Deep Dive: How Automation, Virtual Cards Can Help Firms Meet Their Next-Gen B2B Payment Needs

Firms’ interest in B2B payments innovation has peaked over the past few years as companies inch ever closer to achieving the payment speeds and ease afforded to B2C transactions. As many as one-third of businesses are now tapping electronic payments for the bulk of their B2B transactions while 60 percent of companies remain confident that they could move domestic transactions from paper check-based methods toward digital payment options in the near future.

The pandemic has further hampered firms’ abilities to continue using outdated manual processes, prompting more companies worldwide to examine emerging digital tools and technologies. Many firms are still struggling with the challenges brought about by their outdated infrastructure when it comes to upgrading their B2B payments, however. They may struggle to connect electronic payment methods like corporate and virtual cards to their legacy accounting systems or absorb the rising costs associated with such upgrades. One recent report found that these are two of the top concerns holding businesses back from adopting digital B2B payments as 35 percent of companies cite each of these issues as a main innovation barrier. Reliance on legacy infrastructure and siloed data is also hampering these companies as they seek to enhance their payment processes for a digital world. Forty-two percent of organizations cited legacy infrastructure as the primary stumbling block holding them back from adopting transformative digital tools such as APIs.

Firms around the globe are working to overcome these challenges as businesses become more interconnected. Mastercard estimated that B2B payments now represent a more than $100 trillion global opportunity — a development that could have dire economic consequences for companies that drag their feet on accounts receivable (AR) and accounts payable (AP) innovations. Figuring out how to implement tools or solutions that could accelerate or otherwise enhance their B2B payment processes is thus key.

Crossing The Digital Rubicon

B2B payments have moved toward digitization for many years as firms — particularly larger businesses — grow more cognizant of the need to update their existing systems and of the benefits that electronic payments offer. One recent study, for example, found that 50 percent of firms cite settlement speed as a key digital payment benefit while 30 percent said the same for improved cash forecasting. Thirty-one percent of firms said electronic payments’ ability to enable straight-through processing, which entails the replacement of manual checks with wholly electronic ones, for AP and AR departments was the main advantage such payment methods provided.

These trends have accelerated in recent months as finalizing manual payment processes has become more challenging and costly. One recent study found that 23 percent of larger companies are currently deploying payments modernization strategies, for example, with many examining how specific payment tools could help their businesses. Thirty-four percent of these companies are looking to incorporate third-party FinTech or software to manage their payments. Companies are also working to streamline many of their processes for their AR and AP paper-based functions, with a September PYMNTS report revealing that 64 percent of firms have moved away from physical invoices.

B2B payments digitization may be on the upswing, but some firms — notably small to medium-sized businesses (SMBs) — are still struggling to innovate their payments operations. Only 11 percent of SMBs reported that they have payments modernization strategies in place, and many are still examining which technologies can help them bring their B2B payments up to speed. Solutions such as virtual cards are becoming particularly appealing, but businesses are still confronting a lack of access and other pain points that are keeping them from adopting these tools.

Virtual Cards, Automation And Next-Gen B2B Processes

Virtual cards can provide key benefits to firms looking to address their modern B2B payments needs, especially as many companies’ approaches to routine payment operations shift. A recent report found that 54 percent of chief financial officers planned to make some company roles permanently remote in the years ahead. Another 44 percent of chief financial officers noted that they plan to increase their use of automation and examine new ways of working in the future, for that matter. This move to a remote office environment would make the continued use of paper checks and invoices exceedingly difficult and expensive in most cases, and it is paving the way for the increased adoption of commercial credit cards and virtual cards.

Virtual cards allow businesses to more transparently view their spending, and they can also add much-needed speed to firms’ payment processes. These cards also enable companies to access payments data in real time, which can help them better track their cash flows and gain insights into their partners’ and vendors’ needs. Challenges remain for businesses that may want to tap such cards, however. Many companies still do not accept virtual card payments due to concerns or misconceptions about how these payments can be received, for example. Other firms may not have taken steps to upgrade their current payment processes to accommodate digital payments.

