Visa CEO Weighs in On Europe and Digital Payments Opportunities

In an interview with Lisa Ellis, analyst with Sanford Bernstein, and as reported by Seeking Alpha, Visa CEO Al Kelly weighed in on a number of opportunities and challenges facing the company, from Visa Europe to China to digital payments.

Kelly said that within the larger picture, the company is focused on “growing the payments pie; we’re in a unique space in payments where we don’t necessarily have to go out and battle for a fixed share of a pie. The opportunity in payments to just grow the pie is enormous.”

In tandem with that opportunity, the next five years will be focused in part with growing acceptance points “as eCommerce continues to evolve and the Internet of Things comes along.” Digital also will continue to be an area of expansion, Kelly said, where Visa will evolve into more of an “open company,” interacting with an expanding payments ecosystem. He maintained that the firm has developed “very good relationships with Samsung, with Stride, with Facebook, with PayPal.”

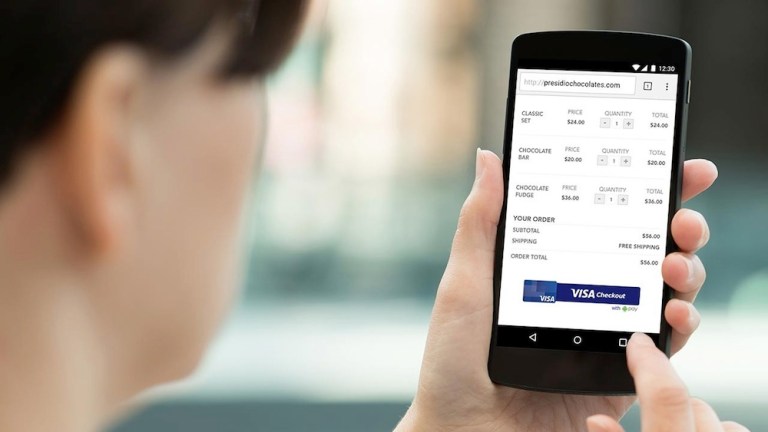

The continued evolution from physical cards to the digital environment, he told the analyst, hinges on “a high standard” of security, which is illustrated by Visa’s emphasis on tokenization and “devalued data in an open environment.” But beyond security, the digital transformation also has the opportunity to increase conversions from shopping to buying and where Visa Checkout continues to make strides. Kelly emphasized that the Checkout offering has 300,000 merchants worldwide across $200 billion of addressable volume.

In the wake of the Visa Europe deal, he continued, “We are off to a very good start … we have a playbook from moving from an association model to a commercial enterprise model. On the expense side we’ve gone through both the people and profits rationalization which has resulted in less duplication of efforts, more streamlined processes and a better expense profile, which will help raise our margins in Europe over time.” The transition to a single system will carry through 2018, he continued, across core authorization, clearing and settlement.

Speaking to Europe in general, Kelly said that amid the regulatory environment, “Much of what’s going to play out in Europe is still to be played out. It’s very, very early innings. We just went through the scheme processor division. You know, it’s frankly was culturally disruptive, it’s very difficult that we literally have to make people sit in separate spaces.”

And turning to PSD2, he said, “There are a number of elements to it, the two that get a lot of attention are the two–factor authentication and the need for the financial institutions that have opened up their accounts to outside parties if that’s what consumers request.

“How well that’s going to play out is really early days. We have been working hard with and spending a lot of time with both, the regulators and our clients; we’re trying to make sure that the two-factor authentication doesn’t hurt at the point of sale.”

Asked by Ellis whether Alipay is “friend or foe,” Kelly noted that though expanding eCommerce is good for all, “I personally think they’ve gotten a bit of a free pass in China, in that they are operating in an uneven playing field with their Chinese bank competitors. And let’s make no mistake about it, Alipay is a bank and as they move out of China into other markets, I believe they’re going to be pressed to get a bank license, if that’s the way they are going to compete.

“They are going to be subject to the same rules that their competitive banks are subject to, whether that’s capital — anything from capital requirements to KYC.” India also remains a market with opportunity, said Kelly, and which operates as a relatively open market. There, he said, Visa, has seen a 50 percent gain in merchant locations and also has boosted volume by 100 percent year on year.

Touching on the B2B market, Kelly mentioned Visa Direct as an advantage here, with “fast payments push capability” which proves especially advantageous in the shared economy.