How Innovation Priorities Are Evolving for FIs

It’s easy to get sidetracked by the new and flashy. But how much are FIs really investing in blockchain and artificial intelligence (AI) compared to more foundational innovations?

The latest Innovation Readiness Playbook looks at where FIs have been focusing over the past three years and what their plans are for the near future.

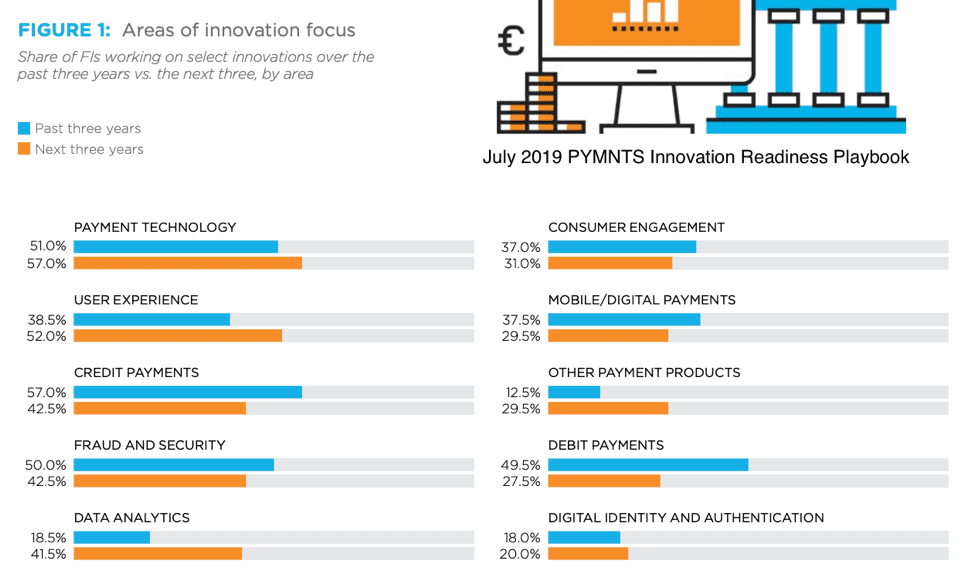

Payment technology is an area of interest that stands out for all FIs. More than half (57 percent) of banks will focus on innovating payment tech over the next three years, making it the single highest priority.

According to the study, priorities have shifted over the years, as well. Debit payments were a priority for nearly half (49.5 percent) over the past three years, though looking forward only 27.5 percent are focusing on them, likely because debit payments (and credit products) are more market-ready than other offerings. Fraud and security innovation has seen a slight decline, from 50.0 percent to 42.5 percent.

Data analytics is ready for a surge in interest, however. While only 18.5 percent of FIs have focused on it in the past three years, 41.5 percent will do so in the next three. User experience (UX) will also experience significant increases in interest over the next three years compared to the past three.

When asked about specific innovations, 56.1 percent of FIs reported focusing on digital wallets during the previous three-year period, making it the most popular technological feature by far. P2P payments, real-time payments and digital identity and authentication are going to become larger areas of focus in the near future.

The index component of the PYMNTS Innovation Readiness Index is a score from zero to 100 in terms of innovation readiness, based on a survey of more than 200 executives from United States banks.

Data analytic is an area that illustrates the starkest differences between top and bottom performers. More than three-fourths (80 percent) of top performers will focus on this area, compared to just 37.3 percent and 50 percent of middle and bottom performers, respectively.

Bottom performers are focused on UX (62.5 percent) and consumer engagement (37.5 percent) more than top and middle performers. This might reflect the perception that UX and consumer engagement are easier to tackle than payment technology and data analytics.

Innovation performance is often tied to investment. According to the study, data analytics and payment technology were stand outs in this area, as well. FIs focusing on these initiatives devote greater shares of their budgets to innovation; 66.3 percent of analytics-focused FIs allocate more than 40 percent of their budgets to innovation, while 54.4 percent of those working in payment technology say the same.

FIs focusing on UX and consumer engagement are the least likely to allocate more than 40 percent of their budgets for innovation, at 43.3 percent and 40.3 percent, respectively. This reinforces earlier findings about bottom performers being more focused on UX and consumer engagement than their more successful peers.

The study dug deeper and tried to elicit the motivation behind the focus on particular innovations. Meeting changing consumer behaviors was the biggest impetus for innovating data analytics (86.7 percent) and payment technology (78.1 percent) while 71.0 percent on average were trying to meet changing consumer behaviors. The stands in contrast to those focused on UX and consumer engagement who are comparatively more likely to say they are responding to existing client demands.

Innovating mobile/digital payments was most done to get ahead of potential client needs (71.2 percent) while 82.5 percent were focused on innovating digital identity and authentication for this same reason.

Innovation is easier said than done, though. When analyzing the barriers to innovation plans, technical and regulatory issues were some of the biggest hindrances. Inflexible technology systems challenge banks across the spectrum. FIs focusing on analytics are more likely than others to cite this as a barrier, with 50.6 percent of them considering inflexible technology systems as impediments.

Regulations were cited disproportionately as barriers to mobile/digital payment innovation while complicated internal processes were most cited as stumbling blocks to digital identity and authentication innovation.

FIs are getting more serious about their innovation strategies and narrowing their focuses. This is apparent in their continued investments in payment technology and data analytics. While these may not be the newest, attention-grabbing areas to focus on, they do indicate that successful innovation comes from solid intelligence and agile infrastructure.