Automated solutions could help smooth onboarding frictions, yet many AP departments still rely on old-school techniques and are perfectly satisfied with them. The latest Payables Friction Playbook analyzes the ways businesses onboard new suppliers to see where digital methods excel (and potentially fall short).

AP departments are still very much analog operations; 80.8 percent of AP departments still pay suppliers using paper checks, while 45.2 percent rely on cash. This reliance on traditional methods goes both ways. Roughly three-fourths (72.4 percent) receive suppliers’ invoices via mail and 43.8 percent via fax.

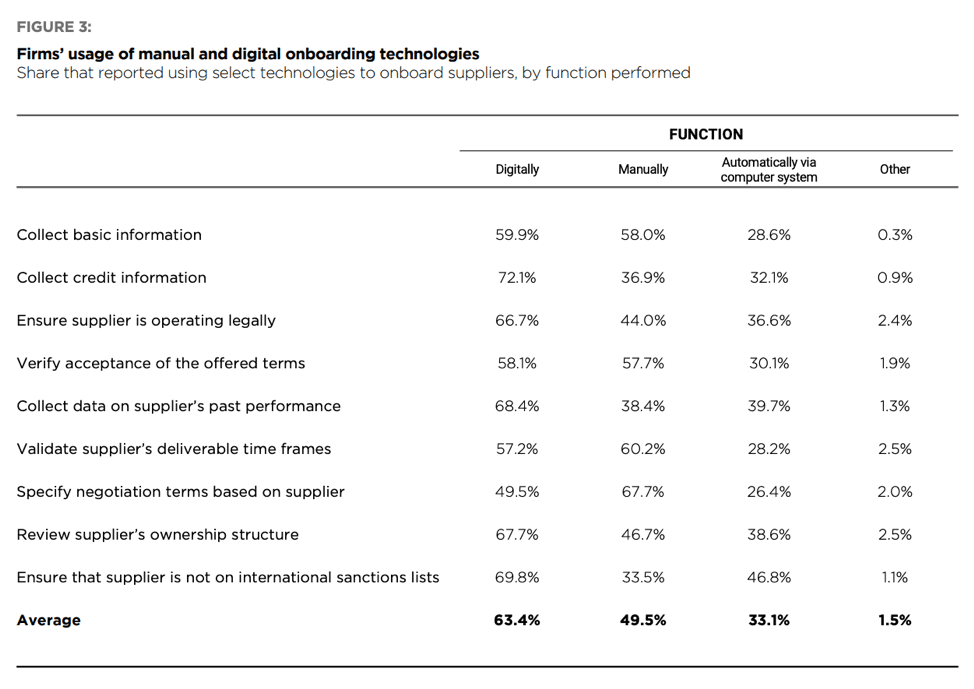

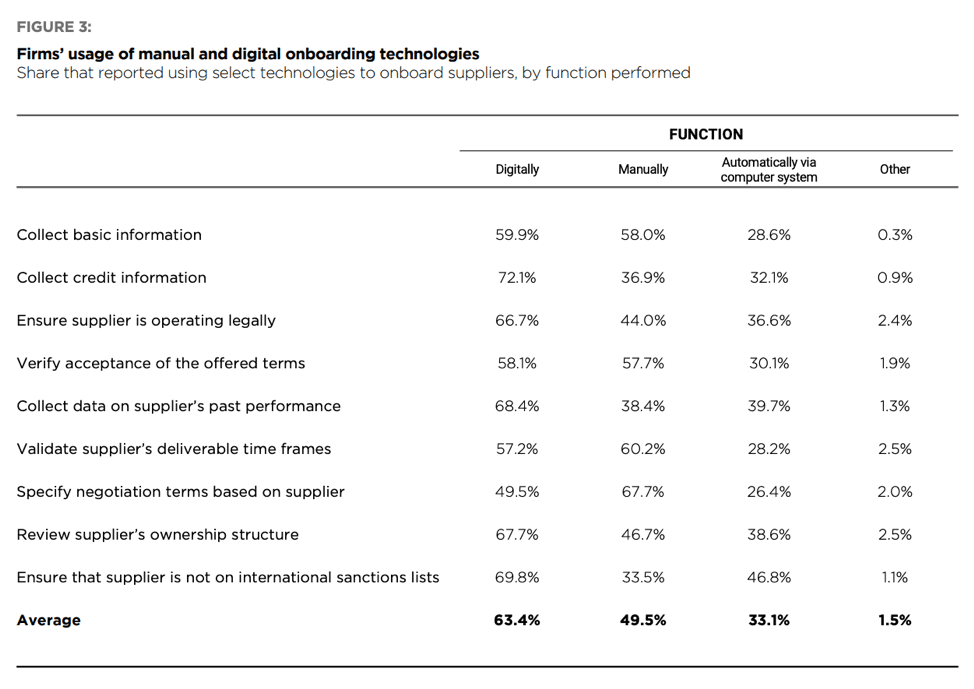

This stands in contrast, though, to onboarding procedures, which are largely digital. A majority (63.4 percent) of AP departments use digital methods to onboard suppliers, while close to half (49.5 percent) use manual techniques. Collecting credit information is the largest use of digital onboarding (72.1 percent), while 68.4 percent collect data digitally on suppliers’ past performance. This reflects the importance of gauging business partners’ financial stability.

Manual methods are most used to negotiate contract terms when onboarding suppliers (67.7 percent).

In the study, just 72.5 percent of AP professionals report collecting basic supplier information like contact names, business addresses and account numbers. And 42 percent collect this basic info electronically, while 31.2 percent do so manually.

The propensity to collect basic supplier information digitally is tied to performance. A majority (57 percent) of firms reporting annual revenues over $500 million use electronic means to collect this info during onboarding. Firms earning less were more likely to use a mix of digital and manual methods. Thirty-nine percent of firms with annual revenues under $10 million used a mix, while 19 percent did manual checks.

Advertisement: Scroll to Continue

