Operational Innovations Drive Software Publishing Marketplaces

The software publishing industry is in a state of flux right now as it embraces embedded finance to facilitate new growth — and many payment facilitators (PayFacs), independent software vendors (ISVs) and marketplaces are now working to support this push.

Research confirms PayFacs, ISVs and marketplaces are prioritizing the innovations — such as digital wallets and short-term lending products — that can help software publishers realize new customers and new cash inflows.

PYMNTS Intelligence data shows 71% of software industry PayFacs now offer digital wallets while they also focus on enhancing digital wallet capabilities — two features that are lower priorities for ISVs and marketplaces. Conversely, 70% of marketplaces are helping software publishers enhance (or in some cases introduce entirely) short-term merchant credit offerings, which will appeal to the software publishers interested in expanding the credit options they can provide their users.

These are only a few of the findings included in “The Embedded Finance Ecosystem: Software Publishing Edition,” a PYMNTS Intelligence study created in collaboration with Carat from Fiserv. The report includes survey data from nearly 300 PayFac, marketplace and ISV executives who were asked about how they are working to better meet the needs of software publishers.

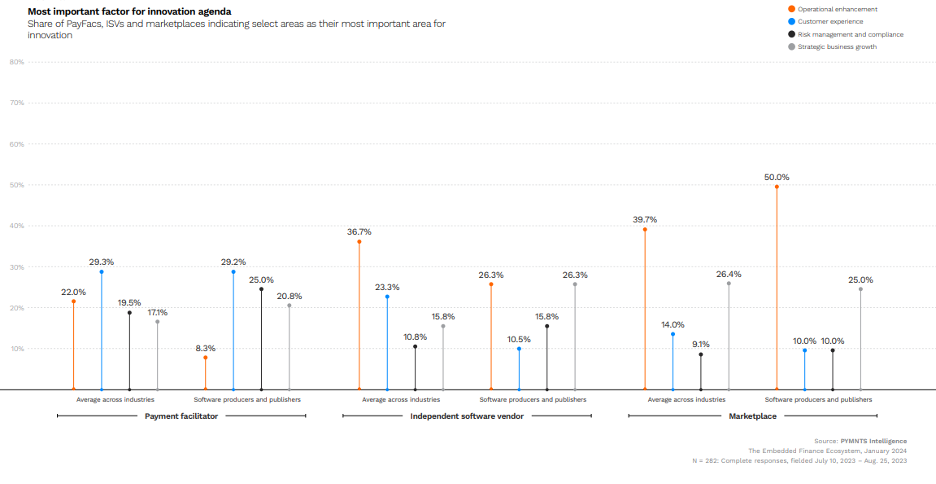

One important takeaway is the finding that 50% of the marketplaces working with the software publishing sector are now collaborating with their customers to provide operational enhancements — a percentage that is almost six times greater than that of sector PayFacs (8.3%) prioritizing operations. Across all industries studied, 40% of marketplaces prioritize operational enhancements.

The study also found that 25% of PayFacs rank risk management and compliance above all else on their innovation agendas, while only a small fraction of ISVs (16%) and marketplaces (10%) do the same. Thirty percent of PayFacs place a premium on customer experience when mapping out their innovation agendas for software publishers.

ISVs differ by putting equal weight (26%) on operational enhancements and strategic business growth. For comparison, strategic business growth captures the top spot for 25% of marketplaces serving this segment, followed closely by the 21% of PayFacs that said the same.

These variations are likely due to the fact that different software producers and publishers place different degrees of emphasis on customer experience, compliance, operational enhancement and business growth. Meaning that the PayFacs, ISVs and marketplaces that work with these software producers must pivot accordingly.