File it under the ongoing rise of voice-powered smart personal assistants, which aren’t new, but they are gaining new utility.

We’ve been talking to Apple’s Siri since 2011, to Amazon’s Alexa since 2014, and saying, “Hey, Google,” since 2016. These devices have found a place in homes, cars and routines, from buying pet food to checking the weather. But two key developments — the three-year pandemic era that began in 2020, and the late 2022 release of OpenAI’s ChatGPT — have changed the tone.

That voice was destined to become a primary interface was something the writers of “Star Trek” knew in the 1960s, long before the most primitive personal computers first shipped in the 1980s. And, as PYMNTS’ Karen Webster wrote in April, “The voice economy isn’t new. In fact, voice as an enabler to just about any activity, including commerce, is about 200,000 years old.”

What’s changing is the well-documented advances in large language models (LLMs) — of which ChatGPT is the technology du jour — and their impacts on the commerce landscape, putting aside the essay writing cheats and existential human fears that also attend the innovation.

The simple fact is that people like voice, and if anything, they believe it’s high time for the LLM upgrade as they would like to use voice in digital commerce as they have for millennia in other retail settings, from the bazaars of old to the eCommerce capabilities of the 21st century.

The simple fact is that people like voice, and if anything, they believe it’s high time for the LLM upgrade as they would like to use voice in digital commerce as they have for millennia in other retail settings, from the bazaars of old to the eCommerce capabilities of the 21st century.

Advertisement: Scroll to Continue

Consumers Say Voice Commerce Singularity Is Less Than 5 Years Away

In April, PYMNTS released the results of a survey of nearly 3,000 U.S. consumers in the study “How Consumers Want to Live in the Voice Economy.”

Major revelations from that research include the fact that “more than 60% of consumers say voice assistants will be as smart and reliable as real people, and close to half say this vision is less than five years away, with many willing to pay for such a service.”

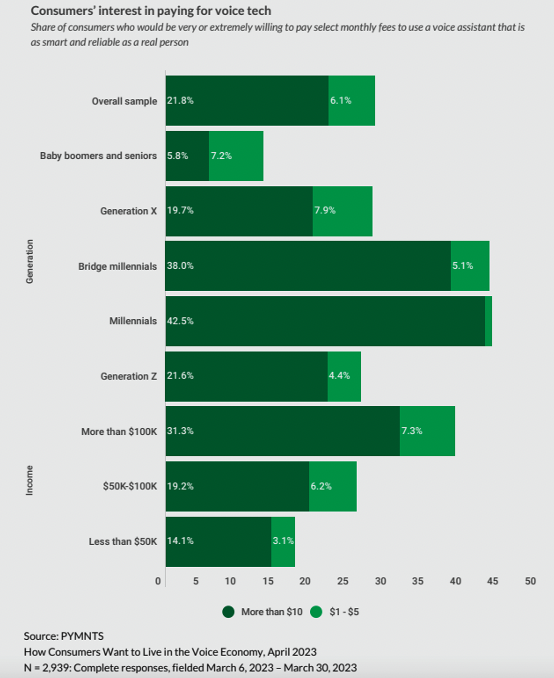

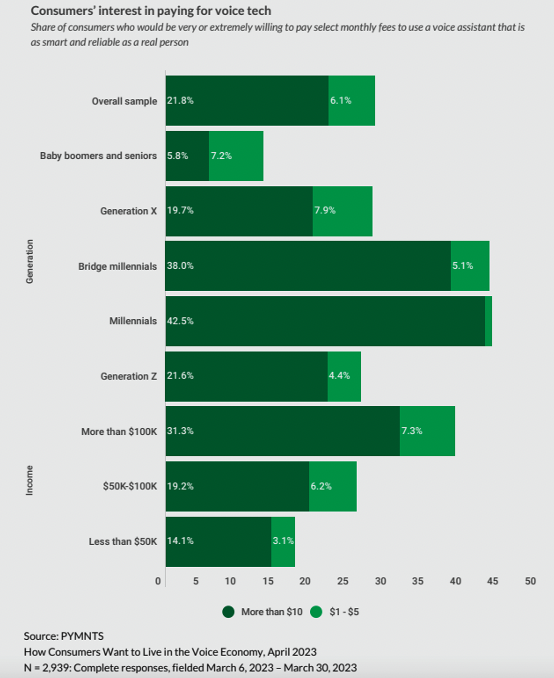

Consumer enthusiasm for more capable voice assistants in their daily lives is an opportunity on its own, as the research found that 28% of Americans are very or extremely willing to pay a monthly fee for a reliable and smart voice assistant. Among millennials, 43% are very or extremely willing to pay more than $10 a month, as are 31% of high-income consumers.

At present, however, voice is still nascent compared to consumer expectations of what they should be able to do — and buy — by simply speaking commands to their preferred assistant.

