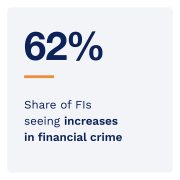

Corporate fraud and corruption have risen since 2020, as the digital transformation that accompanied the pandemic opened new opportunities. New channels for workflows have left companies playing catch-up with oversight and governance, and greater reliance on remote work presents added opportunities for digital infiltration.

The “B2B Payments Fraud Tracker®” explores the most prevalent trends in B2B payments fraud and the steps companies are taking to shore themselves up against bad actors.

Around the B2B Payments Fraud Space

Around the B2B Payments Fraud Space

Seventy-seven percent of corporate and bank executives say that reducing payments fraud is a spending priority. This makes payments fraud even more important than same-day or real-time payments status visibility, which was named as a spending priority by 67% of respondents. At the same time, phishing attacks — a common way for fraudsters to gain access to employee identities — are rising, as are the amounts that criminals seek each time they commit wire fraud.

For more on these and other stories, visit the Tracker’s News and Trends section.

Learn From an Insider How to Protect Against B2B Payments Fraud

Even institutions of higher education are fraud targets, as personal data can be just as valuable as money itself, according to Pablo Molina, chief information security officer at Drexel University.  At the same time, institutions are constantly fighting to stay ahead of new fraud techniques, such as deepfakes, spoofed payment platforms and diverted phone calls.

At the same time, institutions are constantly fighting to stay ahead of new fraud techniques, such as deepfakes, spoofed payment platforms and diverted phone calls.

At the same time, manual processes are often still the weakest link in business-to-business (B2B) payment fraud prevention plans, according to Nithai Barzam, chief operating officer at nsKnox. This is because the manual portions of transactions present the softest target to criminals, who can exploit much less sophisticated methods for tricking humans than are involved in attacks such as the use of ransomware.

To learn more about the weak spots in B2B payments fraud prevention, read the Tracker’s Insider POV.

Confronting the Challenge of B2B Fraud

Since 2020, 52% of companies with annual revenues over $10 billion experienced some form of fraud, with nearly 20% of those saying the financial impact exceeded $50 million.  While B2B fraud may not garner the attention of consumer fraud in the press, 98% of B2B firms reported fraud attacks in 2021 alone, with these companies losing an average of 3.5% of annual revenues to fraud.

While B2B fraud may not garner the attention of consumer fraud in the press, 98% of B2B firms reported fraud attacks in 2021 alone, with these companies losing an average of 3.5% of annual revenues to fraud.

It is no surprise, then, that 72% of surveyed companies say B2B fraud tops their list of challenges. In fact, 68% of B2B marketplaces and firms in the retail and manufacturing sector say they are not very satisfied with their fraud detection systems, and automated and technology-driven solutions could better protect businesses against criminal acts.

To learn more about overcoming B2B payments fraud, read the Tracker’s PYMNTS Intelligence.

About the Tracker

The “B2B Payments Fraud Tracker®,” a collaboration with nsKnox, examines trends in B2B payments fraud and the steps companies are taking against them.