Amazon Business Takes Personalized Approach To Cross-Border B2B Payments

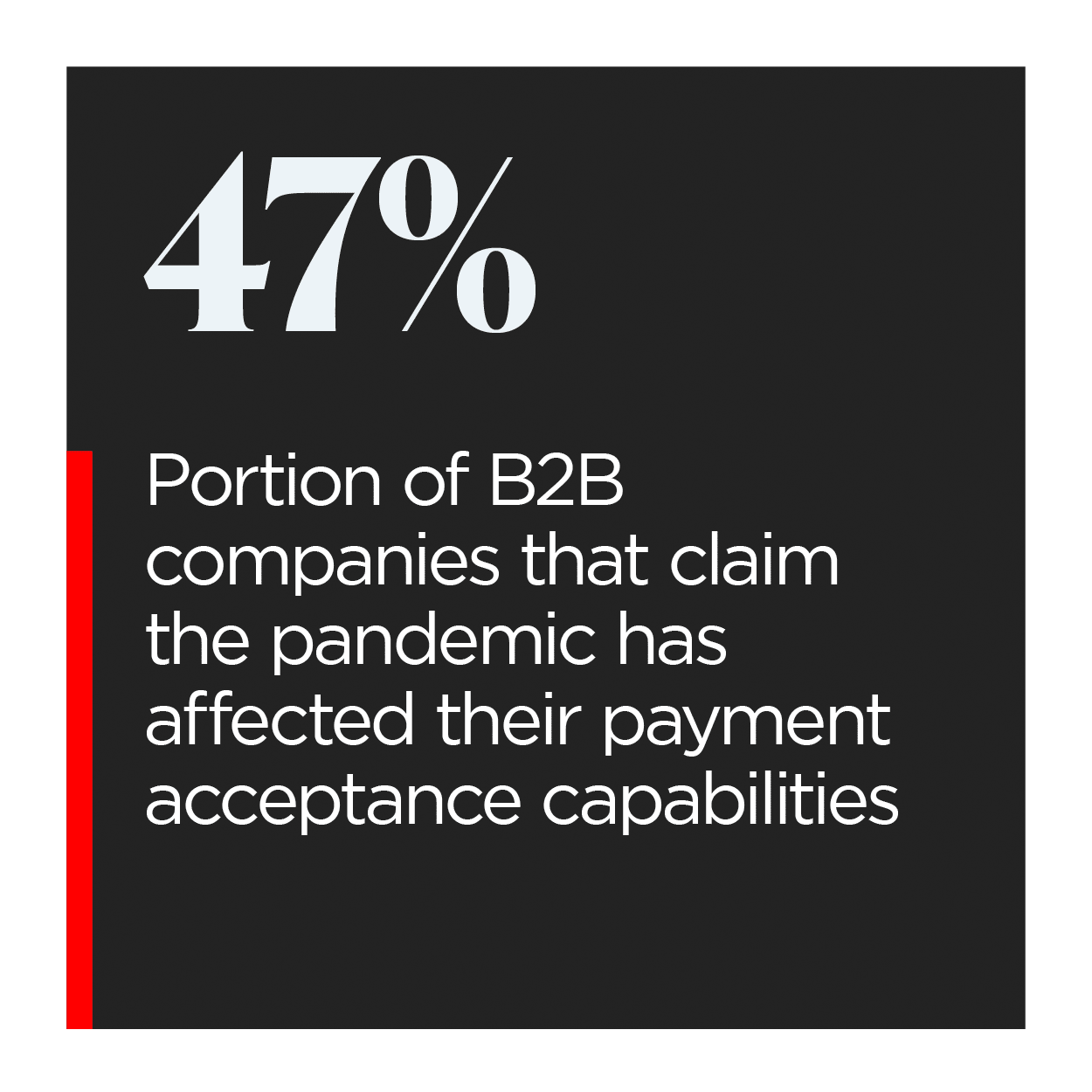

Both businesses and consumers alike made moves to cut down on their expenses in 2020 as the pandemic continued to impact the global economy. Many businesses, for their part, began to seek out ways to reduce the costs and inefficiencies in manual or outdated business-to-business (B2B) sales channels to respond to these pandemic-driven shifts.