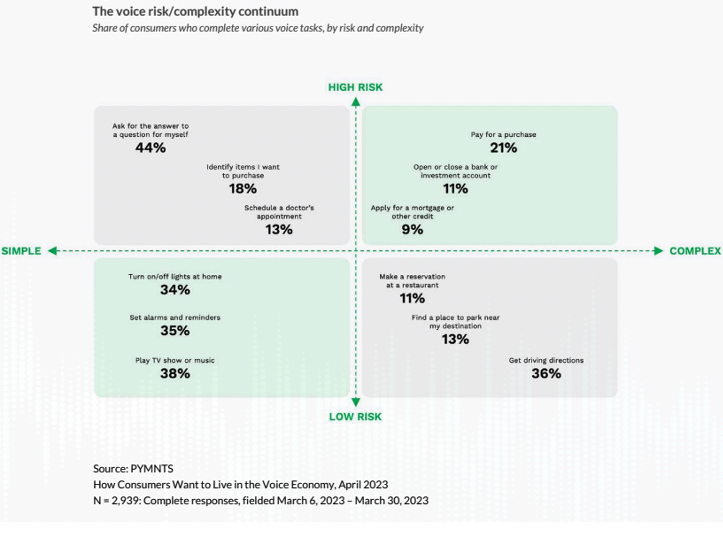

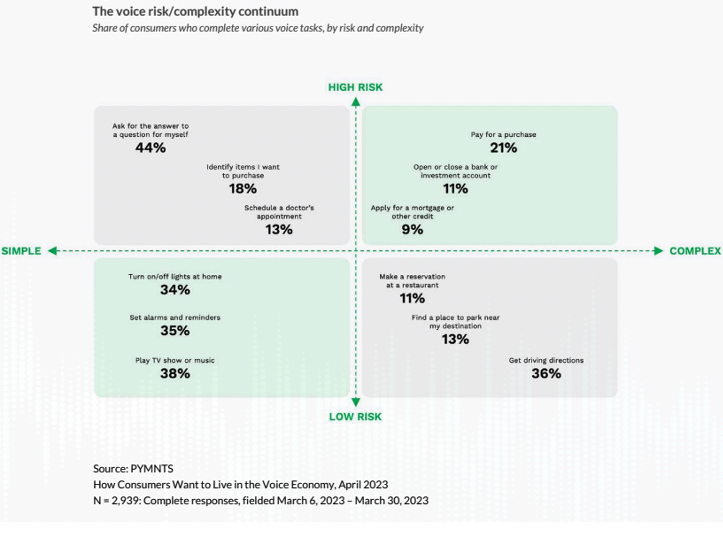

Per the PYMNTS study, “consumers are more familiar with using voice for simpler and low-risk tasks such as playing music, at 38%, setting alarms, at 35%, and asking for directions, at 36%. Consumers are less comfortable with riskier, if not necessarily more complex tasks, where they may be exposed to particularly damaging data errors and security breaches, such as opening a bank account, at 11%, or scheduling a doctor’s appointment, at 13%.”

That risk-reward calculus will dissipate as voice assistants get smarter and use increases, giving consumers the confidence that these systems are both accurate and secure.

That risk-reward calculus will dissipate as voice assistants get smarter and use increases, giving consumers the confidence that these systems are both accurate and secure.

For the time being, only 7.8% of consumers surveyed by PYMNTS said they believe voice technology is as smart and reliable as a real person today. We found that “52% of consumers have used voice to identify and purchase airline tickets and accommodations on their mobile devices and did so by using a voice prompt to make a call. Just 44% completed the purchase using voice prompts.”

Again, that’s higher than pre-pandemic use and an indicator of the total addressable market just eight months after the public got its first taste of ChatGPT and the potential of LLMs.

Proof of Concept, Done

In the runup to that, as Webster pointed out in her April column: “Over the last three years, we have seen a 40% increase in online grocery orders and a 39% increase in online food shares. In 2019, less than 2% of grocery orders were done online — today that stands at 12%. People still shop in grocery stores, but not for the same things they did when that was the only way to purchase their food.”

Webster added that “players as diverse as PayPal, Amazon and Uber make it possible for many similar activities to be connected inside of a single digital ecosystem where payments and identity are inextricably linked. A single app for these everyday experiences is something that nearly half (48%) of consumers say they like and will use — as many do already — because it’s convenient and more secure than having their identity and payments credentials stored all over the web.”

Expect a few stumbles as we run headlong toward spoken-word digital commerce. As PYMNTS reported, “The Consumer Financial Protection Bureau (CFPB) said Tuesday (June 6) that it has gotten several complaints from customers frustrated by their interactions with banks’ artificial intelligence (AI), used to answer questions or solve problems.

“To reduce costs, many financial institutions are integrating artificial intelligence technologies to steer people toward chatbots,” CFPB Director Rohit Chopra said in a news release. “A poorly deployed chatbot can lead to customer frustration, reduced trust, and even violations of the law.”