Most eCommerce Merchants Recognize Innovation’s Potential in Curbing Fraud

The digital age has ushered in unprecedented opportunities for business growth, but it has also given rise to increasingly sophisticated fraudulent activities. From friendly fraud to elaborate chargeback schemes, merchants face a myriad of challenges in their quest to safeguard their operations, frequently leading to the occurrence of failed payments.

In “The Role of Fraud Screening in Minimizing Failed Payments,” PYMNTS Intelligence leverages insights from a survey of 300 heads of payments or fraud departments from international eCommerce companies to examine the effectiveness of the fraud screening mechanisms eCommerce merchants use today.

According to the report, many eCommerce merchants fail to recognize the connection between fraud detection and failed payments, resulting in lost sales and missed opportunities for improving payment success rates. Surprisingly, only one-third of merchants currently utilize mechanisms that detect potential fraud as the cause of failed payments.

The report also uncovered a disparity between smaller and larger merchants in the adoption of screening mechanisms for fraud detection. Smaller merchants, which generate revenues between $100 million and $250 million, lag behind their larger counterparts in implementing fraud prevention measures.

Collaboration between payment service providers (PSPs) and eCommerce merchants plays a critical role in deploying effective fraud prevention strategies, the study further noted.

In fact, merchants who engage in greater levels of collaboration with PSPs are more likely to adopt screening mechanisms that identify potential fraud as the cause of failed payments. These partnerships are therefore essential for striking a balance between security and seamless customer experiences.

When it comes to how merchants respond to flagged transactions, they often encourage customers to reattempt purchases using the same payment method that was initially flagged as potentially fraudulent in order to prevent lost sales. This strategy minimizes friction and maximizes recovered transactions. Notably, merchants with deep levels of collaboration with PSPs are more likely to engage in this practice, further highlighting the benefits of strong partnerships.

Fighting Fraud With Innovation

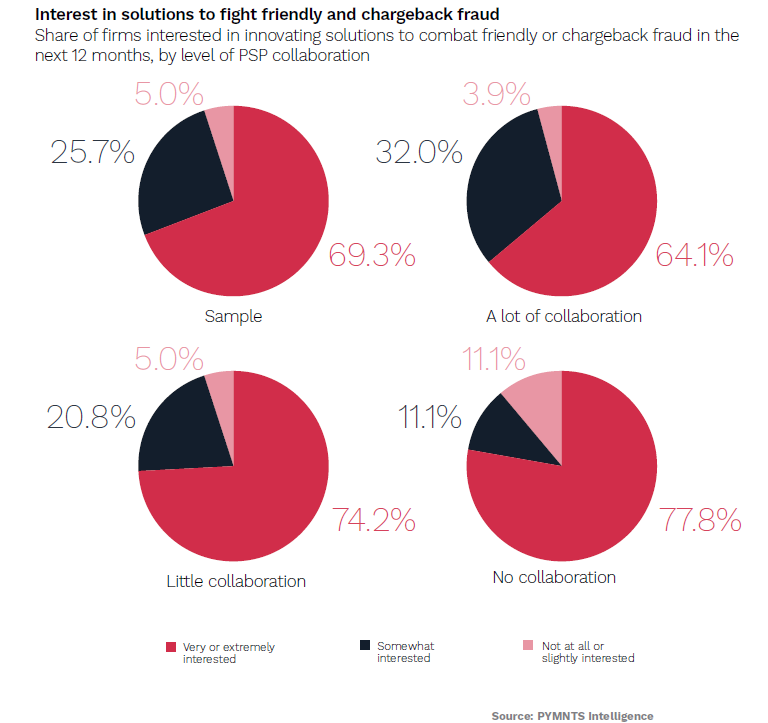

Regardless of whether eCommerce merchants collaborate with PSPs on fraud prevention strategies, one fact remains: a significant portion recognizes the significance of innovative solutions in the ongoing battle against fraud.

Specifically, the report revealed that approximately 70% of merchants show significant interest in cutting-edge solutions to counter friendly and chargeback fraud. This interest is particularly heightened among merchants with limited or no collaboration with PSPs, standing at 74% and 78%, respectively.

In contrast, only 64% of merchants extensively collaborating with PSPs express strong interest in innovating solutions to mitigate such fraud. This relatively subdued demand implies that these merchants already enjoy the advantages of comprehensive fraud management tools provided through their existing PSP relationships.

Drawing from the findings, the report offers actionable insights for merchants. Smaller merchants are advised to invest in scalable fraud screening tools to enhance payment security and conversion rates and strengthening collaboration with PSPs is identified as a vital step in improving fraud detection capabilities.

Merchants are also encouraged to actively seek partnerships with technology providers specializing in advanced fraud detection and prevention. Lastly, merchants are urged to strike a balance between transaction security and customer experience, especially for flagged transactions, in order to enhance overall customer satisfaction.