With increased adoption come raised expectations for what a P2P app should offer, with seamlessness and convenience emerging as consumers’ top priorities. Firms seeking to implement or improve P2P apps must ensure that their products deliver exceptional experiences, provide robust protections from fraud and adhere to regulatory standards.

With increased adoption come raised expectations for what a P2P app should offer, with seamlessness and convenience emerging as consumers’ top priorities. Firms seeking to implement or improve P2P apps must ensure that their products deliver exceptional experiences, provide robust protections from fraud and adhere to regulatory standards.

The “Money Mobility Tracker®” explores the popularity of P2P payment apps, especially among younger consumers, highlighting the challenges firms face when implementing these services to balance smooth user experiences with strong regulatory compliance.

Younger Consumers Flock to P2P Payments

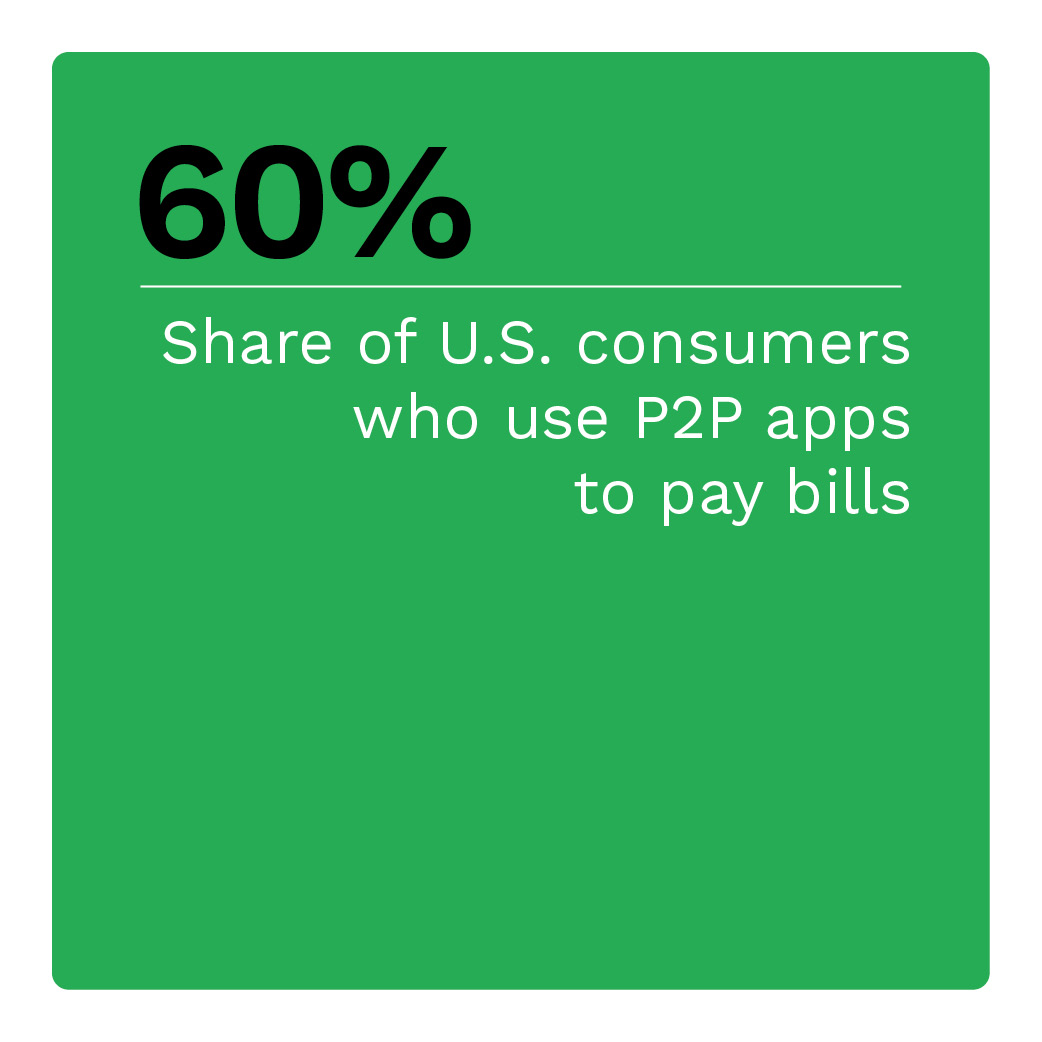

P2P payment apps are gaining popularity due to their ease of use and versatility in various situations. Younger consumers — especially millennials and Generation Z — are particularly enthusiastic about these payment methods.

Zelle payment volume among Bank of America customers increased to $101 billion — up 25% year over year — according to the bank’s Q4 2023 earnings report. In contrast, traditional debit and credit options showed only modest growth, increasing by just 3%. Usage among younger demographics significantly drives this rise in P2P payments.