This is where implementing tools like artificial intelligence (AI) could come into play for firms looking to adopt virtual cards. Integrating such solutions could provide transparency and speed to companies’ payment processes, removing some of the friction points blocking their adoption of virtual cards or other emerging electronic payment methods. The level of expertise or familiarity with AI and its potential benefits for quicker payments or resolution varies highly among firms, however. A recent study found that only 26 percent of organizations counted as “seasoned” AI adopters, meaning they feel confident choosing third-party technology or payment processors supported by it. An additional 27 percent of companies were determined to be AI “starters,” meaning they are still figuring out how to find or integrate AI or AI-supported solutions. Growth in the adoption of the technology will rely on convincing these “starter” companies of AI’s benefits — especially those related to payments.

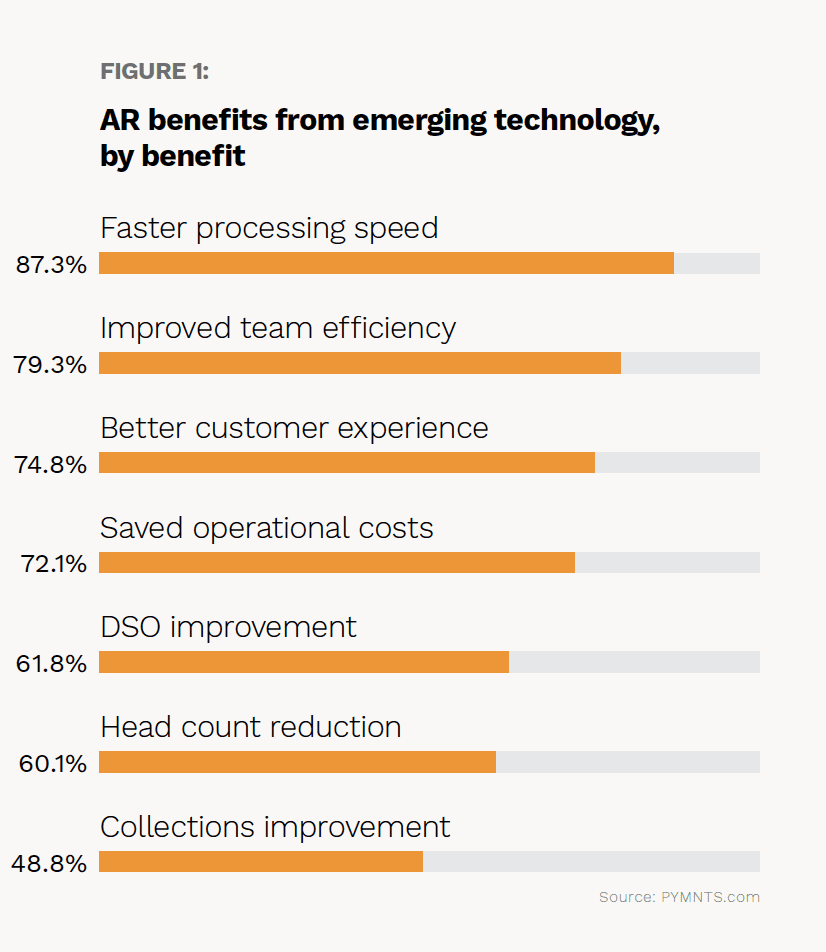

Implementing AI or related technologies such as machine learning (ML) could provide various benefits to businesses, including allowing them to automatically match invoices to their correct payments as well as making it easier for them to track incoming payments. One February PYMNTS study found that nearly 88 percent of firms indicated integrating automation or other technology improved their AR payment processing speed, for example.

The good news is that firms that have already integrated at least some form of automation experienced a 23 percent improvement in prioritizing collections compared to those that conduct their payments manually. The energy industry, in particular, appears to be leading the way with automation as 71 percent of energy firms are now tapping automated AR offerings. Technology firms are following right on their heels with nearly 65 percent stating they had adopted such tools.

Combining automation and virtual cards could help firms bring their B2B payments up to speeds mirroring those of the B2C space, and this advancement is becoming critical as companies leave their manual processes behind. One way in which businesses may be able to evolve with the swiftness they need to stay competitive is by partnering with third-party processors who have already integrated such tools and payment methods, enabling firms to more easily manage the transition to digital payments. Financial services and other solutions providers must carefully monitor these trends and use their insights to select the best approach for enabling swift, seamless digital B2B payments.