Ice Cream Trucks Get an on-Demand Digital Makeover

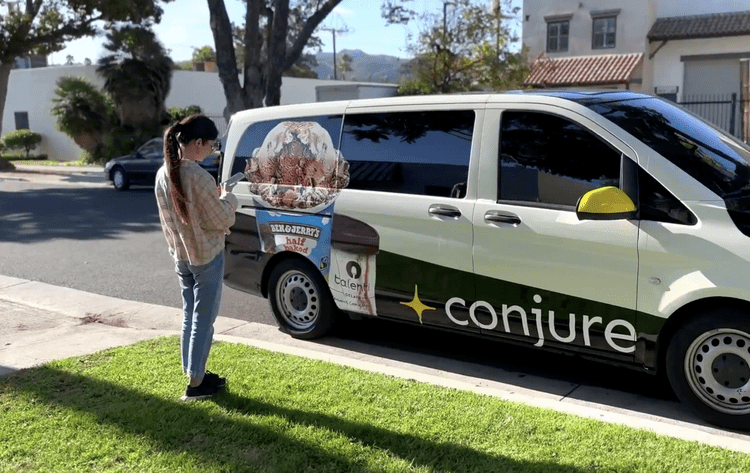

With hail-able mobile stores, food brands are driving D2C sales, reimagining the ice cream truck.

In an interview with PYMNTS, Ali Ahmed, co-founder and CEO of Conjure, the company formerly known as Robomart that creates mobile shops that can be hailed via app like an Uber or Lyft ride, contended that the model offers more convenience than on-demand delivery, solving for the main points of friction.

“The existing model of delivering preordered goods always has a tradeoff between affordability, profitability and speed,” Ahmed said. “They cannot maximize all, whether it’s a delivery app or a quick-commerce service or a delivery robot. But there’s a new model of roving shops, which we’re part of (there are also others in the space) that solves that trilemma … by getting rid of that order-creating process and order pickups.”

He noted that the model eliminates the picking and packing process, since consumers pick their own items out from the mobile shop. It also combines order creation and order fulfillment — consumers get what they want right as they are choosing it.

Major food brands are getting on board. Earlier this month, confectionery giant Mars announced a partnership with Conjure to offer hail-able mobile stores to drive direct-to-consumer (D2C) ice cream sales. The initial test will go live in the spring in Hollywood, Los Angeles, with more locations to come, offering frozen treats from Mars’ Snickers, Twix and M&M’s brands. The move followed Conjure’s tie-up with Unilever, which debuted last year.

Ahmed noted that ice cream is highly in demand, citing an International Dairy Foods Association statistic that the average American eats more than 20 pounds of the treat a year.

“Where we can create a model that is much more convenient and faster for people, we’re focusing in on those categories,” he said. “We’re using ice cream as our anchor, and we’re moving towards snacks and food-on-the-go very soon.”

Certainly, the demand is there, with many consumers getting their food needs met digitally. Research from PYMNTS’ study “Changes in Grocery Shopping Habits and Perception,” which drew from a December survey of more than 2,400 U.S. consumers, found that 45% shop for groceries online at least some of the time. Plus, 7% of grocery shoppers do so all the time, a 36-fold increase in digital-only grocery shoppers compared to before the pandemic.

Indeed, merchants are seeing that the convenience of getting items to wherever the consumer is, is key to retaining food shoppers’ loyalty. Research from PYMNTS’ study “Big Retail’s Innovation Mandate: Convenience and Personalization,” created in collaboration with ACI Worldwide, which drew from a survey of 300 U.S. and U.K. retailers, found that three-quarters of grocers think that consumers would be very or extremely likely to switch merchants if the ability to order products for delivery were not provided.

Looking ahead, Ahmed predicted that one of the main challenges for the model will be getting consumers onboard with this unfamiliar way of shopping. However, he noted that those who try it out keep coming back, with 90% of users in the company’s beta test being repeat buyers.

“In 30 years, you’ve never really had a new retail channel,” he said. “You’ve either had to go to a store physically and buy goods or place an order through an app or through a website and have somebody deliver it. But now, you can hail a shop and shop at your doorstep. And so, it is a new experience that will take some time to get adopted.”