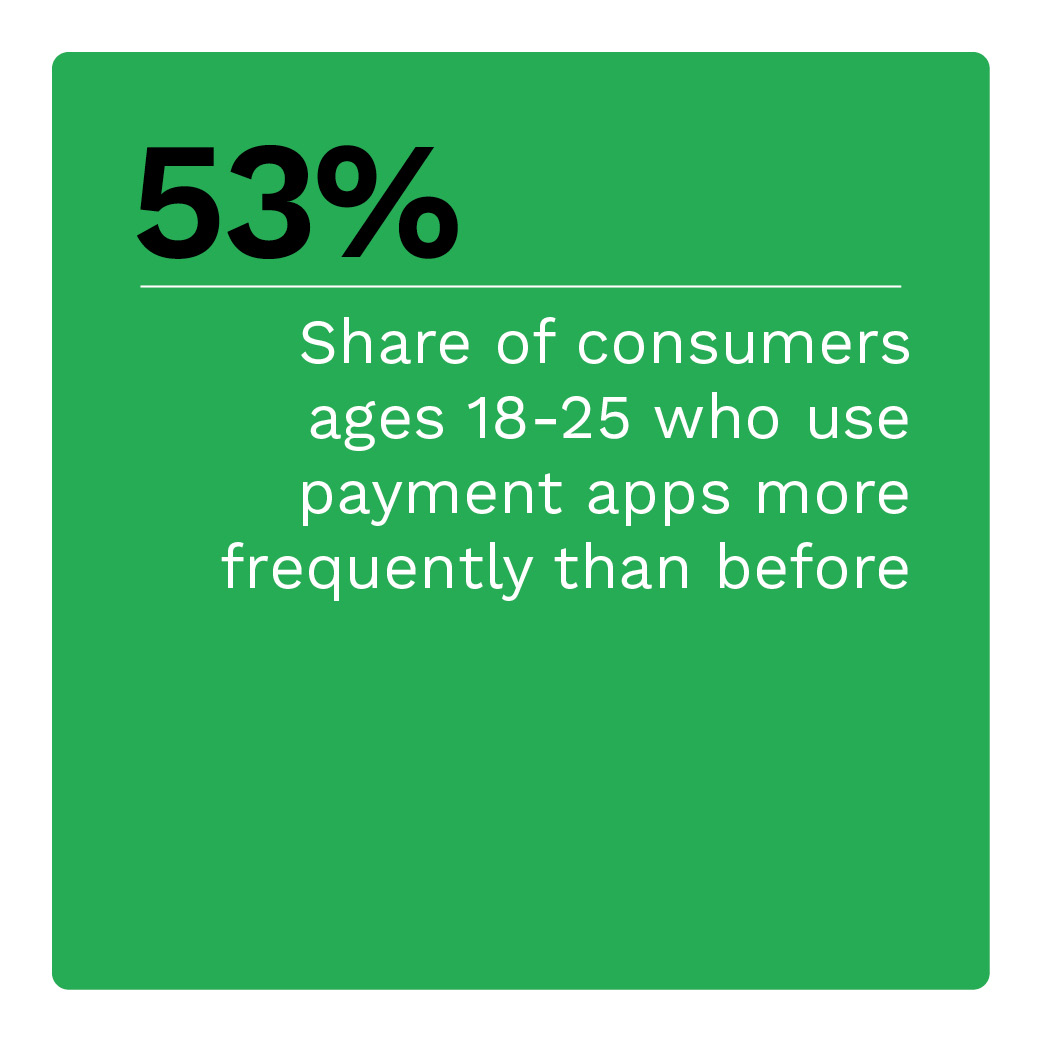

One study found that 53% of consumers ages 18-25 reported using payment apps more often than before to manage increased costs from inflation, with 50% of consumers ages 26-41 saying the same. Interestingly, this growth has led to a social phenomenon among certain groups: 30% of young adults said they knew a “Venmo vulture,” typically a friend who regularly sends them frivolous P2P payment requests for small amounts.

To learn more, visit the Tracker’s P2P Payment Demand section.

P2P Payment Methods Struggle to Meet Customer Demands

Customers have grown accustomed to leveraging P2P payment methods and have developed distinct preferences and dislikes among the apps they use. Too often, though, P2P payment providers overlook these considerations.

PYMNTS Intelligence research revealed that while 93% of FinTechs recognize their customers’ issues with P2P payments, many are not accurately identifying the underlying reasons. For example, 41% of consumers depositing money and 28% of those withdrawing funds cited the absence of a guarantee of good funds or speed as their primary issue. In contrast, FinTechs reported just 20% and 12% of their account holders having those concerns. As the P2P payment market becomes increasingly crowded, these FinTechs must address their customers’ primary concerns or risk losing them to the competition.

To learn more, visit the Tracker’s P2P Payment Challenges section.

Payment Providers Grapple with Regulation

P2P payments are certainly convenient for consumers, but like all digital transactions, they carry the risk of fraud and scams. Government regulators are calling on these apps to tighten their fraud prevention systems.

