Firms Partnering With Third Parties to Fight Fraud See Profit Boost

Payment service providers – also known as PSPs – are an important piece of the payment ecosystem. For any business that wants to deliver a payment to their customers, PSPs provides a platform to collect and manage any type of payment in an efficient and secure way. Beyond ensuring a seamless payment process and a connection with the financial institutions, PYMNTS Intelligence research finds firms that collaborate with PSPs to balance fraud and authorization of their online sales transactions see a greater positive impact on profitability due to fraud monitoring.

This is just one of the conclusions drawn from “The Role of Fraud Screening in Minimizing Failed Payments,” a PYMNTS Intelligence research study in collaboration with Nuvei that examines the efficacy of the fraud screening mechanisms eCommerce merchants use. To do so, as part of the study, PYMNTS/ Nuvei tandem conducted a survey of 300 heads of payments or fraud departments from international eCommerce companies.

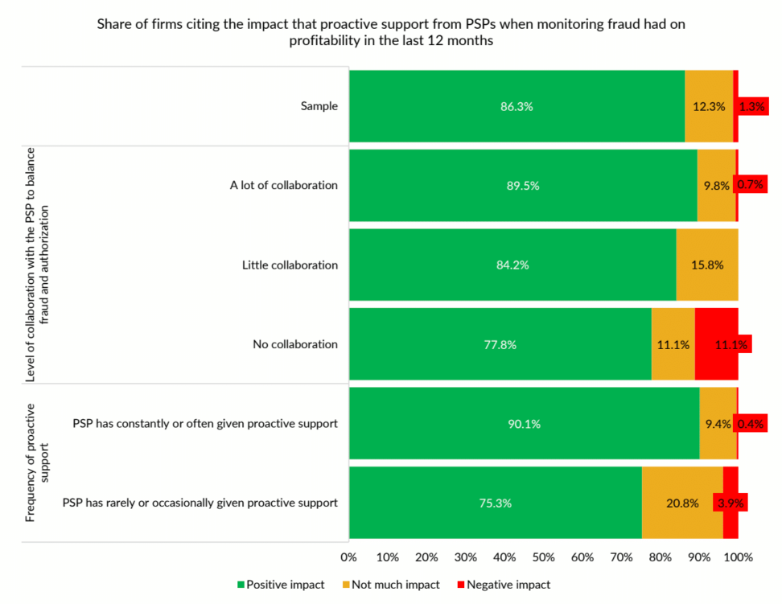

According to the research, 90% of firms collaborating intensively with PSPs cite a positive impact on their profitability, compared to 78% of those with no collaboration with PSPs in contrast. Furthermore, 11% of these firms say that not collaborating with PSPs has a negative impact on their profitability.

Firms know that failed payments damage their reputations, lead to customer churn and generate operational inefficiencies, resulting in an erosion of business profitability. With nearly 80% of companies struggling to discover what caused failed payments, collaboration with PSPs is proving to be a fundamental tool in optimizing fraud prevention efforts and reducing failed payments in consequence.

Fraud is a challenge many merchants are trying to solve with the increasing threat of online fraudsters that demand constant vigilance. As detailed in the study, nearly 4 in 10 merchants collaborating extensively with PSPs have implemented screening mechanisms to detect potential fraud as a cause of failed payments. The most common tools or methods used to combat fraud are cloud-based fraud and financial crime platforms, with roughly two-thirds of firms currently using them.

Strategic partnerships that balance seamless customer experiences with fraud protection solutions are crucial for eCommerce, as PYMNTS Intelligence recently reported. By using a broad set of sophisticated tools, PSPs can automatically approve as many legitimate transactions as possible, even during peak seasons.

Overall, whether companies work with third-party solutions or develop them in-house, the technology used to combat fraud positively impacts the customer experience. Collaboration between merchants and PSPs contributes to this enhanced experience by providing fraud monitoring solutions and reducing failed payments or identifying the cause of them.