For most women, a complex cluster of building blocks — their life stage, household responsibilities, financial circumstances, age and dependents, among others — shape how they prioritize their own healthcare needs, a PYMNTS Intelligence study finds. And data in the “2024 Women’s Wellness Index,” a collaboration with CareCredit that drew on surveys of more than 10,000 U.S. consumers, found those priorities ultimately impact their overall health and well-being.

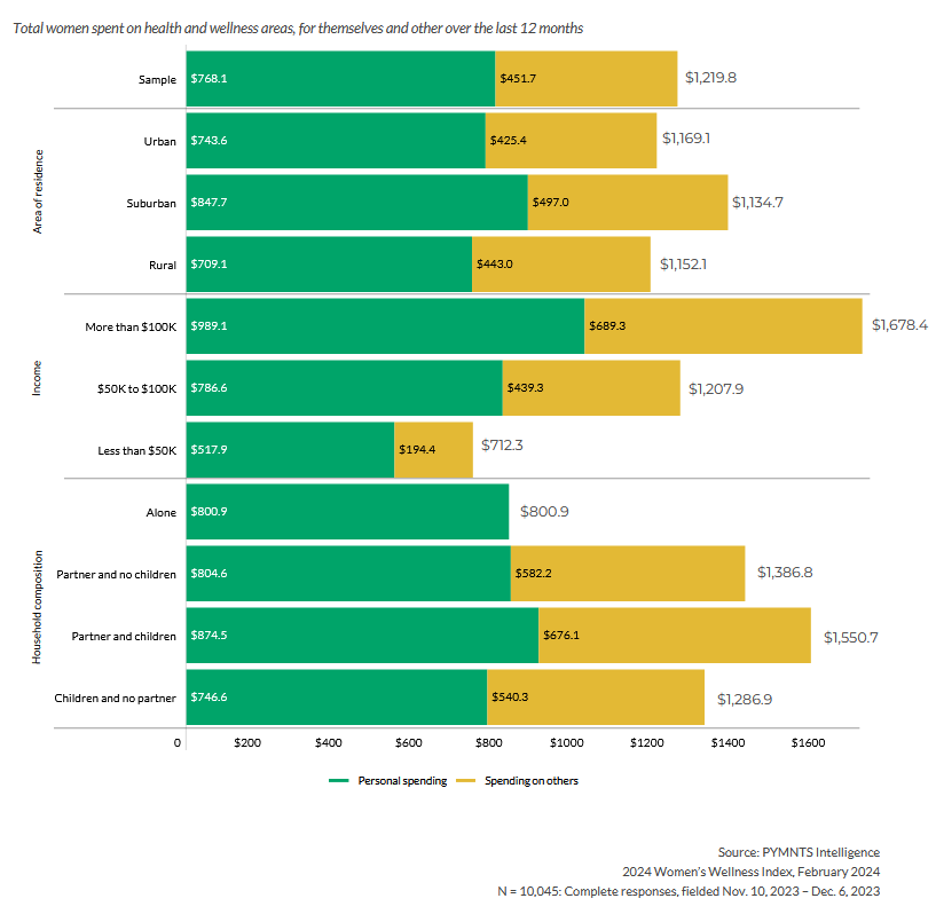

According to additional PYMNTS Intelligence data (which was not included in our final report), on average, U.S. women spend about $768 on their own health and wellness each year on top of spending about $452 on others.

However, a wide variety of factors can alter those spending habits. For instance, women living alone spend about $800 on their health and wellness needs, and that amount doesn’t change much if a significant other enters the picture. But, for the average women, living with a partner means spending more — an additional $582 per year — on that partner’s health needs, which can have a significant impact on her budget.

If the woman and her partner live under one roof with children, she will spend about $874 on her own health-related needs, but she will also devote $676 on the healthcare needs of the others living in her household. Meanwhile, a woman caring for children on her own spends less on her own annual healthcare needs ($747) while spending $540 on others, confirming a willingness on her part to sacrifice resources toward her own health and wellness.

But as the old saying goes, money changes everything.

Women who earn more than $100,000 annually allocate almost $990 to their own health and wellness needs each year while spending about $670 on the health and wellness needs of others. That means they spend about $1,678 a year on health and wellness expenses, which is more than double the amount a woman living alone spends each year on her own wellness.

Conversely, women earning less than $50,000 annually allocate about $518 to the costs of their own health and wellness while spending less than $200 on the needs of others in their lives.

In the abstract, these sorts of health-related allocations may not appear to be especially impactful on the average woman’s monthly budget, earning less can translate into woman have to make health-related trade-offs that have real ripple effects. In our surveys, PYMNTS Intelligence found that it’s not uncommon for women on the lower end of the earnings spectrum to bypass prescribed medical screening guidelines due to the costs of those procedures. We also found low-income earners occasionally cancel medical appointments because the funds that were set aside to cover the cost of a co-pay had to be used to buy groceries instead.