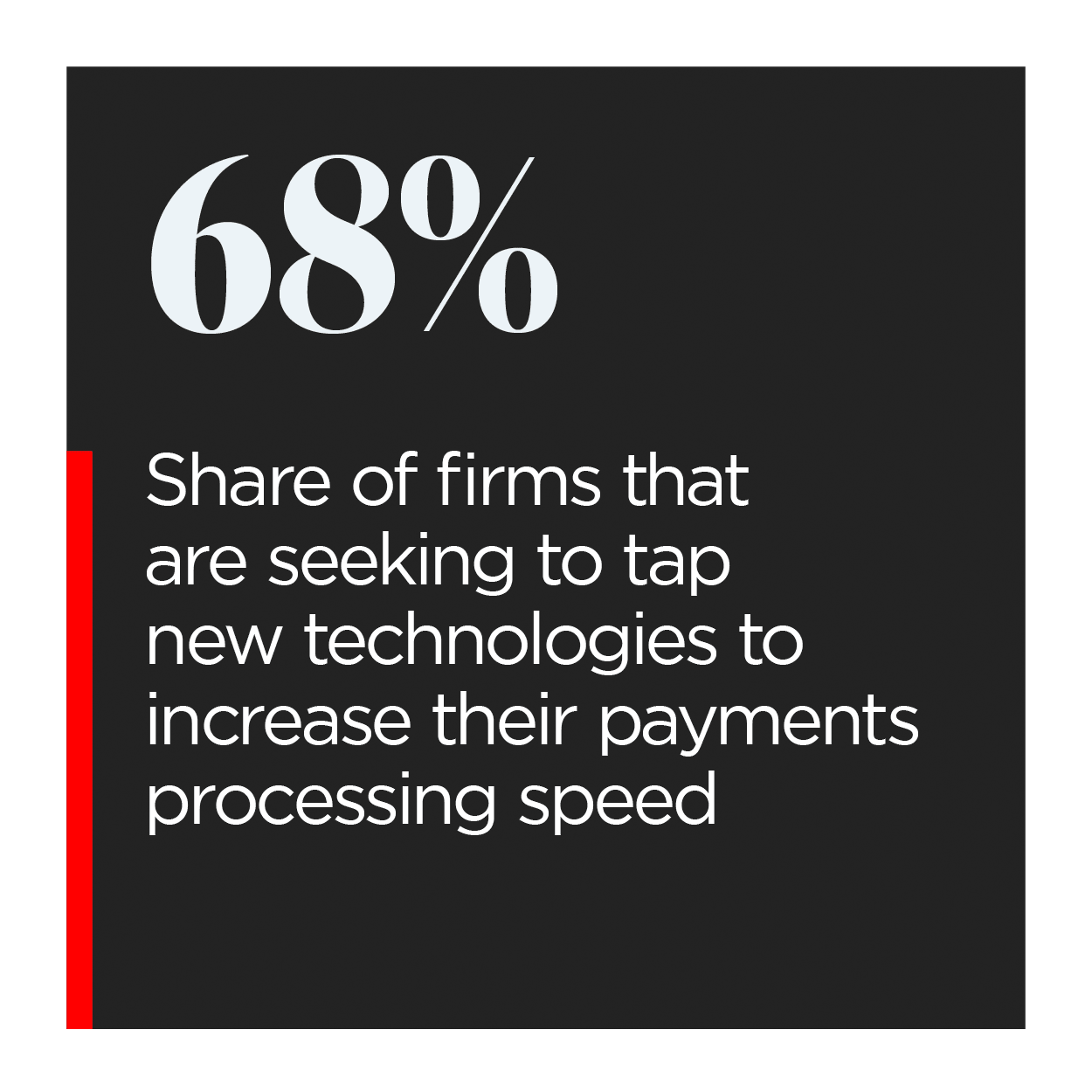

This, in turn, has led to B2B firms’ surge in interest surrounding online marketplaces, many of which are looking to participate in the B2B eCommerce space in higher numbers. More businesses are citing payments processing speeds as a crucial need, with a recent PYMNTS report finding that 48 percent of B2B companies indicated it as a concern. Another study found that only 20 percent of businesses had a desire to move away from digital and back to manual sales, something that shows virtual B2B payments and interactions are beginning to filter  into the mainstream.

into the mainstream.

In the February edition of the Global B2B Payments Playbook, PYMNTS analyzes how the pandemic has accelerated the ongoing shift to eCommerce and digital payment tools for B2B firms worldwide. It also takes a close look at how this B2B eCommerce migration is impacting the overall role of B2B payments within consumer-facing commerce.

