1 in 5 Consumers Pay Auto Loans With Mobile Wallets

Mobile wallets have gained immense popularity among consumers, not only for making in-store purchases but also for their ability to manage finances and store sensitive personal information.

According to a recent survey conducted by PYMNTS and ACI Worldwide, mobile wallets are now the preferred method for paying bills, surpassing QR codes and NFC tap-to-pay options. This trend is particularly prominent among millennials, with a significant 68% using mobile wallets for bill payments in the past year.

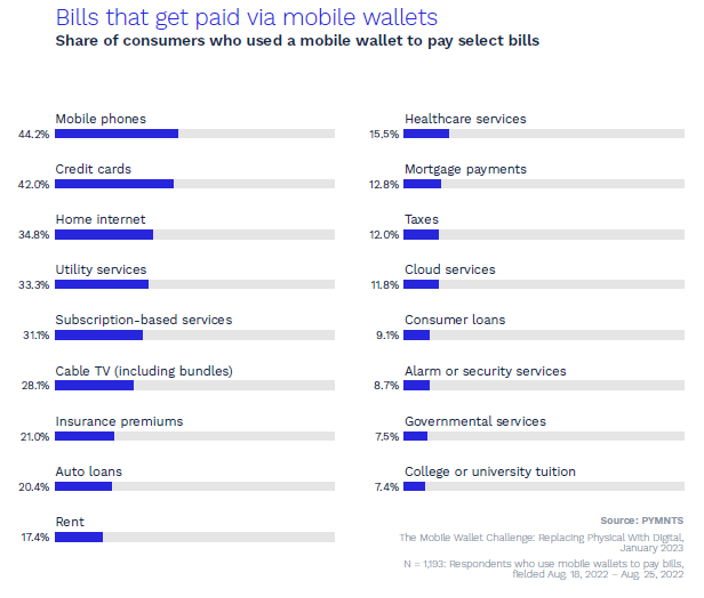

On average, consumers have utilized their mobile wallets to pay at least three to four bills in the past year. The most frequently paid bills via mobile wallets include mobile phone bills, credit card bills, home internet bills and utility bills.

Specifically, nearly 44% and 35% of consumers used a mobile wallet to pay their phone and home internet bills, respectively. Additionally, 33% opted for a digital wallet to settle their utility bills, while 31% utilized a mobile wallet for subscription payments. The data also shows that over 20% adopt the same method for reimbursing auto loans.

When it comes to benefits, the convenience factor is a significant driver behind the increasing popularity of mobile wallet bill payments. This is due to the streamlined process they offer, eliminating the need for manually entering payment information and providing users with a quick, hassle-free experience. Additionally, these payments ensure secure transactions, giving users peace of mind.

Apart from bill payments, consumers can store debit or credit cards, transfer funds to and from bank accounts, send person-to-person payments and manage transactions, all within their mobile wallets.

Additionally, mobile wallets provide the convenience of storing various types of ID cards, event tickets, and virtual keys, reducing the need to carry physical documents. Specifically, millennials commonly store health insurance cards (47%), auto insurance cards (41%), and identification cards (40%). Baby boomers, seniors and Gen X individuals have the highest tendency to store travel tickets, with rates at 48% and 45%, respectively. And nearly 40% of consumers across all generations, excluding Gen Z, opt to store event tickets.

The security offered by mobile wallets is another key factor enhancing their appeal. With the implementation of biometrics and tokenization, mobile wallets provide secure access to consumers’ stored credit or debit card information, effectively preventing unauthorized access to personal and financial data. In fact, a significant 58% of consumers find mobile wallets to be as secure or even more secure than physical wallets.

But while digital wallets have gained widespread acceptance, there are still generational differences in their adoption. Younger generations, such as millennials and Generation Z, are more likely to view mobile wallets as a viable replacement for physical wallets. They also tend to utilize a wider range of mobile wallet features compared to older generations.

In essence, the increasing recognition of the benefits offered by mobile wallets for bill payments and other financial transactions is reshaping how consumers handle their personal finances in the digital era. With the convenience, security and versatility they provide, mobile wallets have become an essential tool for modern-day financial management.

And as this technology progresses and gains wider acceptance among merchants and service providers, the relevance of physical wallets may dwindle even more, potentially leading to a decline in their prevalence.