The outliers were firms generating between $100 million and $500 million in annual sales revenue. They were less likely to use digital methods to collect supplier information than either manual methods or a mixture of both; 55.2 percent of those in this bracket use purely manual methods to obtain such data, while 16.9 percent rely on a mix of digital and manual and 27.8 percent utilize solely digital tools.

Not all the findings from this study were intuitive. It might make sense for firms that receive a higher volume of invoices per month to use digital information collection to a higher degree than firms with a lower volume of monthly invoices. But this wasn’t the case. Those that receive more invoices per month appear to be more likely to manually collect basic supplier information – 48.8 percent, to be exact. A similar number (47.8 percent) that process between 2,000 and 5,000 invoices per month use digital information collection.

Moving beyond simply collecting basic info, most rely exclusively on digital tools to collect details on suppliers’ credit histories and financial records, with 63 percent of respondents whose firms collect the information using purely digital means, along with 61.2 percent of those whose firms collect data on past financial performances.

Very few say their firms use either manual data entry or a combination of manual and digital data input to collect such information.

When it comes to negotiation operations, which could include tasks like processing new suppliers’ credit information to determine contract terms based on financial reliability, manual negotiations are more common than digital ones. Nearly 42 percent of respondents say the negotiation portions of their supplier onboarding processes are entirely manual and carried out by human employees via non-digital communication channels, while 31.8 percent report using exclusively digital tools.

Whether firms operate manually or digitally—or are even in agreement about how best to innovate—most concur that digital onboarding is more efficient than traditional methods.

