Consumers Demand Anti-Fraud Tools From eCommerce Merchants

As scammers and fraudsters become more sophisticated, shoppers are demanding more effective prevention tools from their eCommerce merchants.

By the Numbers

The PYMNTS Intelligence study “Fraud Management, False Declines and Improved Profitability,” created in collaboration with Nuvei, draws on insights from a survey last summer of 300 executives from eCommerce firms generating annual revenues of more than $100 million who have deep knowledge of their company’s payments systems.

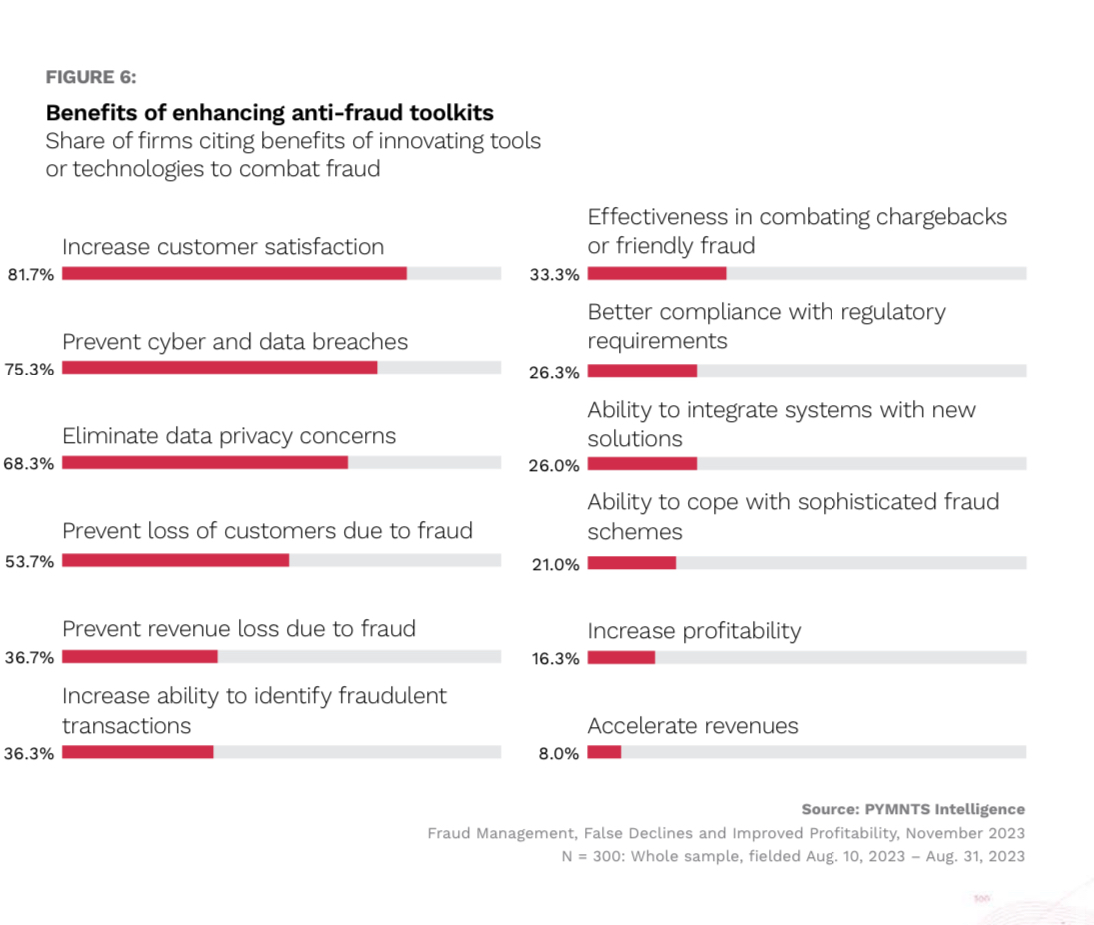

The study found that 82% of firms cite increased customer satisfaction as a key benefit of innovating tools or technologies to combat fraud — a greater share than said the same of any other benefit. Customers feel more confident and reassured when they know that their personal and financial information is protected.

Plus, 54% of firms see such innovation as something of a loyalty play, with these tools or technologies helping to prevent loss of customers due to fraud.

Effective fraud management tools can distinguish between legitimate and fraudulent transactions swiftly and accurately, minimizing false declines and ensuring that genuine purchases are not disrupted. This results in a smoother and more convenient shopping experience for customers, without unnecessary friction or inconvenience.

By demonstrating a commitment to security and protecting customers from fraudulent activities, eCommerce firms build trust and credibility with their customer base. Customers are more likely to return to a platform where they feel safe and valued, leading to increased loyalty and positive word-of-mouth recommendations.

The Data in Context

As technology has become increasingly sophisticated, so too have the methods employed by scammers and fraudsters.

“The reality is scammers are embracing really sophisticated technologies, like AI (artificial intelligence), to deceive their victims — and scams these days are incredibly convincing,” Chris Reid, executive vice president of identity solutions at Mastercard, told PYMNTS in a recent interview.

According to Pradheep Sampath, chief product officer at Entersekt, AI-based models play a crucial role in identifying anomalies and dynamically adapting to emerging fraud patterns, staying ahead of evolving threat vectors and shielding customers from financial losses.

“[Curbing fraud] is a team sport and there is a certain amount of collaboration that must happen to make sure that we pull our resources together to fight [it],” he told PYMNTS.