suspicious activity and properly mitigate cyberattacks. To learn more about how BNPL providers can defend their systems against the attacks of increasingly sophisticated fraudsters, visit the Tracker’s Deep Dive.

About the Tracker

The monthly “Digital Fraud Tracker,” a DataVisor collaboration, offers coverage of the most recent news and trends in the fraud prevention space.