Around The Global B2B Payments World

One market where B2B eCommerce transactions have shot up rapidly is India. A recent study found that growth within the B2B online sector rose 200 percent faster than that of the country’s business-to-consumer (B2C) eCommerce space in 2020. This indicates that B2B firms are already making significant moves in the eCommerce world, and to access the digital tools and resources that have been utilized by their B2C counterparts for some time. The report also indicated that both India’s B2B and B2C segments turned their attention to emerging technologies like automated or mobile tools that could provide them with speedier transactions, for example. Overall mobile orders within the country have since jumped by 8 percent, and it is likely that mobile will continue to rise in importance as a key channel both for B2B and B2C companies.

Moving B2B payments and interactions online comes with many benefits. One study indicated that shifting to digital sales channels can help companies boost their revenue, with digital sales pushing revenue growth forward for 62 percent of B2B entities in 2020. The study also found that 29 percent of such companies expanded the number of digital sales they made during that year, something that shows these firms may be taking a higher interest in eCommerce and its potential benefits.

Increased revenue is just one of many positives of shifting to digital marketplaces or solutions, a move that could also level the playing field for small- to mid-sized businesses (SMBs). These companies could also tap  digital solutions to compete on a more level playing field with their larger competitors, explained Anmol Bhansali, director for Goldiam International in a recent PYMNTS interview. Moving to digital platforms could enable smaller firms in the diamond industry to streamline aspects of their supply chain for faster order deliveries and payments, enabling them to more evenly compete with industry giants. Many companies within this industry still handle critical parts of their supply chains offline, he explained, even if they list their inventory or other services online. Moving the entire supply chain online could help to eliminate some of the frictions attached to these manual processes.

digital solutions to compete on a more level playing field with their larger competitors, explained Anmol Bhansali, director for Goldiam International in a recent PYMNTS interview. Moving to digital platforms could enable smaller firms in the diamond industry to streamline aspects of their supply chain for faster order deliveries and payments, enabling them to more evenly compete with industry giants. Many companies within this industry still handle critical parts of their supply chains offline, he explained, even if they list their inventory or other services online. Moving the entire supply chain online could help to eliminate some of the frictions attached to these manual processes.

For more on these and other stories, visit the Playbook’s News & Trends.

Amazon Business On Why B2B Companies Must Stay On Top Of Digital Payment Trends

Consumers’ expectations for speed and service have grown exponentially since the start of the pandemic, a shift that is also rippling throughout the B2B space. The B2B payments that underpin consumer-facing transactions must move swiftly as well to ensure that consumers’ changing needs are met, and this may be why many B2B firms are moving to eCommerce marketplaces to interact with or pay their partners with higher speeds. These marketplaces must be sure that they are accommodating these payment needs in order to keep businesses’ interest, however, explained Ragui Selwanes, director of business payments for Amazon Business in a recent PYMNTS interview.

To learn more about why offering flexible payment methods will be key to the success of B2B companies and online marketplaces, visit the Playbook’s Feature Story.

Deep Dive: How The Pandemic Is Affecting B2B Payments’ Role In Accelerating eCommerce B2B and B2C Transactions

Deep Dive: How The Pandemic Is Affecting B2B Payments’ Role In Accelerating eCommerce B2B and B2C Transactions

Businesses of all types across all industries have had to adjust quickly to how daily business operations can be conducted since the pandemic started. Many have moved to digital platforms to find new partners or conduct payments, accelerating an existing move to eCommerce that has been ongoing within the B2B space for several years. Online B2B sales reached $1.3 trillion by the end of 2019, for example. B2B companies’ flock to digital marketplaces makes it more than likely that these sales figures will continue to grow, especially as consumers continue their own move to digital channels — putting pressure to innovate the B2B transactions that make consumer-facing eCommerce’s trademark speed possible. Participating in this emerging B2B eCommerce world may be difficult for businesses that have yet to adopt digital payment solutions for their business transactions, however. These companies must examine what solutions could best tie into the needs of their clients and partners to best compete on these platforms.

To learn more about how the pandemic is affecting the B2B eCommerce space, especially regarding payments, visit the Playbook’s Deep Dive.

About The Playbook

The Global B2B Payments Playbook, a PYMNTS and Worldpay collaboration, examines the latest headlines in the cross-border B2B payments space and details why businesses are gravitating toward digital solutions to maintain seamless and robust global business relationships.