Where Consumers Turn To Personalize Their Card Spending Experiences

Consumers are not only using their smartphones to text and talk, but to manage how they use their credit, debit and prepaid cards. Whether it’s keeping tabs on their dependents’ financial spending habits or managing payments from their mobile phones, consumers are turning to these mobile card services (MCS) to manage their day-to-day finances.

In the Mobile Card Services Playbook, a PYMNTS collaboration with Ondot, our researchers collected survey response data from 9,513 consumers, and examined how the 3,240 who had MCS-linked cards used them in their daily lives. This provided us with valuable insight into MCS-based shopping habits, including how consumers used their smartphones to manage their monthly expenditures, as well as those of their financial dependents.

In the Mobile Card Services Playbook, a PYMNTS collaboration with Ondot, our researchers collected survey response data from 9,513 consumers, and examined how the 3,240 who had MCS-linked cards used them in their daily lives. This provided us with valuable insight into MCS-based shopping habits, including how consumers used their smartphones to manage their monthly expenditures, as well as those of their financial dependents.

Over a third of them used these services because they liked being able to receive text alerts when their cards had been declined. Another 53.3 percent liked the ability to turn off their cards in real time because they felt it helped fight fraud.

Still, 24.3 percent enjoyed being able to set their own spending limits based on the type of merchant because they felt that made it easier and more convenient to monitor their own finances. That said, different consumers used MCS for different reasons.

Still, 24.3 percent enjoyed being able to set their own spending limits based on the type of merchant because they felt that made it easier and more convenient to monitor their own finances. That said, different consumers used MCS for different reasons.

The PYMNTS research showed that the ability to customize card payments with MCS was one of its key selling points. A diverse collection of consumers used MCS precisely because it allowed them to tailor their card services to their individual circumstances. Some used MCS to limit their own card spending, while others used it to keep a watchful eye on the spending habits of their dependent children.

For instance, 90.4 percent of MCS users leveraged the services to enhance the way they used their own personal cards. This group of consumers tended to be younger than others, with 92.4 percent of those under the age of 35 — without any financial dependents — reportedly using MCS in this way.

For instance, 90.4 percent of MCS users leveraged the services to enhance the way they used their own personal cards. This group of consumers tended to be younger than others, with 92.4 percent of those under the age of 35 — without any financial dependents — reportedly using MCS in this way.

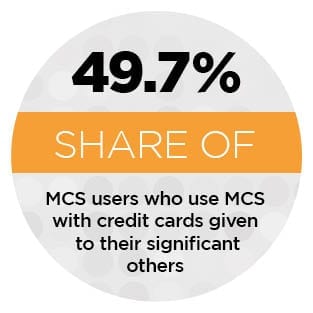

Meanwhile, consumers under the age of 35 who were providing support for a financial dependent were the most likely to report linking MCS to a card they had given to a significant other or spouse. Among this group, 34.2 percent said they had used MCS in this way.

However, whether young or old, for most consumers, it was not a question of whether MCS could improve their card using experience, but a question of how.

To learn more about how consumers of different means and circumstances used MCS in their daily lives, click here to download the report.