Mobile wallets have moved from sending money to friends and family to paying bills. Digital wallet adoption seems to be more advanced in Europe, but it is also taking off in the United States.

An Emerging Payment Method

In joint research conducted by PYMNTS Intelligence and Nuvei, nearly half of U.S. consumers tried using a new payment method in the past year, and 16% switched to a new one. Digital wallets are the preferred option when switching, having been used in 30% of these “new” cases, which means that 3 in 5 U.S. consumers who tried a new payment method in the last year did so with digital wallets.

Those who tried digital wallets for the first time continued to use them as a substitute for other payment options. As extracted from the study, 4 in 10 consumers who tried this method reduced the use of other payment methods after beginning their use of digital wallets.

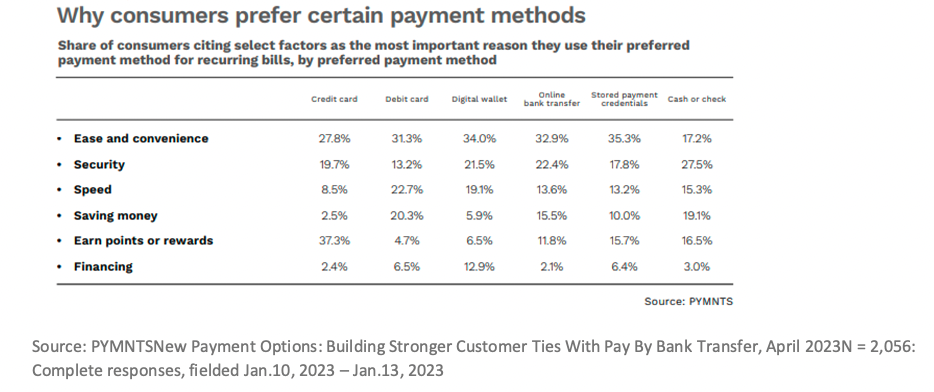

It seems several factors are influencing the heightened use of digital wallets at the expense of other payment methods. Consumers cited speed, convenience and security among the more important factors in choosing digital wallets for recurring bills than other methods.

Bill Payments

A PYMNTS Intelligence and ACI Worldwide study found that mobile wallet use for bill pay is growing across age demographics, with consumers preferring the speed and convenience it provides over legacy methods such as writing paper checks.

Advertisement: Scroll to Continue

Although satisfaction is high among mobile wallet users when making bill payments, many face difficulties during the process. The study found that around 60% of consumers in the U.S. use mobile wallets to pay bills, and more than two-thirds of them are very satisfied with the experience. Bill-paying consumers faced multiple pain points in the bill payment process, including security concerns, lack of features, inconvenience and cost.

Barriers to Further Adoption

Overall, as the number of bills paid using digital wallets increased, the number of issues experienced by consumers also increased. Specifically, 59% of users paying more than five different bills encountered difficulties, compared to 48% of those who paid just one type of bill. These frequent users probably experienced more challenges due to their higher usage, but their continued use suggests that the benefits outweigh the drawbacks. Nevertheless, there is potential for improvement, as consumers may reach a point of frustration with these tools.

Another PYMNTS Intelligence study found that cost is an adoption obstacle to consider. For instance, nearly half of consumers said it’s not likely that they would use a mobile wallet to pay a bill if there was a fee involved.

Introducing friction corrections and enhancing payment processes may be translated into higher consumer satisfaction and likely broader adoption of these applications.