Payments Innovation Crucial In Consumer Services

For the new Retail Innovation Readiness Index, PYMNTS studied companies like auto garages, contractors and tourism and entertainment-related venues to find out the state of innovation.

The demand for innovation is now par for the course, but the drive for digital transformation has been snail-like for small and medium-sized consumer services companies.

In the new PYMNTS Retail Innovation Readiness Index, powered by AEVI, studied companies like auto garages, contractors and tourism and entertainment-related venues to gauge the state of innovation, especially among small and medium-sized businesses (SMBs).

Most of these firms aren’t working with Disney-sized budgets. Mobile doesn’t typically mean augmented reality or other dazzling tech for smaller, regional theme parks.

Consumer services merchants might lag a little, especially compared to SMBs in food service and hospitality, but close to half (44.8 percent) said innovation was crucial to staying competitive.

Mobile payments are top of mind for these merchants. There was considerable interest in consumer-facing apps for payments (75.6 percent). Just 8.4 percent had no interest in consumer apps.

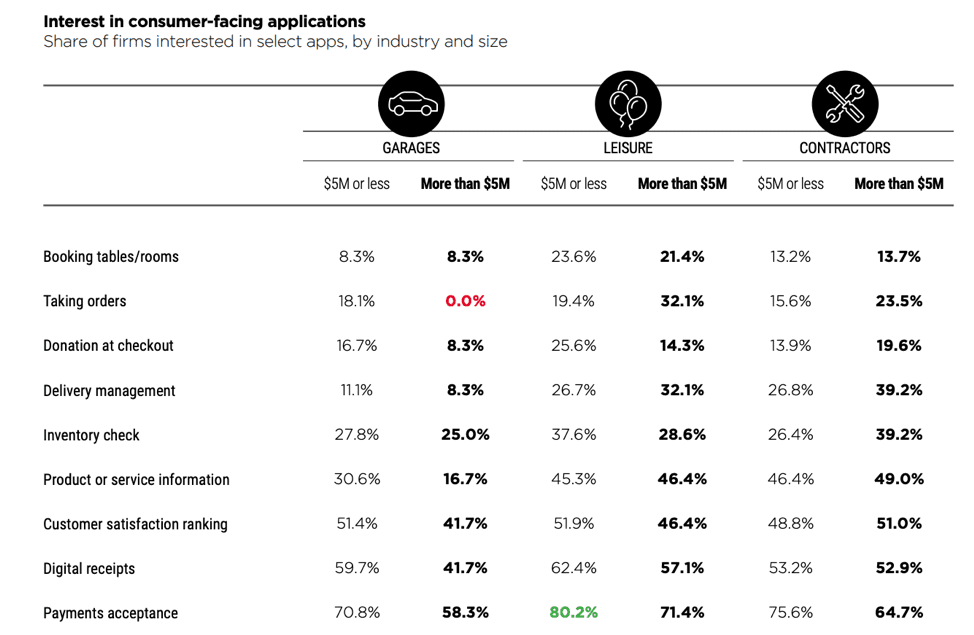

Business size and specific industries played a significant role in interest levels in the different features provided by consumer-facing apps.

Payment acceptance was a bigger deal to leisure companies like amusement parks, and even more so to companies with less than $5 million in annual revenues (80.2 percent). Small contractors and garages also valued mobile payments highly. This is likely driven by the knowledge that consumers want digital payments, and other industries are ahead in offering this option.

Customer satisfaction rankings also had high appeal for smaller firms, cited by nearly 50 percent of SMBs. Good reviews can make or break a smaller company’s reputation, especially for services like plumbing or auto repair.

Behind the scenes, consumer services firms are most interested in apps that can facilitate inventory management (49.2 percent) and payroll management (47.6 percent).

Firms generating between $10 million and $100 million were more interested in both payroll (85.2 percent) and inventory management (74.1 percent) than the average. It stands to reason that larger firms would have more staff and more stuff to keep track of.

Smart POS systems can offer the desired consumer-facing features, while also helping back-office operations. Yet smart POS adoption among the consumer services segment is fairly low. Only 14.2 percent already use a smart POS system, and 16.1 percent weren’t familiar with them and weren’t interested.

Usage was tied to firm size. More than one-quarter (25.9 percent) of those with revenues between $10 million and $100 million were using a smart POS, while just 12.7 percent of firms earning less than $250,000 were using the technology.

By sub-sector, travel and tourism had a larger number of those “extremely” interested in using a smart POS system (10.5 percent), particularly when compared to auto garages (5.5 percent) and amusement parks (5.0 percent).

Consumer service businesses recognize the value of innovating even if they are behind the curve. So, what’s holding back this industry?

Cost, primarily. For smaller businesses, a reasonable price was cited as a key factor in choosing a smart POS system. This sentiment was shared strongly by garages generating less than $5 million (70.8 percent). The ability to customize a POS system had very little appeal across the board. Zero garages, even in a higher sales bracket (earning over $5 million), were interested in customization.

Consumer service businesses are likely to have smaller staff and possibly lack a dedicated IT department, so it makes sense that these firms placed high importance on a smart POS system that is easy to use and intuitive. Garages, leisure companies and contractors all had high numbers, citing ease of use as a reason to select a particular smart POS system. Even consumer services with larger revenues placed high value on intuitiveness and ease of use; 85.7 percent of leisure businesses earning more than $5 million said as much.

What does innovation in the consumer services industry look like?

Roll by Goodyear, a consumer-friendly concept store, is attempting to transform the tire maintenance process. FinTech startups like Rabbet have sprung up to speed B2B transactions in the construction industry.

It might just be a matter of time before local plumbers and electricians start accepting mobile payments. These SMBs might be cautious with financial investments, but they also can’t afford to sit out while others innovate.