Smaller banks and credit unions enjoy a reputation of offering more personalized services than large financial institutions (FIs). When it comes to technological innovation, however, the smaller players have long been outgunned by larger FIs and their sizable IT budgets. This is changing — in a big way.

Today, small banks are more aggressive and ambitious in their innovation strategies than medium-sized and large FIs. In fact, more than 40 percent of small banks aim to be first to market with their innovations, a twofold increase from 2017 that surpasses that of larger banks. Meanwhile, medium and large FIs are taking a more cautious approach to innovation. Half of medium-sized FIs prefer to observe market trends before rolling out new innovations.

Today, small banks are more aggressive and ambitious in their innovation strategies than medium-sized and large FIs. In fact, more than 40 percent of small banks aim to be first to market with their innovations, a twofold increase from 2017 that surpasses that of larger banks. Meanwhile, medium and large FIs are taking a more cautious approach to innovation. Half of medium-sized FIs prefer to observe market trends before rolling out new innovations.

In the Leveling the Playing Field For Different-Sized FIs Edition of the latest Innovation Readiness Playbook™ series, a collaboration with i2c, PYMNTS surveyed more than 200 FI decision-makers to examine how institutional size relates to innovation. The report analyzed a wide range of metrics, such as investment in innovation, on-time performance and new product development for three groups of FIs: small banks (with less than $500 million in assets), medium FIs (with $500 million to $25 billion) and large FIs (with more than $25 billion).

The research determined that greater assets do not translate into a stronger appetite for innovation. The overall innovation climate in the banking sector is cooler than it was in 2017, when PYMNTS last took stock. However, while medium and large FIs saw their performance scores decline, the average score for small banks increased from 33.6 percent to higher than that of large FIs.

The research determined that greater assets do not translate into a stronger appetite for innovation. The overall innovation climate in the banking sector is cooler than it was in 2017, when PYMNTS last took stock. However, while medium and large FIs saw their performance scores decline, the average score for small banks increased from 33.6 percent to higher than that of large FIs.

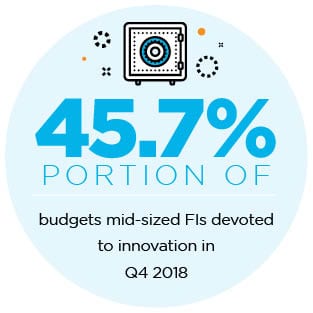

At the same time, mid-sized banks remain committed to innovation — and demonstrate this where it counts. On average, these FIs designate 45.7 percent of their budgets to innovation, surpassing the levels of small banks (33.2 percent) and large banks (23.8 percent). On the other hand, mid-sized banks are more careful with how they spend their innovation dollars. Half of the respondents reported preferring to observe market trends before rolling out new innovations, up from 40.3 percent in 2017.

Advertisement: Scroll to Continue

Banks of differing sizes also diverge in the innovation areas where they want to invest. A dominant focus for small FIs over the next three years will be user experience: 57.4 percent will focus on this area. While payments technology will be a priority for all FIs, large FIs will make this a particular focus, with 60.8 percent investing in this area over the next three years.

Banks of differing sizes also diverge in the innovation areas where they want to invest. A dominant focus for small FIs over the next three years will be user experience: 57.4 percent will focus on this area. While payments technology will be a priority for all FIs, large FIs will make this a particular focus, with 60.8 percent investing in this area over the next three years.

Being a leading innovator today no longer requires having large asset levels or sizable in-house IT departments. To learn more about the qualities that make innovative FIs stand out from the crowd, download the report.

About the Playbook

The Innovation Readiness Playbook, done in partnership with digital banking and payment solutions provider i2c Inc., gauges where banks are on the road to becoming innovators. We surveyed executives at more than 200 U.S. FIs (excluding the largest 25 banks) and scored the institutions from zero to 100 in terms of innovation readiness. Our sample banks fell into four size groups: those with assets below $500 million, $500 million to $1 billion, $1 billion to $25 billion and more than $25 billion. We divided the FIs into three groups — top, middle and bottom performers — then analyzed the data to understand what top performers were doing so well, and the lessons everyone else can learn from them.