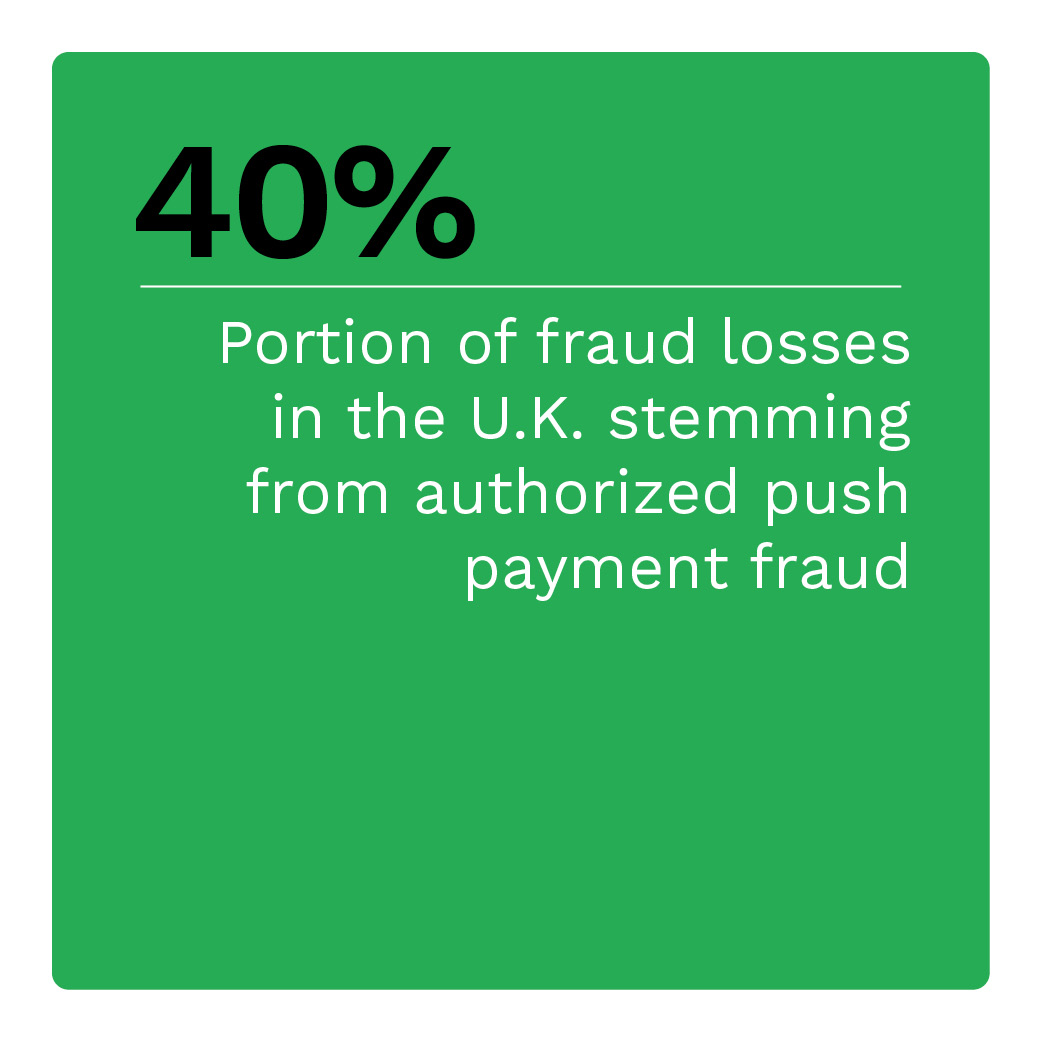

Among the most common forms of fraud associated with P2P payments is authorized push payment (APP) fraud. In this type of fraud, criminals deceive individuals or businesses into transferring funds to the fraudster’s account. According to a report, APP fraud constituted an astonishing 40% of all fraud losses in the United Kingdom in 2022. Such frauds are difficult to reverse due to the victim’s authorization of the funds transfer — even amid fraudulent circumstances.

Among the most common forms of fraud associated with P2P payments is authorized push payment (APP) fraud. In this type of fraud, criminals deceive individuals or businesses into transferring funds to the fraudster’s account. According to a report, APP fraud constituted an astonishing 40% of all fraud losses in the United Kingdom in 2022. Such frauds are difficult to reverse due to the victim’s authorization of the funds transfer — even amid fraudulent circumstances.

Many banks and payment providers are enlisting artificial intelligence (AI) to combat APP fraud. In fact, a recent study shows that more than 70% of financial institutions (FIs) with assets of at least $5 billion employed both AI and machine learning (ML) solutions to tackle fraud in 2023. These systems analyze spending patterns and flag inconsistencies as potential fraud.

To learn more, visit the Tracker’s P2P Payment Regulatory Concerns section.

About the Tracker

The “Money Mobility Tracker®,” a collaboration with Ingo Payments, explores the increasing popularity of peer-to-peer (P2P) payment apps, especially among younger consumers, highlighting the challenges faced by firms implementing these services to balance smooth user experiences with strong regulatory compliance.

![]()