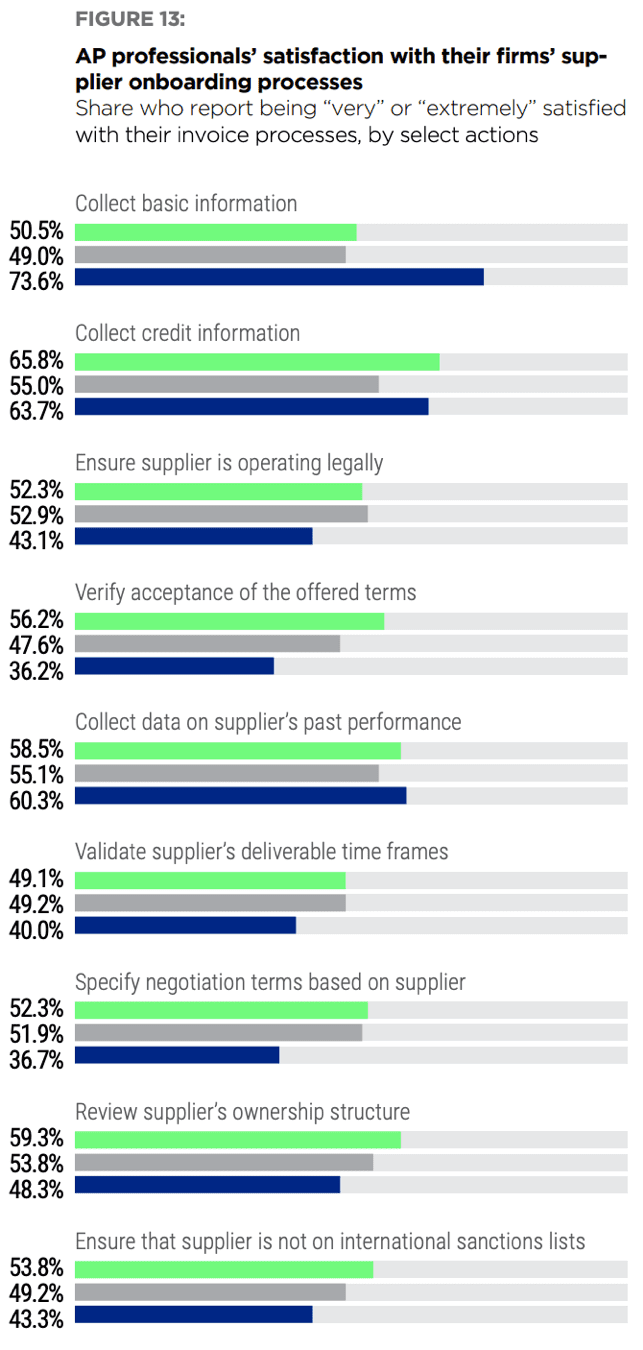

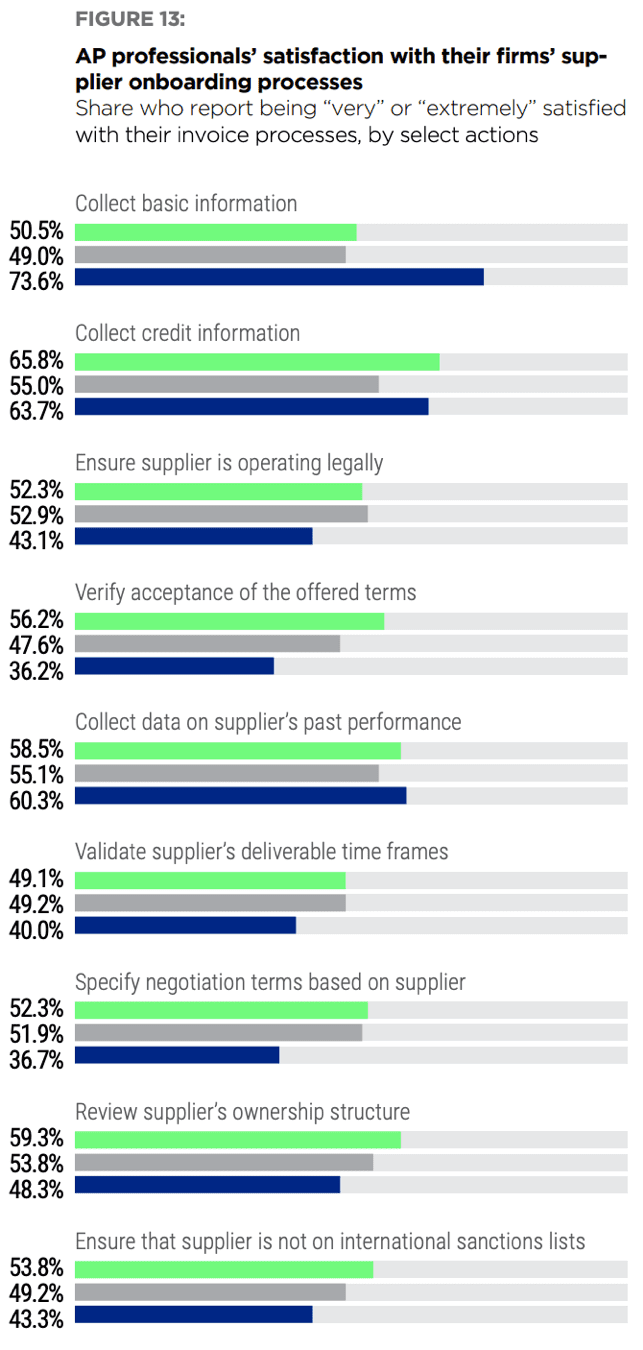

Three-fourths (73.6 percent) of firms that manually collect basic information are “very” or “extremely” satisfied with their operations’ invoice processing systems, which implies that manual methods are sufficient for the most basic tasks. There were lower levels of satisfaction for verifying acceptance of offered terms.

A majority (59.4 percent) of AP professionals from firms that electronically specify supplier negotiating rate their companies’ overall onboarding processes as “very” or “extremely” efficient. High marks are also given by the 65.8 percent of AP professionals that collect credit information digitally.